Is something wrong with the economy? Just a few months after economists predicted that 2015 would be a banner year for the economy, the data are telling the opposite story.

The latest evidence of an economic slowdown came on Friday when the Labor Department released the April jobs report. The economy added 223,000 jobs last month, slightly below expectations of 228,000, and the unemployment fell to 5.4 percent. Sounds OK, right? If you look a bit deeper, the numbers become more concerning. The Labor Department revised the February and March numbers up 2,000 and down 41,000, respectively. That means the economy added just 85,000 jobs in March,

Monthly jobs reports can be very noisy, so it’s better to use a three-month using average to smooth the data. At the end of 2014, the economy clearly looked on the upswing, with job growth averaging nearly 300,000 per month. But that trend has quickly reversed itself this year. Over the past three months, job growth has been just 191,000.

Economists are paying very close attention to the wage data. As the labor market tightens, workers will gain more leverage over their employers and be able to demand higher wages. This has already led some major companies, like Wal-Mart and McDonalds, to raise their wages. If these anecdotal stories begin showing up in the data, it will indicate that the economy is approaching full employment. But that isn’t happening. Wages grew just 0.1 percent in April and have grown just 2.2 percent over the past year, barely keeping up with inflation. The lack of wage pressure is a clear sign that the economy still has slack in it and policymakers should act accordingly.

Other data has also been worrisome. Last week, the government reported that annualized growth was just 0.2 percent in the first quarter. When the government revises that number in late May, it will likely be negative because the trade deficit was larger than expected. In other words, the economy probably contracted in the first quarter. And this was supposed to be the year the recovery kicked into second gear!

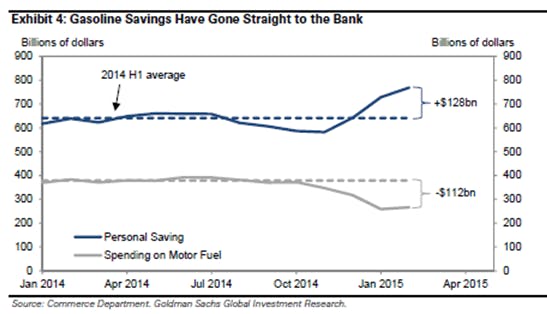

So, what is going wrong? A few things: First, the stronger dollar is hurting exports. The U.S. economic recovery, as slow as it has been, has exceeded the recovery in Europe. As the European Central Bank has implemented a quantitative easing program, the Federal Reserve has tightened its monetary policy and is likely to raise interest rates later this year. That has put upward pressure on the dollar, making U.S. exports more expensive (and imports cheaper) and hurting U.S. businesses. Second, the drop in oil prices has hurt U.S. oil companies and led to a reduction in investment. Most economists expected the drop in oil prices to be a net winner for the American economy, with consumers using their savings to go out to a family dinner or buy a new pair of shoes. But instead, it seems that Americans are not spending those savings.

The combination of that with reduced investment has made the drop in oil prices less beneficial—and maybe even harmful—for the economy than expected.

Finally, an unsually cold winter and the strike at the Los Angeles port may also have held back the economy. Boston had one of its worst winters ever, for instance, and other areas of the country, including New York City and Washington, D.C., also experienced rough conditions. That may have led people to stay home more, hurting consumer spending.

It's important not to overreact to the latest data. As the weather warms, consumers should spend more money. The strengthening of the dollar has leveled off recently. Average job growth of 200,000 is not bad by any means. But it's not great either and doesn't represent the economic recovery than many analysts expected this year.

What does this mean for policymakers? For Congress, it doesn't mean much. Gridlock ensures that legislators aren't making any moves to help the economy anytime soon, although it should add even more urgency to a budget deal that lifts sequestration. More importantly, this should be another sign for the Fed to delay raising rates. It appears almost certain that the Fed will not do so at its June meeting. A rate hike in September now is more probable. Fed Chair Janet Yellen and the rest of the board will have far more data to work with before that meeting. But so far, wage growth remains muted and there is still no signs of inflationary pressure. As Charles Evans, the president of the Chicago Fed, said last year, the Fed needs to be patient.