For going on a year now, a group of reform-minded conservatives has been gently coaxing more pious coreligionists into supporting a tax reform plan that would violate the first commandment of supply-side economic theory.

In a broad sense, the two groups share similar goals. Both want to distribute income upward. The difference is that reformicons would like to limit the amount of upward redistribution to preserve some significant spoils for middle-class workers with children. They've rallied behind legislation, drafted by Senator Mike Lee (a Tea Party favorite from Utah) that would lower the top marginal tax rate only modestly—from about 40 to 35—while creating generous new tax credits for families with kids. The supply siders, as you probably guessed, want to ply those spoils into even larger rate cuts for the wealthy. The poor are left almost entirely out of the equation.

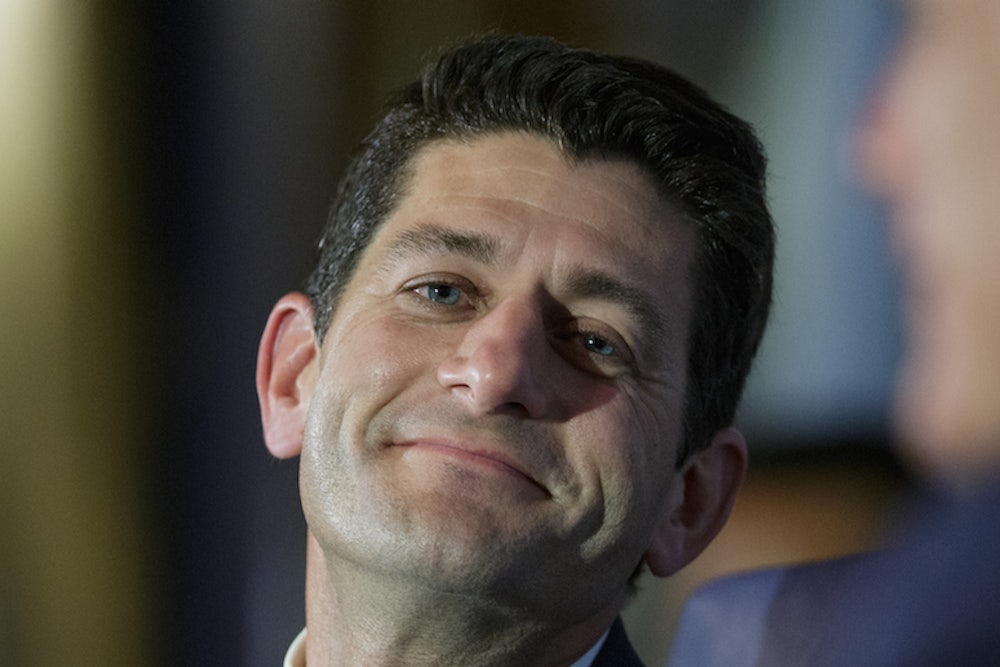

Under normal circumstances, the two camps would resolve a policy dispute like this by splitting the baby (the proverbial one; not the human one that comes with a generous tax-subsidy). But as supply-side stalwart Congressman Paul Ryan explained recently, asking rate-cutters like him to check their rate-cutting ambitions would be like asking Lance Armstrong to share his “secret sauce” with mid-tier racers—not much help for them, at the expense of his competitive edge. And on the flip side, the reformicons can’t yield too much to the supply siders, because at some point the political payoff (more money for the middle class) would disappear along with the whatever supposed incentive the credits would create for people to start families.

Enter Ramesh Ponnuru, a high-profile reformicon, with a plan to win Ryan over using clever spin. Just pretend the Lee plan’s child tax subsidies are comparable to tax cuts for investors, except the investors here are parents rescuing the country from a bleak demographic future, and the tax cuts are actually new tax expenditures.

“You can't draw up a realistic budget with a top tax rate of 25 percent and a large child credit,” Ponnuru writes for Bloomberg. “(You might not be able to draw up a realistic budget with a top rate of 25 percent even without the credit.) You probably can, however, draw up one with a lower top rate than we have today and better treatment for investment — including parents' investment in the next generation. Because that mix of policies would leave many millions of middle-class families ahead, it may well be easier to enact than a plan that concentrates solely on reducing the top rate. Supply-siders, that is, might achieve more of the rate reduction they seek if they embrace the credit.”

This is another way of saying that the politics of the Lee plan are vastly more appealing than the politics of the Ryan plan. The tax blueprint in Ryan’s budget is such a political disaster that it would likelier die in committee than become law in some less radical form, leaving Ryan with no rate reduction at all. Under the circumstances, he’d be better off settling for less-severe rate cuts and plying some of the projected deficits into the pockets of the middle class.

That’s absolutely true. But for supply-sider zeal, it would settle the argument under the prevailing terms. Yet those terms omit something fundamental to both plans: deficits. Neither party to the conversation has used the word deficit even once. And when you introduce the idea that both of these plans—not just Ryan’s—are deficit-financed (or financed with implicit tax increases on the poor and middle classes) it becomes hard to fathom why a tug of war between the reformicons and the supply-siders is necessary at all.

Lee offsets his tax cuts by eliminating and reducing a swath of tax expenditures. Nevertheless, they would increase deficits $2.4 trillion over ten years. Ryan’s plan would probably increase them by twice as much (before offsets, which he’s never specified). There isn’t a point along the connecting line where this trespasses into fantasy. These are just two different fantasies. Under the circumstances, the smart play isn’t for the reformicons to out-debate the supply siders, or to negotiate with them, but to buy them off. Give Ryan a big rate cut. Keep the middle-class child subsidies. Don’t bother paying for either, in full.

This, as Ponnuru sort of implies, would be deeply irresponsible. But it would enjoy the dual benefits of papering over the rift and solving the GOP’s miser problem, in much the same way that George W. Bush solved his regressivity problem in 2001 by cutting everyone’s taxes (the wealthy merely got a hefty bonus tax cut).

Instead Lee is teaming up with Senator Marco Rubio to narrow the $2.4 trillion shortfall. Perhaps they’ll succeed. But they’ll also have widened the conservative rift, leaving them a plan that’s intended to forge an alliance between the ruling and working classes, but does less for the former than the supply siders and less for the latter than Democrats. Actually legislating will almost certainly require surrendering to one faction or the other.