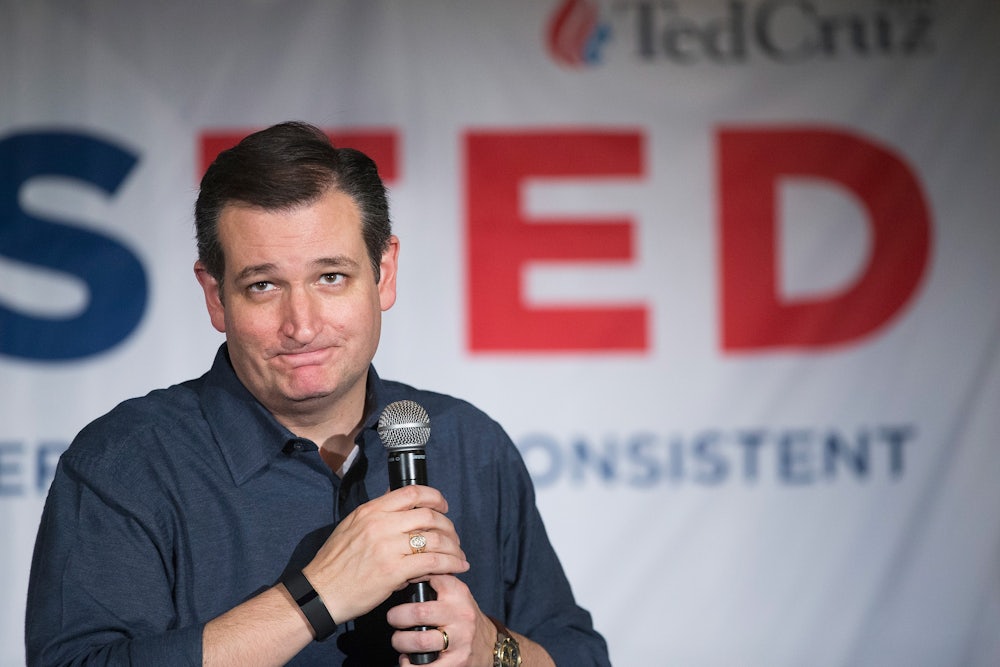

The tale of Ted Cruz’s failure to disclose lines of credit from Goldman Sachs and Citibank that helped finance his 2012 Senate race yields a bounty of hypocrisies: the Texas senator’s made-up story about risking all his savings on a selfless quest to become a humble public servant, his connections to the kind of corporate behemoths he decries in speeches about crony capitalism, etc. But the incident actually reveals yet another consequence of inequality: Only the wealthy have the ability to obtain these kinds of loans, putting powerful government posts like the Senate that much further out of reach.

Here’s what Cruz did: He put $1.2 million of his family’s savings into his 2012 Senate campaign. Not only is self-funding of this nature not illegal, it’s encouraged by party bigwigs because it means the candidate needs to fundraise less and opens with an automatic leg up on their competitors. Democratic and Republican campaign committees routinely hunt for self-funders.

What Cruz never revealed to the Federal Election Commission were two loans against brokerage accounts with Goldman and Citi totaling up to $1 million before being paid down. Candidates can legally take out loans to finance their operations under the current campaign finance regime—advances from a brokerage account, credit card arrears, a second mortgage, whatever. They can even loan their campaign cash and get it back, with interest, down the road. Grace Napolitano, a congresswoman from southern California, got in trouble in 2009 after word leaked that she collected $158,000 in interest on loans to her own campaigns, for which she charged 18 percent interest.

At the time, Cruz had a seven-figure income as a corporate lawyer (representing the likes of Walmart, JPMorgan, Pfizer, and the payday lender Cash Advance), and his wife worked for Goldman out of their Houston office. Only someone of that stature could walk into Goldman Sachs or Citigroup and come out with a million-dollar line of credit at a skinny 3 percent interest rate, which the New York Times informs us is “generally in line with rates available to wealthy borrowers.”

For a two-income, multi-million-dollar couple, no underwriter would blink before approving that loan. The only mild repayment risk comes if Cruz wins; his salary would go down as a senator relative to his legal work. Since the financial crisis, in fact, most of the uptick in consumer bank loans has come from high net-worth clients like the Cruzes. The adage is that you can’t get a loan from a bank unless you don’t need one.

By contrast, those making the median salary—a career legislative aide, a teacher with student loans, whoever—would have no chance to draw against $1 million, and especially not at such a minuscule interest rate.

This immediately creates a disparity in the potential talent pool for elected officials, particularly for expensive seats like a statewide race in Texas. Sure, millions of people giving $10 can create a formidable war chest, as the Bernie Sanders campaign is showing. But it’s a lot easier with a million-dollar head start. Plus, a corporate lawyer and bank executive live among a social milieu of people willing and able to write far bigger checks.

Even if Cruz did liquidate his net worth to gamble on a Senate run, his place in the upper echelons of society gives him the ability to do that. People without savings obviously cannot. And people without seven-figure jobs to fall back on cannot afford the risk.

Cruz didn’t disclose the loans, as required, with the FEC (the loans were listed in Cruz’s Senate ethics report, but that’s a different reporting obligation). His campaign says that failure to report was an inadvertent oversight. But if anybody thinks this violation will spur some type of regulatory action, they don’t know anything about the FEC, a completely broken agency.

Don’t take my word for it. Here’s what Ann Ravel, the lead commissioner on the FEC in 2015, had to say just two weeks ago: “I actually realized after about a week or two that what was being done was essentially nothing.” The commission has an equal number of Democrats and Republicans, leading to near-total deadlock amid party-line votes. The only risk to Cruz from hiding a loan, then, is reputational, should it come out later. And by that time, the election in question is over.

In the State of the Union address, President Barack Obama lamented how “a handful of families and hidden interests” bankroll elections. But he forgot the other element: the typically rich candidates themselves. For the most part, only someone of means can take a year off to campaign, self-fund, or line up the financing to compete in modern elections. It means that those sent to Washington to act in the public interest typically come from the top 1 percent, and as you’d expect, they privilege the concerns of that class over those of ordinary Americans. If we want to talk seriously about money in politics, we must talk about the tiny sliver of people who can afford to run for office.