One thing is for sure: No one can ever accuse Art Laffer of being a pessimist.

The famous conservative economist explained to the Washington Post’s Jim Tankersley why he thinks there will be a Republican wave in 2016—and why it will set the stage, as Tankersley writes, for “a generational lock on Washington for the GOP.” Laffer’s reasoning has nothing to do with demographics or polling. In fact, he doesn’t even look at polls. Any of the numerous Republican candidates, he says, will be good enough to ensure a long-term Republican majority.

Instead, it’s all about economics. Laffer sees the U.S. on the brink of an economic boom, if only Congress enacts and the next president signs massive tax cuts. The Republican playbook, under this view, is pretty simple: Win in 2016, enact those tax cuts, and just wait for the American people to flock to the GOP as the economic boom happens.

This is wrong for many reasons. First, neither party is on the verge of a “generational lock on Washington.” But if anyone is closer to that lock, it’s the Democratic Party, simply for demographic reasons. Over the next few decades, Democrats are primed to gain a tighter control over the presidency as Hispanics become a greater share of the voting population. Meanwhile, older voters—the GOP’s bread and butter—are dying off. Still, no one is arguing that Democrats are on the verge of a long-term takeover of Washington because the American electorate is deeply polarized. A booming economy won’t suddenly convert a large swath of Democratic voters to the GOP, or vice versa.

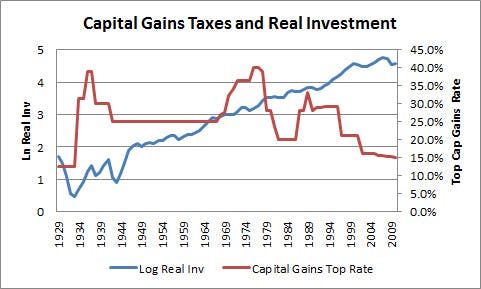

More importantly, Laffer’s economic theory is deeply flawed. He and other supply-siders are convinced that the only thing holding the economy back is tax reform; particularly reform that drastically lowers rates. But the academic evidence on this is thin. It’s hard to see any correlation, much less causation, between lowering taxes on capital gains and increased investment:

Meanwhile, top individual tax rates are far lower now than they were in the 1970s, the decade Laffer and company often point to as evidence that supply-side economics is correct. That means the benefits of cutting individual rates, if such benefits exist, are far smaller now than they were four decades ago. And never mind the weak growth that ensued after the Bush tax cuts. None of this means that taxes don't affect the economy. But Laffer's commitment to supply-side economics has not wavered at all, even as evidence against the theory has continued to increase.

In fact, we only have to look to Kansas to see the failure of Laffer’s economic and political theory. Governor Sam Brownback worked with Laffer to design large tax cuts that were supposed to trigger an economic boom. That hasn’t happened. Growth has been middling and the cuts have created a hole in the state budget that the Republican governor is struggling to fill. The politics of the cuts have been even worse. Brownback's reelection race gained national attention last year as polls showed a tight contest in the normally dark red Kansas. Eventually, Brownback won by four points in one of the most solidly Republican states.

While Laffer is undeterred in his support for supply-side economics, the Republican Party should take a lesson from Kansas. Brownback may have survived, but in less conservative states his policies would have ended his political career. If other GOPers want to avoid a similar fate elsewhere, they would be wise not to take Laffer’s advice—presidential candidates included.