“Our problem today was not caused by a lack of business and banking regulations,” argued Ron Paul in his 2009 manifesto End the Fed, which outlined a theory of the financial crisis that only implicated government policy and the Federal Reserve, while mocking the idea that Wall Street’s financial engineering and derivatives played any role. "The only regulations lacking were the ones that should have been placed on the government officials who ran roughshod over the people and the Constitution.”

There seems to be some confusion about the relationship between the Tea Party and Wall Street. New York magazine's Jonathan Chait says the two "are friends after all," while the Washington Examiner's Tim Carney insists that the Tea Party has loosened the business lobby's "grip on the GOP." So let’s make this clear: The Tea Party agenda is currently aligned with the Wall Street agenda.

The Tea Party's theory of the financial crisis has absolved Wall Street completely. Instead, the crisis is interpreted according to two pillars of reactionary thought: that the government is a fundamentally corrupt enterprise trying to give undeserving people free stuff, and that hard money should rule the day. This will have major consequences for the future of reform, should the GOP take the Senate this fall.

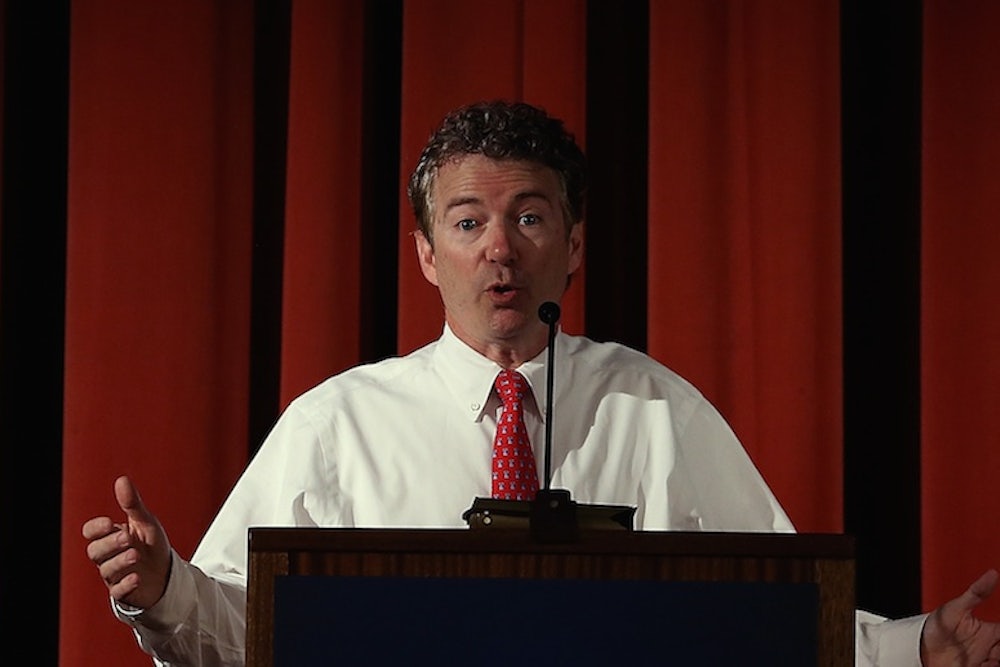

On the Hill, it’s hard to find where the Tea Party and Wall Street disagree. Tea Party senators like Mike Lee, Rand Paul, and Ted Cruz, plus conservative senators like David Vitter, have rallied around a one-line bill repealing the entirety of Dodd-Frank and replacing it with nothing. In the House, Republicans are attacking new derivatives regulations, all the activities of the Consumer Financial Protection Bureau, the existence of the Volcker Rule, and the ability of the FDIC to wind down a major financial institution, while relentlessly attacking strong regulators and cutting regulatory funding. This is Wall Street’s wet dream of a policy agenda.

Note the lack of any Republican counter-proposal or framework. The few that have been suggested, such as David Camp's bank tax or Vitter's higher capital requirements have gotten no additional support from the right. House Republicans attacked Camp’s plan publicly, and Vitter's bill lost one of its only two other Republican supporters immediately after it was announced. So why is there a lack of an agenda? Because the Tea Party thinks that Wall Street has done nothing wrong.

The story of the crisis, according to the right, goes like this: The Community Reinvestment Act and other government regulations forced banks into making subprime loans, and the “affordability goals” of government-sponsored enterprises made the rest of the subprime that crashed the economy. The Federal Reserve pumped a credit bubble, as it always does when it tries to push against recessions. In other words, the financial crisis in 2008 was entirely a government creation, and could have been solved by just putting all the financial firms into bankruptcy. There’s no such problem as “shadow banking,” and to whatever extent Wall Street misbehaved, it was only the result of the moral hazard created by the assumption that there would be bailouts. Or as Senator Marco Rubio said in his 2013 State of the Union response, we suffered “a housing crisis created by reckless government policies."

This narrative is an easy one to believe for people who distrust government, but it's far from the facts. The CRA didn’t even cover the fly-by-night institutions making the vast majority of subprime loans. The GSEs lost market share during the housing bubble and subprime loans account for less than 5 percent of their losses. Low interest rates likely account for only a quarter of housing price shifts, and even then, low interest rates likely offset capital coming into the country from abroad.

The mainstream account of the crisis, as Dean Starkman pointed out in The New Republic, is that we're all to blame—or, as Georgetown law professor Adam Levitin wrote in his recent survey of the crisis, that it was a “perfect storm.” Starkman argues that the Everyone-Is-To-Blame narrative is partially responsible for the lack of serious homeowner help in the Home Affordable Modification Program. As he demonstrates in his piece, “there’s a big and growing body of documentation about what happened as the financial system became incentivized to sell as many loans as possible on the most burdensome possible terms.”

The lack of any Republican policy on financial reform is the result of several factors. Mitt Romney thought it would be a liability to put forward his own agenda in 2012. By voting nearly unanimously against Dodd-Frank, Republicans were able to make this moderate, lukewarm response to the crisis look like a partisan takeover of finance (financial reform is hard and may not work, so all the better to have Democrats own the issue so they can be clubbed with it later). Rather than wage total war against Dodd-Frank through partisan outfits, the smartest minds on the right are weakening the law through law firms and K Street. And the conservative infrastructure has been solely focused on privatizing the GSEs completely.

This lack of policy has allowed the far right and Austrian School acolytes to occupy the intellectual space in the party. It's the minority party for now, but all it takes is a few Senate seats changing hands before the Tea Party narrative becomes the prevailing one on the Hill—and nothing would delight Wall Street more.