I have two points to make about the relationship between economics and foreign policy. The first is to distinguish between the domestic economic and domestic political constraints on power; and the second is to argue for a new conceptual approach to the integration of politics and economics.

Political Constraints on American Power

Let’s begin with the first issue, the distinction between domestic economic constraints and domestic political constraints. The first has to do with the economic resources available to the U.S. government relative to those of other political units, economic growth rates, and the fiscal sustainability of the underlying growth models. The second has to do with the degree to which the political system can translate those resources into effective foreign and security policies. The latter might be thought of as a kind of discount rate applied to the former, and that discount rate varies for different political entities. Many of the discussions of American “decline” (or lack thereof) have failed to distinguish between the underlying economic base and the political discount rate. I believe that American society is not in decline because the overall situation of the economy is relatively strong, but that the political system has been subject to considerable decay.

Of the major political actors in the world today, the political discount rate is probably highest for the European Union (EU). The EU as a whole is somewhat larger in population and total gross domestic product (GDP) than the United States (though not in per capita terms), and it has had some success in turning that economic power into political outcomes (for example, in exporting its policies on genetically modified organisms, or GMOs, to Africa). But overall (and by design), it lacks a sufficiently hierarchical decision-making structure that can delegate power and resources to an executive. It is hard for the EU to be a strong unitary actor. This is the most true in foreign and defense policy, where its inability to stabilize the Balkans in the 1990s or prevent the United States from invading Iraq in 2003 were widely recognized. But this lack of political decisiveness also extends to economic policy, where the European Central Bank (ECB) has significantly weaker powers and autonomy than the United States Federal Reserve.

China’s discount rate, by contrast, is relatively low, since it is ruled by a relatively disciplined Communist Party that brooks no internal dissent. There have been some questions raised about the Party’s control over the People’s Liberation Army (PLA), but no real evidence that this amounts to a serious problem. China’s underlying economic power has been exaggerated, but has grown quickly and is rapidly being turned into political influence in East Asia.

The political discount rate for the United States has historically been higher than for the EU, but lower than China’s. I would argue that the rate has been increasing in recent years, meaning that America’s usable power is lower than its potential capacity.

I do not believe that there are any fundamental short- to medium-term economic constraints on America’s ability to remain the world’s dominant power. The American economy has finally returned to growth on the back of a domestic energy revolution, and is poised to achieve perhaps 3% growth in 2014. America’s debt-to-GDP ratio peaked at over 12% in 2009 (including federal, state, and local), but has fallen this past year to 6%, and according to the CBO will fall to 4% next year. The real deficit problems lie further down the road, when our aging population and health care costs will force the ratio up again by the early 2020s. The long-term deficit problem is a very big and serious one, but it can only be solved through entitlement reform, and not on the back of cuts in discretionary spending (which includes the defense budget). If we fail to take on the entitlement problem, then yes, defense and foreign policy will be heavily constrained—but cutting the defense budget preemptively to solve the anticipated deficit problem strikes me as a foolish strategy because it will not deal with the real problem.

However, I do believe that the political discount rate that translates economic strength into internationally usable power has increased for the United States as a result of the political polarization in Washington. Here the problem lies more with the political elite and less with society. I am not sure whether there are significantly deeper polarizations in American society than previously on foreign policy issues the way there are on domestic economic and cultural issues. After two expensive wars in the Middle East, both parties have become more cautious in their support for intervention and a muscular foreign policy. The Republican Party for the first time in two generations has seen the appearance of a significant isolationist wing under the leadership of politicians like Senator Rand Paul. Even on a sensitive issue like National Security Agency (NSA) surveillance there is no Republican-Democrat polarization; rather, the cleavages run through both parties.

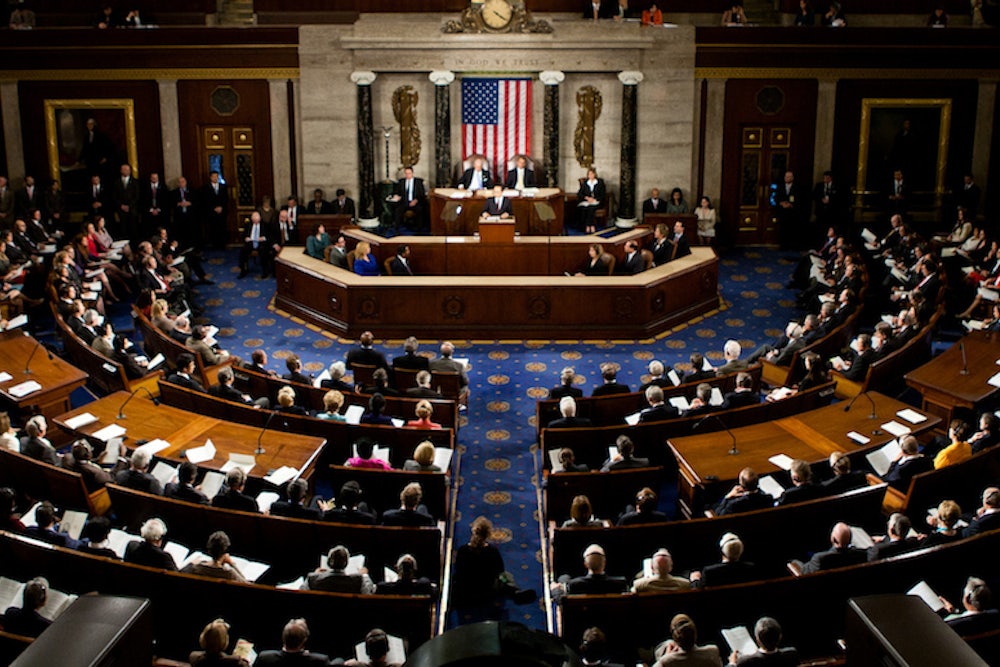

What is different now is a much more poisonous partisan atmosphere in Washington, which sees virtually any policy issue as an arena for political combat and point-scoring. This means that Congress is much less willing to delegate discretion to the executive branch on foreign policy, and makes the president in turn preemptively cautious in exercising power.

There are two recent cases of this: the murder of Ambassador Stevens in Benghazi and the current negotiations on a nuclear deal with Iran. As suggested by the recent Senate report, the Obama administration made numerous mistakes in the actions leading up to Ambassador Stevens’s death, but these tended to be errors of judgment by middle-ranking officials (including perhaps the ambassador himself), and not by Hillary Clinton or President Obama. The administration was guilty not of a cover-up, but of trying to spin the incident to minimize damage in an election campaign. Nonetheless, politicization of this event has consumed Washington for half a year, discouraged any risk-taking with regard to Middle East policy, and reinforced the already excessive emphasis on self-protection and diplomatic security as the first priority of U.S. regional policy.

Similarly, the bill currently before the Senate setting forth in great detail the terms that any final nuclear agreement with Iran would have to meet is an unhelpful infringement on the executive branch’s discretionary powers. It is hard to see how any complex negotiation could ever be completed when Congress lays down so stringent a bottom line. This of course does not mean that the administration should be given a blank check; Congress will have to approve any agreement that eventually emerges, since many of the existing sanctions are legislatively imposed. But this is a very poor way to proceed in a negotiation.

The net effect of political polarization has been to shift control over foreign policy back from the president to Congress in much the same manner as in arguments over Vietnam in the 1970s and Central America in the 1980s. This reduces executive discretion and increases the effective political discount rate.

New Approaches to the Integration of Economics and Politics

A second issue is a conceptual one concerning the way that we think about the relationship of economic and political policy.

From the Reagan years on, the United States has been the foremost proponent both of economic liberalism (often dubbed “neo-liberalism”) in the global economy and of democracy in the political sphere. The two were seen as working hand in glove, both as intrinsically good objectives and ones that would be mutually supportive.

The economic part of the agenda took the form of the Washington Consensus, a series of liberalizing measures to lower tariff barriers and push for a global free-trade system, privatization, deregulation, and a general cutting back of state sectors. Economic liberalization along Anglo-American rather than continental European lines was seen to be supportive of the promotion of liberal democracies around the world. Liberalization would lead to economic growth, which would produce larger middle classes, which in turn would be more critical of authoritarian governments. Economic freedom was seen as part of a package of liberal political rights.

The policy of promoting both economic liberalization and greater democracy succeeded to a great extent. Formerly closed economies like those of the former Communist countries in Eastern Europe, China, India, and many developing countries were opened up to the global economy. Global output quadrupled between 1970 and the 2008 financial crisis, largely as a result of this liberalization. Although democracy has not so far swept all the major economies, the number of electoral democracies around the world went from about 35-40 to more than 100 today.

However, this particularly American approach to integrating economics and politics had real limitations, and since the first warning signs at the time of the 1997 Asian financial crisis, has gotten into increasing trouble. There were two critical weaknesses in the economic liberalization agenda.

The first was the fact that liberalization works much better in the real economy than in the financial sector. In the late 1990s, there was almost universal consensus among economists that freer and more globally integrated financial markets would lead to more efficient capital allocation and thus higher growth. However, it turned out that global financial markets are not necessarily efficient; they are subject to bubbles, manias, and irrational exuberance, whose costs are ultimately borne by taxpayers. Much of the apparent growth during the 2000s was illusory and based on excessive bank risk-taking. Countries such as Mexico, Thailand, and South Korea quickly got into trouble after they followed American advice and opened up their capital accounts in the 1990s. Those countries that did not liberalize, like China, found themselves protected from the damaging impact of volatile hot money. The United States was hoisted by its own petard when it dismantled the Glass-Steagall regulatory regime in the late 1990s and opened itself up to a wave of liquidity washing in from China and other emerging markets. All of this facilitated the financial crisis of 2008 and led to the most serious recession since the Great Depression.

The second weakness was distributional. As Michael Spence’s article indicates, the combination of globalization and unfettered technological advance has had some rather unfortunate distributional consequences. America and other advanced democracies have undergone a prolonged period of deindustrialization, as manufacturing employment has stagnated, along with the incomes of many working-class Americans. In the meantime, highly educated Americans have seen massive increases in their incomes, together with a similarly cosmopolitan global elite.

During the 1990s and 2000s, the United States lost a great deal of its manufacturing base and supply chains to China and other countries in Asia. This was partly the inevitable result of capital’s search for higher returns, but it did not have to take as extreme a form as it did. Under the rubric of fighting protectionism, the United States passively stood by as China undervalued its currency and moved U.S. jobs to China. The economists insisted that we not mix political goals with economic efficiency considerations, while our rival was doing just the opposite.

The early phases of this liberalizing period were good for global democracy, as middle classes spread across the developing world. Perhaps someday this will lead to pressures for the democratization of China. But it has had a potentially negative impact on democracy in the developed world, and in the United States. With increasing recognition of the fact of unequal development has come populist pushback against those elites who have profited from globalization. At the moment, none of this populism has undermined the stability of democracy in the developed world. But in the end, unequal distribution of the fruits of economic growth is likely to erode the legitimacy of democratic systems.

The problem as I see it is to define a different way of integrating economics and politics that avoids the exuberant neo-liberalism of the 1990s, while at the same time avoiding a return to growth-undermining populist or redistributive policies. No one to date in the United States or Europe has clearly articulated what such a model would be. It would have to dethrone growth as the single measure of the performance of the economy and raise the priority of employment and even distribution. It would have to define a new, larger role for the state, particularly in the regulation of financial markets. It would need to focus on middle-class employment, and perhaps consider ways of channeling innovation into labor-utilizing innovation. It would explicitly target preservation of a manufacturing base and keeping supply chains geographically close to the United States.

Internationally, definition of such a model will be important in maintaining American leadership and “soft power.” Because of Wall Street’s failures, the neo-liberal model has been discredited around the world, and countries such as Brazil and Argentina are falling back into bad habits with regard to industrial policy and subsidization. The United States needs to figure out how to modify its neo-liberal model, owning up to past excesses but preserving the core of an open international order. Free trade and deregulation cannot be our only goals; indeed, re-regulation of the international banking sector is a critical requirement if we are to avoid another financial crisis of the sort we suffered five years ago. But neither domestic stability nor the projection of soft power abroad will be possible without a different approach to economic policy.

This essay was cross-posted at Lawfare. Francis Fukuyama is Olivier Nomellini Senior Fellow at Stanford’s Freeman Spogli Institute for International Studies, and a member of the Hoover Foreign Policy Working Group on Grand Strategy. His book Political Order and Political Decay: From the Industrial Revolution to Globalized Democracy will be published in October 2014.