Even before the Federal Reserve announced a quarter-point interest-rate hike Wednesday, boosting interest rates for the first time since 2018, former Treasury Secretary Lawrence Summers said that wasn’t enough. Summers made this pronouncement in a Washington Post op-ed headlined “The Fed is charting a course to stagflation and recession.”

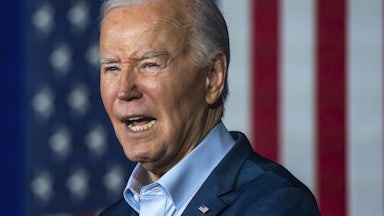

“Recession” is a bad enough word to hear when, like Joe Biden, you have the slenderest possible Senate majority and an approval rating that’s only just started rising out of a late-February trough. “Stagflation” is the panic button. To predict stagflation’s return is a bit like predicting Japanese planes will once again bomb Pearl Harbor. Sure, anything’s possible, but you’re talking about a historic moment long past.

Stagflation is what ravaged the economy of the 1970s when inflation spun out of control during a period of high unemployment. Economic theory said this wasn’t possible. Economic theory, not for the first time, was wrong. While the profession struggled to catch up, candidate Jimmy Carter defeated incumbent Gerald Ford in 1976 partly by hanging around Ford’s neck a nearly 13 percent “misery index,” i.e., the inflation rate added to the unemployment rate. Four years later, Ronald Reagan hung the misery index, by then above 20 percent, around Carter’s neck. The result was a new political epoch, dubbed the Age of Reagan by the Princeton historian Sean Wilentz, during which, even when Democrats won the White House, they had to accommodate a conservative ascendancy.

The Age of Reagan ended with the Great Recession of 2007–9. After that, the GOP, having gone as far right as it’s possible to go and still claim allegiance to any coherent philosophy, entered a period of authoritarian Tea Party-MAGA derangement so complete that even some prominent Republicans worry privately what will happen if they regain power. The Democrats meanwhile inched leftward, which troubled some Democratic centrists like Summers, who was treasury secretary under Bill Clinton and National Economic Council chairman under Barack Obama. Summers has shifted a few microns leftward himself, but he remains a rabid inflation hawk. In resurrecting the s-word, Summers is in effect saying that if the Democrats don’t move more aggressively to tackle inflation, an opposition still in thrall to Donald Trump may once again seize power.

A lot of people on the left ignore Summers because he’s been wrong about some very big things. His greatest blunder was blocking regulation of derivatives in the 1990s, a mistake that gives him some ownership of the Great Recession, the worst economic downturn since the Great Depression. Summers’s second-biggest blunder was lowballing the economic stimulus necessary to recover from the Great Recession. Summers also irritates a lot of people because he can be wildly arrogant. And don’t forget that he reportedly dated Laura Ingraham 20-odd years ago.

But Summers is a respected economist, a 1995 John Bates Clark Medal winner (that’s a big deal) who’s been right about some things when others were wrong. Most notably, he predicted, it turns out correctly, that the economy would recover from Covid-19 faster than people realized and that as a result the stimulus bill would “set off inflationary pressures of a kind we have not seen in a generation.” Most economists give greater weight to supply-chain snags when tracing the causes of Covid-era inflation, but the stimulus played a role, too, and inflation (like Covid) settled in longer than most economists expected.

Still, Summers’s prediction that we’re headed for stagflation does seem pretty nuts. “He’s doing some damage to the history,” Josh Bivens, research director at the Economic Policy Institute, told me. Stagflation was, practically speaking, a one-time event. There was a momentary recurrence during the first half of 2008, when oil prices spiked at the start of the Great Recession, but that “was so short that no one remembers,” Bivens said. (A consumption boom in China coincided briefly with falling Saudi production.) What people remember about the Great Recession isn’t inflation, but years and years of high unemployment and low wages.

The stagflation that people remember from the 1970s occurred due to a unique set of circumstances. I think of it as a very crowded elevator. Entering the elevator all at once are an economic recession, an oil embargo, and a floating dollar suddenly linked no longer to the price of gold. They’re all jostling each other quite rudely to push the button for their floors, none of them giving a damn what the others think, all of them outraged by the lack of deference. That was stagflation. It happened in 1973, and again in 1980.

It’s possible to imagine the elevator crowding in such a way again, but it seems unlikely. U.S. sanctions on Russian oil and other items will be inflationary, but nothing like the Arab oil embargo or the 1979 oil shock. The United States can’t go off the gold standard again because it never got back on. Recessions—yes, recessions do happen. But at the moment we’re in a pretty robust economic expansion.

One of the more baffling statements in Summers’s op-ed was this: “With price increases outstripping wage increases, a wage-price spiral is a major risk.” I recently wrote a piece arguing that runaway inflation was unlikely precisely because wages won’t rise in tandem with prices. (Workers don’t have enough power.) “I really don’t understand his case for a wage-price spiral,” Dean Baker, senior economist at Washington’s Center for Economic and Policy Research, told me in an email. Baker continued:

There has been a redistribution from wages to profits in the pandemic. The opposite happened in the 1970s, where we arguably did see a profit squeeze. It’s hard to see how in the current labor market (we had 20 plus percent private sector unionization in 1970s, we’re just over 6.0 percent today) we would have a story where wages spiral upward. Contrary to what [Summers] said in his piece, there is evidence wage growth is slowing, not increasing.

Baker also pointed out that productivity increased during the past three years, averaging 2.3 percent compared to 0.8 percent during the previous eight years. “That allows for room for substantial real wage growth without inflation,” Baker wrote, “which was not true in the 70s.” (Maybe I should have put low productivity into that elevator too.)

Summers is waving the stagflation flag partly because he knows Jerome Powell reveres Paul Volcker, who ended the Great Inflation in the early 1980s by raising interest rates sky-high. In recent congressional testimony, Powell called Volcker “one of the great public servants of the era.” Volcker ended stagflation by bringing on the brutal recessions of 1980 and 1983. Summers wants Powell to do the same.

But why? The economy grew at an annualized rate of 7 percent during the last quarter of 2021. The misery index (unemployment plus inflation) is about half what it was when Reagan laid into Carter. It’s already morning in America, as Reagan declared triumphantly after the Volcker recession ended. The Fed is right to raise rates, and it will continue doing so for some time. But we are not headed back to the 1970s. Do not pull your old leisure suit out of the back of your closet. Stagflation is not some cyclical phenomenon. It’s a weird thing that happened once, and won’t likely happen again.