The economist Arthur Laffer appeared early Monday on the Fox Business Network to defend the current president’s proposed tax cuts. “I’m hoping the Democrats vote with it. They should vote with it, they believe in it, they want it,” he said, wrongly. “To let this partisanship go to that extreme that they vote against America is, to me, shocking. I can’t imagine a lot of them not voting in favor of the president’s bill.” Minutes later, he added, “I just don’t know how a Democrat can honestly vote against this bill and hold his face up high to the electorate. It just doesn’t make sense to me.” Donald Trump, a known cable-news addict, tweeted later that morning:

The Democrats only want to increase taxes and obstruct. That's all they are good at!

— Donald J. Trump (@realDonaldTrump) October 16, 2017

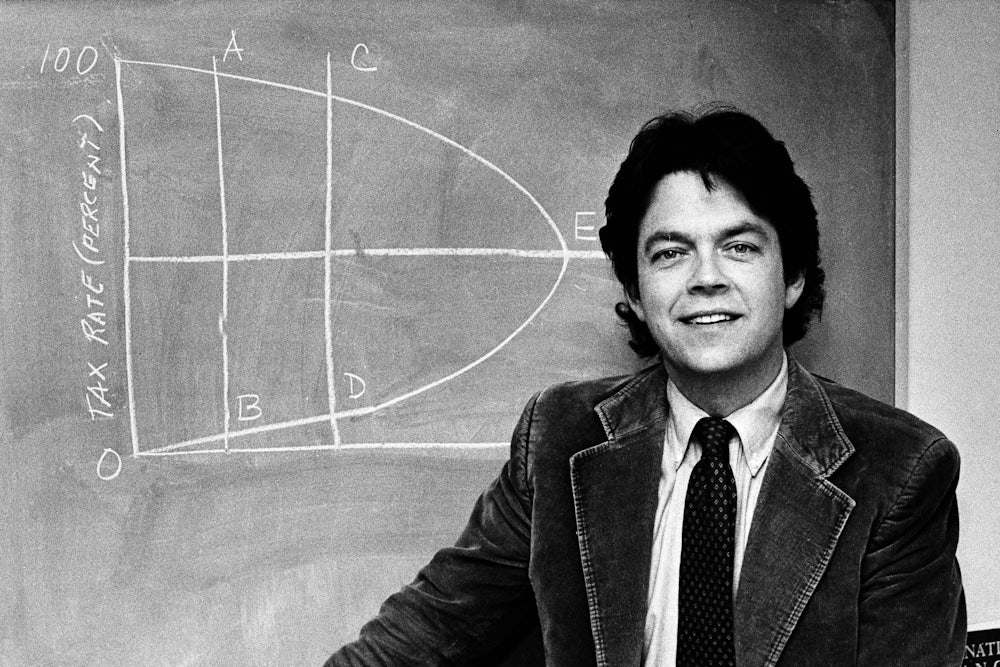

Laffer might not be a familiar figure to many of Trump’s 40 million Twitter followers, but the former economic adviser to President Ronald Reagan is a giant within the Republican Party as the “godfather” of supply-side economics, the theory that cutting taxes and regulations creates economic growth (a cousin to trickle-down economics, which argues more specifically for tax cuts for the rich). In reality, though, Laffer is a Svengali or huckster who holds unconscionable influence on one of America’s two major parties, despite his ideas having been discredited—and not only by critics on the left—from the very beginning. That Trump and other Republican policymakers are promoting Laffer’s disproven theory yet again is the most damning evidence of the party’s intellectual rot.

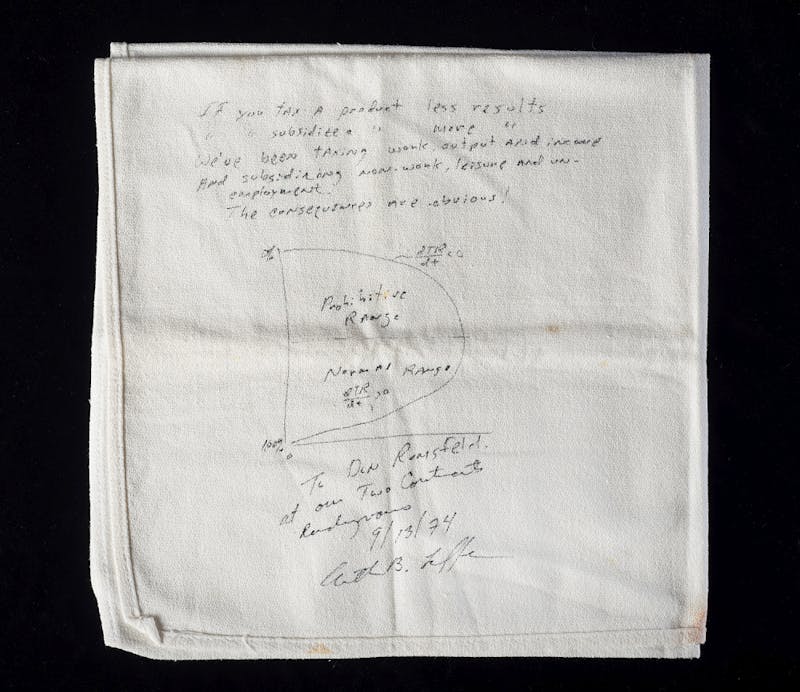

The legend of Laffer begins with a bar napkin, on which he drew the famous “Laffer Curve” during a meeting in 1974 with Donald Rumsfeld, then President Gerald Ford’s chief of staff, and Dick Cheney, Rumsfeld’s deputy. The Smithsonian is currently displaying what they claim to be the original napkin, but Laffer himself disputes its authenticity, telling The New York Times that he thinks it’s a keepsake he created later. Still, the Smithsonian is right to to honor this most famous of American serviettes, the Magna Carta of modern Republican economics.

The bell-shaped curve illustrates Laffer’s argument that there are two points where a tax rate generates no income: 0 percent, for obvious reasons, and 100 percent, because no one would work if their entire income were taxed. Between those two points, if we follow the trajectory of Laffer’s semicircle, there’s a point where rising taxes raises more revenue, but also a downhill slide where a higher tax rate becomes counterproductive. The curve is more theoretical than practical, since it doesn’t answer the question of when a tax rate is too high. As a matter of politics, though, it offers a splendid rhetorical tool to Republicans who want to slash taxes for the wealthy without having to worry about the deficit: Tax cuts, they claim, spur enough economic growth to offset the lost revenue.

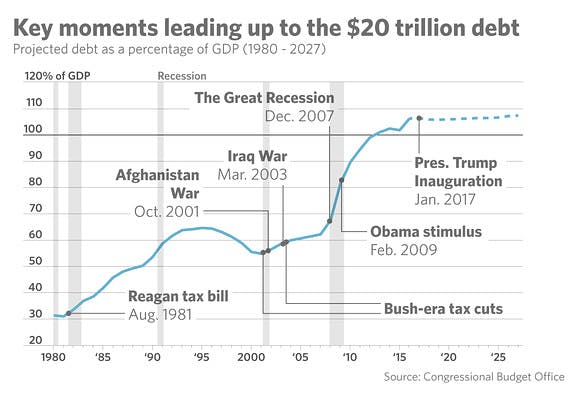

But Laffer’s insistence that tax cuts are self-financing has been disproven time and again over the past 40 years. Reagan’s tax cuts were followed by ballooning debt. Clinton raised taxes on the wealthiest Americans, then the economy expanded and the government recorded its first budget surplus since the 1960s. After George W. Bush’s tax cuts, America fell back into red and the economy sputtered.

Of course, as some Republicans will note, the tax rate is one of many factors that impact economic growth or contraction; the late ’90s tech boom helped Clinton, then hurt Bush when it burst. But ardent supply-siders like Laffer claim that the tax rate is the determining factor, which, considering the historical graph above, makes their case even weaker. As Jonathan Chait demonstrated in his 2007 book The Big Con, “supply-siders have taken the germ of a decent point—that marginal tax rates matter—and stretched it, beyond all plausibility, into a monocausal explanation of the world.” The supply-siders “think booms and busts result from changes in tax policy—and only from changes in tax policy.” In reality, the Laffer Curve is a solution to an imaginary problem. While there might be a point where higher taxes yield less revenue, America is nowhere near that juncture. According to the Tax Policy Center, the nation’s tax revenue in 2015 equaled 26 percent of the gross domestic product, compared to an average of 34 percent average among developed economies.

For these and other empirical reasons, economists across the political spectrum are dismissive of the Laffer Curve. Harvard economist Greg Mankiw, an outspoken conservative who led George W. Bush’s Council of Economic Advisors, has called supply-siders “Charlatans and Cranks” and compared them to a “snake-oil salesman.” Paul Krugman, the liberal New York Times columnist and Nobel Prize–winning economist, often argues with Mankiw on economic policy, but also thinks “the supply-siders are cranks” who adhere to a doctrine “without a shred of logic or evidence in its favor.” This widespread criticism is almost as old as the Laffer Curve itself. As The Washington Post reported in 1989, at the dawn of George H. W. Bush’s presidency:

Laffer’s mathematical ‘curve’ gained folklore status—if limited acceptance by other analysts..... Critics seize on the $155 billion federal budget deficit as proof that the tax cuts he advocated were excessive. They also dismiss the supply-side claim that a tax cut could pay for itself by stimulating new business activity, a claim Laffer says that others exaggerated. “History has contradicted, not confirmed, the Laffer hypothesis,’’ said Robert Eisner, an economics professor at Northwestern University and past president of the American Economic Association. “Certainly, I think it made no contribution to professional economics.’’ Lawrence Chimerine, chairman of the WEFA Group, an economic consulting firm in Bala-Cynwyd, Pa., said the tax cuts aggravated America’s financial ills, including the trade deficit. He described the benefits promised by Laffer and others as “way, way overblown.’’

Laffer’s theory originally took root, though, because he “voiced a message that the president liked to hear.” The same is true today, as Trump’s tweets on Monday attest, but it’s also a message that Republican leaders in Congress like to hear; they’re all behind the tax reform plan unveiled last month, which is nothing if not a paean to supply-side economics. As Paul Krugman notes, “The main elements of the plan are a cut in top individual tax rates; a cut in corporate taxes; an end to the estate tax; and the creation of a big new loophole that will allow wealthy individuals to pretend that they are small businesses, and get a preferential tax rate. All of these overwhelmingly benefit the wealthy, mainly the top 1 percent.” Laffer is enthusiastic about the plan, since it would lower marginal rates for the economic elite—though Laffer, like most Republicans, denies that the cuts would only benefit the rich. “I think it’s trying to make everyone millionaires, billionaires, and trillionaires,” he told Al Jazeera last month. “This is a plan to get everyone to economic growth and give everyone a shot at the apple.”

Trump’s tax plan is likely to increase public debt and widen inequality instead. History suggests as much, as do distinguished economists. But such evidence means little to Laffer and the Republican Party. As the late Robert Bartley, a Wall Street Journal editor who was one of Laffer’s biggest promoters, once crowed, “Economists still ridicule the Laffer Curve, but policymakers pay it careful heed.” Whether they do so because they believe Laffer’s theory, or just use it as intellectual cover to cut taxes on the rich, is an open question. But Trump could have an entirely different goal in mind: bringing peace to a fractured party. While Steve Bannon’s insurgent populists challenge Senate Majority Leader Mitch McConnell and the GOP establishment, the entire party agrees on cutting taxes for the rich. Supply-side economics is the glue holding Republicans together, for now.

The rise of supply-side economics on the right is perhaps the first major example of the modern Republican Party’s abandonment of policy expertise and empiricism. As such, it’s a forerunner to climate change denial, birtherism, and other noxious forms of anti-intellectualism in the GOP. The resiliency of Laffer and his ideas shows that the Republican Party’s decay goes much deeper than Trump. It’s easy enough to ridicule the president as an ignoramus, but it’s hardly an accident that he leads a party that has elevated a crank into an intellectual luminary. If the GOP is cynical enough to accept the Laffer Curve for purely political reasons, it can convince itself to accept any policy idea, no matter how ruinous. Laffer’s legacy, then, extends well beyond bad economic policy: He made the Republican Party safe for snake-oil salesmen, not least Trump himself.