Every now and then conservatives play against type. George Will, Peggy Noonan, and Senator David Vitter want to break up the big banks. So does Sandy Weill, the former chairman of Citigroup. In 1999, Congress repealed Glass-Steagall, the 1933 law separating commercial and investment banking, in large part so that Weill wouldn’t be inconvenienced as he merged his company with Travelers Group to create the largest financial institution in our solar system. Then, last year, Weill said it had been a mistake to repeal Glass-Steagall. Now he tells us!

To understand why Weill and so many conservatives have had a change of heart, let’s dust off John Kenneth Galbraith’s The New Industrial State. A 1967 best-seller about an economy that no longer exists might seem a perverse place to start, but bear with me.

Galbraith (who died in 2006) argued that big U.S. corporations had become immune to competition. Any effort to break them up into smaller companies would neither succeed nor—given the complex challenges of a modern economy—be especially desirable. Better to keep them in harness through a partnership with government. “Planning,” Galbraith wrote (in a sentence you could probably get arrested for writing today), “must replace the market.”

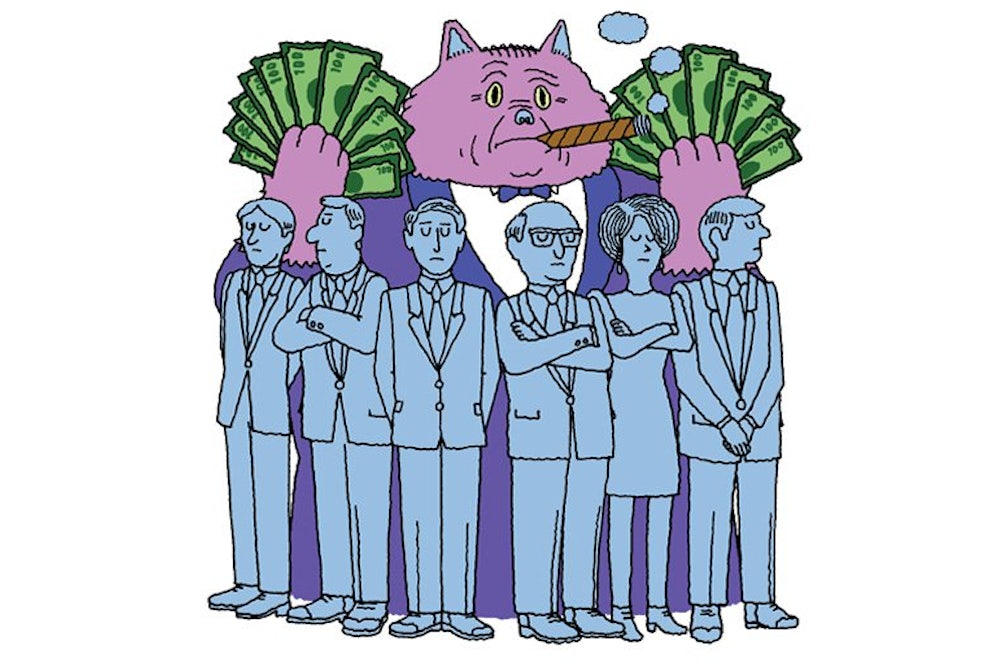

Galbraith was writing about manufacturing giants like General Motors and U.S. Steel. These seemed indestructible at the time, but of course they would soon prove all too susceptible to competition from abroad. Still, Galbraith’s vision of the regulatory state comes pretty close to describing today’s relationship between the federal government and a different oligopoly: the Big Six megabanks. Back in 1967, Galbraith judged financiers a “dwindling influence” in the U.S. economy, “honored more for their past eminence than their present power.” That has all changed. Today, finance practically is the economy, gobbling up nearly one-third of all U.S. corporate profits; its practitioners’ earnings now equal fully 9 percent of gross domestic product.

When the 2008 financial crisis hit, the feds went into Galbraithian planning mode. They bailed out the banks through the Troubled Asset Relief Program (TARP), arranged mergers, and, through the Dodd-Frank bill, required big banks to prepare “living wills” showing how they would dismantle themselves in orderly fashion should the need arise. These actions were loudly protested by many on the right (even though all but Dodd-Frank occurred under a Republican president). The bank bailout, in particular, infuriated Tea Party Republicans through the 2010 elections. Three-term Utah Senator Robert Bennett, a Republican who’d voted for one of two TARP bills, was branded “Bailout Bob” and denied renomination at a state convention where the crowd jeered, “TARP, TARP, TARP”

Conservatives were wrong to oppose the government’s bank rescue, but about one thing they were right: No bank should be “too big to fail.” Dodd-Frank, the Obama administration explained, set in place prudent safeguards, but the right didn’t believe these would work. The more left-leaning liberals (as distinct from centrist liberals, who place more faith in institutional authority) had their doubts, too. Why not just prevent any bank from being so large that its failure might wreck the economy? Averting a future bailout was the main concern, but not the only one. The implicit guarantee of a bailout for megabanks also amounted to a subsidy, skewing the market unfairly in their favor.

A bipartisan conversation began between left and right over the heads of the respectable center. It started in earnest with the publication of MIT economist Simon Johnson’s influential 2010 book, 13 Bankers (co-authored with James Kwak), and has since then been percolating in publications like National Review and The Nation. Jon Huntsman called for bank breakup; so did Dean Baker, a left-leaning economist, and Richard W. Fisher, president of the Federal Reserve Bank of Dallas. “Too big to fail is too big to continue,” Peggy Noonan wrote in a January Wall Street Journal column.

The critique has lately been embraced by a bipartisan cohort of working politicians. Vitter and Democratic Senator Sherrod Brown will soon co-sponsor legislation to limit bank size. Elizabeth Warren, a fellow banking committee member, will likely support their effort. A similar measure introduced by Brown in 2010 was opposed by the Obama administration and by all but one banking-committee Democrat. It failed on a Senate floor vote, 61–33. But Brown told me, “We would get a majority of [committee] Democrats today.” Even in 2010, two current banking-committee Republicans—Richard Shelby and Tom Coburn—supported the bill.

Getting the Obama administration on board is the greater challenge, but Jacob Lew, the newly installed treasury secretary, has yet to demonstrate strong opinions on the matter. (His predecessor, Tim Geithner, was adamantly against bank breakup.) House financial services committee Chairman Jeb Hensarling, a Republican, continually complains that Dodd-Frank never solved “too big to fail.” It isn’t clear he’d support bank breakup, but Republican John Campbell is pushing a somewhat similar bill.

For conservatives who feel queasy advocating the breakup of private enterprises, MIT’s Johnson offers this consolation: Remember George Stigler. Stigler, a conservative economist who died in 1991, won the Nobel for a theory that basically said Galbraith’s partnership approach didn’t work because of “regulatory capture,” i.e., the various ways corporations tame their minders—for example, by maintaining a revolving door between industry and government. Rather than try to control powerful corporations, Stigler thought government should use antitrust law to break them up and let competition rein them in.

Galbraith and Stigler had little use for one another, and the argument about whether it’s better to regulate or break up big companies resists categorical resolution. In this instance, though, Galbraith would likely conclude—as has his son, University of Texas economist James Galbraith—that too-big-to-fail megabanks pose too great a menace to tolerate. In his later years, Galbraith was appalled by the dangerous delusions to which “bankers, investment bankers, brokers, and free-lance financial geniuses” were susceptible, and he opposed repeal of Glass-Steagall. When the subject is stability in the nation’s banking system, most of us think conservatively. Too bad the bankers don’t.