Several years ago, as President Barack Obama negotiated with Republicans over the budget, readers of liberal websites were subjected to ponderous explanations of “chained CPI,” a proposed alternative to the Consumer Price Index that would calculate inflation as growing more slowly. Pitched as a more accurate measurement of inflation, the chained CPI was really an attempt to reduce the deficit on the backs of senior citizens: The net effect would have been a heavy benefit cut for Social Security, which only made sense if you thought the elderly were getting too sweet a deal with their $1,360 a month in average benefits.

Now, chained CPI is back. And the new iteration, proposed as part of the Republican tax bill, is also a Trojan horse. It would establish the proposition that a “better” inflation measure exists and should be employed across the government. Even if this specific legislation doesn’t touch Social Security, make no mistake: It puts Social Security under threat.

Inflation indexing is critical to your wallet. Because prices go up year over year, the government compensates by raising federal benefits to match changes in the cost of living. The government also indexes tax brackets annually, in line with inflation. If it didn’t, the purchasing power of your benefits would erode over time, and because inflation corresponds to wage increases, you would hit higher tax brackets faster.

Measuring inflation might seem simple enough: Compare what everything costs in 2017 to what it cost in 2016, and the net change is the Consumer Price Index. But it’s a consistent source of controversy among economists because indexes can vary depending on what goods you measure or which population you study. Social Security uses a CPI for “urban wage earners and clerical workers,” and the tax code uses one for “all urban consumers.”

Along the way, some experts decided CPI over-measures inflation. They came up with chained CPI, which adds the concept of substitution. For example, if the price of beef spikes, a shopper may choose to purchase lower-cost chicken instead. That individual’s cost of living didn’t increase, technically speaking; they just shifted purchases to fit within a budget. If you do the math on all these substitutions, you get a CPI that’s typically between 0.25 and 0.35 percent lower than the other ways the government calculates inflation.

The idea that this is a more “accurate” inflation measure is debatable. What exactly is the substitution for big-ticket items like education or housing or health care? For an elderly person, a ham might be cheaper than arthritis medication, but it’s not exactly applicable. (In fact, the government specifically calculates an inflation index for the elderly— which, bizarrely, isn’t used for Social Security benefits—and it rises faster than other measures of inflation.) Plus, people buy what they buy because they have a preference that isn’t picked up in economic modeling. Precisely measuring somewhat irrational human behavior is a fool’s errand.

It’s also not really the point of chained CPI, at least not the way it gets used by politicians. Because inflation grows more slowly according to chained CPI, benefits would grow a little less every year. In 2013, the government estimated that chained CPI would cut Social Security payouts by $230 billion over ten years. That goal of cutting benefits matters far more to the bottom line of self-styled budget hawks than a dubious interpretation of “accuracy.”

Chained CPI also increases taxes. The cutoff for tax brackets, the standard deduction, and the Earned Income Tax Credit are all indexed to inflation annually. If the index rises more slowly, more salary gets pushed into a higher tax bracket, and deductions and tax credits erode as well.

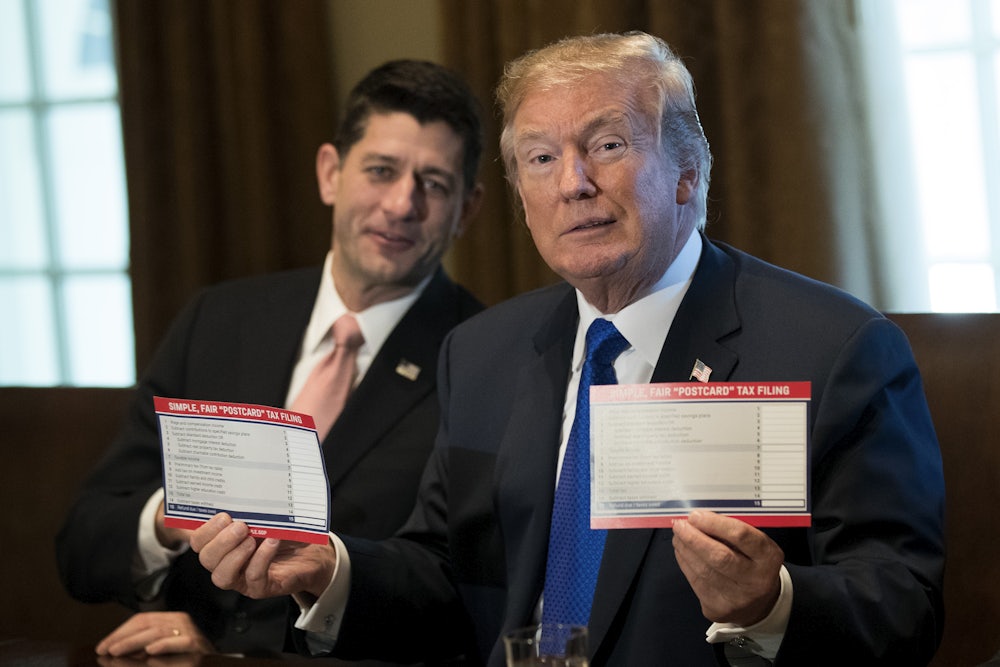

The GOP tax bill proposes applying chained CPI to the tax code. The day after its release, House Ways and Means Chairman Kevin Brady updated the bill to have chained CPI take effect immediately, instead of in 2023. The impacts are at first trivial, but grow over time. According to the Joint Committee on Taxation, chained CPI would increase taxes by $128.2 billion over the next ten years; Howard Gleckman of the Tax Policy Center estimates it would cost taxpayers another $500 billion in the decade after that. People who have less income and rely more on deductions and tax credits—i.e., the working poor and the middle class—are most affected. A major reason that House Speaker Paul Ryan’s model middle class family gets a tax cut in the first year after the legislation but a tax increase in later years is chained CPI.

Republicans have pushed chained CPI for years because it’s a way to cut federal benefits while claiming merely to improve inflation statistics. Obama joined this effort during the ill-fated debt ceiling negotiations, and proposed the switch in his annual budgets until Democratic opposition forced Obama to give up. Now that they’re in power, Republicans might be able to turn chained CPI into the default measurement for inflation.

We need to expand Social Security benefits, particularly for the neediest beneficiaries. But including chained CPI in the tax plan gives those who want to cut Social Security a new rationale. After all, it’s just a more accurate depiction of inflation, it’s good enough for the tax code, and why should we have different measures of inflation for different parts of the government?

That appeal to mathematics conceals the raw politics. If you want to cut Social Security out of selective concern for deficits—which never seem to crop up when giving tax breaks to millionaires—the best way to go about that is to bury the cut in a technical change, the impact of which only widens over time. It’s intentionally confusing and obscure. By installing it for taxes, budget-cutters can call for inflation calculations to be “harmonized.” And they’re sure to mention that even Obama supported the idea.

There are dozens of lines of attack against the tax cut bill, from how it disproportionately benefits wealthy heirs and corporations to how it intentionally attempts to penalize residents of blue states. Chained CPI hasn’t yet been part of that discussion, but if it goes through unchecked, the slippery slope to impoverishing seniors will get coated in grease.