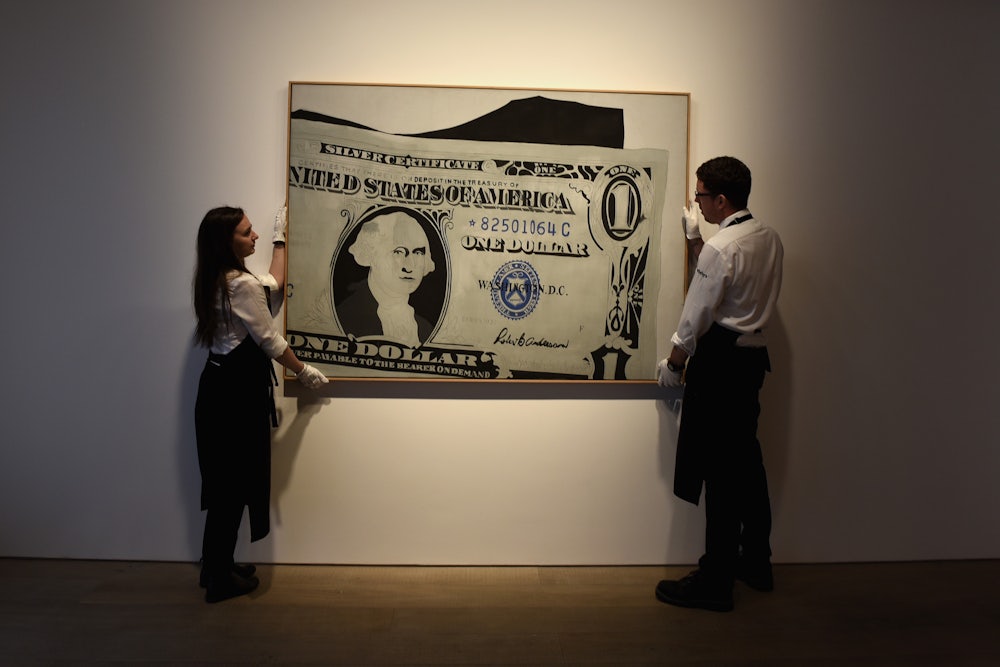

During the late 1950s and 1960s, Robert and Ethel Scull, owners of a lucrative taxi company, became fixtures on the New York gallery circuit, buying up the work of then-emerging Abstract Expressionist, Minimalist, and Pop artists in droves. Described by Tom Wolfe as “the folk heroes of every social climber who ever hit New York”—Robert was a high school drop-out from the Bronx—the Sculls shrewdly recognized that establishing themselves as influential art collectors offered access to the upper echelons of Manhattan society in a way that nouveau riche “taxi tycoon” did not.

Then, on October 18, 1973, in front of a slew of television cameras and a packed salesroom at the auction house Sotheby Parke Bernet, they put 50 works from their collection up for sale, ultimately netting $2.2 million—an unheard of sum for contemporary American art. More spectacular was the disparity between what the Sculls had initially paid, in some cases only a few years prior to the sale, and the prices they commanded at auction: A painting by Cy Twombly, originally purchased for $750, went for $40,000; Jasper Johns’s Double White Map, bought in 1965 for around $10,000, sold for $240,000. Robert Rauschenberg, who had sold his 1958 work Thaw to the Sculls for $900 and now saw it bring in $85,000, infamously confronted Robert Scull after the sale, shoving the collector and accusing him of exploiting artists’ labor. In a scathing essay published the following month in New York magazine, titled “Profit Without Honor,” the critic Barbara Rose described the sale as the moment “when the art world collapsed.”

In retrospect, the Sculls’ auction looks more like the beginning than the end. By today’s standards, the then-record-breaking prices—even adjusted for inflation—sound almost quaint. In November 2013, the Post-War and Contemporary evening sale at Christie’s totaled $691.6 million, setting a new record for the most expensive work by a living artist—$58.4 million for Jeff Koons’s sculpture Balloon Dog. Christie’s proceeded to break its own record auction totals twice more in the next year, with the November 2014 Contemporary sale raking in $852.9 million in a single evening. Meanwhile, this past fall, Christie’s sold a recently rediscovered painting attributed to Leonardo da Vinci for upwards of $450 million, making it the most expensive work ever sold at auction. It’s telling that Christie’s chose to include it in their Post-War and Contemporary sale rather than one devoted to Old Masters where it logically belonged, attesting to the privileged place of contemporary art within today’s art market.

In her 2014 book Big Bucks: The Explosion of the Art Market in the Twenty-First Century, the veteran art market reporter Georgina Adam surveyed the forces that propelled the stratospheric rise in the market for contemporary art, attempting to explain why, for instance, one version of Andy Warhol’s 1963 screen print Liz could sell for $2 million in 1999 and another from the same series for $24 million in 2007, only a few years later. What was once a niche trade overwhelmingly based in the United States and Western Europe has expanded into a global industry bound up with luxury, fashion, and celebrity, attracting an expanded range of ultra-wealthy buyers who aggressively compete for works by brand-name artists. “When I started out, 30 years ago, millionaires had boats and jets—but didn’t necessarily have any art at all,” Thomas Seydoux, the former chairman of Impressionist and Modern art at Christie’s tells Adam. “For the very wealthy today, it’s not fine not to be interested in art.”

In

her follow-up Dark Side of the Boom: The

Excesses of the Art Market in the Twenty-First

Century, Adam, a longtime editor at the Art Newspaper and

contributor to the Financial Times, considers the negative effects this

influx of money has had on the art itself. As contemporary art is increasingly

viewed as an asset class—alongside

equities, bonds, and real estate—Adam

sees artworks often used as a vehicle to hide or launder money, and artists

encouraged to churn out works in market-approved styles, bringing about a

decline in quality.

Art’s imbrication in networks of money and power is hardly a contemporary phenomenon. Many of the great masterpieces of Renaissance art, for instance, were commissioned by members of the nobility. The origins of the modern picture trade date arguably to the 17th century Dutch Republic, where, in the absence of monarchical or church patronage, artists began producing domestically-scaled genre paintings for sale on the open market. In the early 20th century, the art dealer Joseph Duveen—later the 1st Baron Duveen of Millbank—made a fortune selling Old Master paintings he acquired from cash-poor European aristocrats to wealthy American industrialists like Andrew Mellon. As Duveen famously quipped, “Europe has a great deal of art, and America has a great deal of money.” What has changed is speed and scale: There is, Adam argues, more art being produced and sold than ever before, as artists, galleries, and auction houses attempt to keep up with the demand of a new class of international “UHNWIs,” Ultra High Net Worth Individuals attracted by the lure of profit and prestige.

As Adam describes, two significant changes at the end of the 20th century set the stage for today’s inflated contemporary art market. The first was the expansion of the base of potential buyers: The fall of communism in Eastern Europe and economic liberalization in countries like China and India created a new wave of billionaires eager to flaunt their wealth. In China, which has consistently ranked among the top three largest art markets by value since 2009, demand has also been boosted by a government-sponsored museum-building boom. Over 1000 new museums, a combination of state-run and private institutions, have opened in the past decade; as of 2017, there were approximately 200 privately owned museums devoted to contemporary art. Crucially, building private museums serves not only as a status symbol for the country’s elite, but a means of gaining state approval for lucrative real estate development deals.

The second major change was the shift away from Old Masters and Impressionists as the core of the auction business. Historically, selling contemporary art had been the province of galleries and private dealers; the work of living artists went to auction only infrequently. But the major auction houses, Sotheby’s and Christie’s, recognized that promoting the contemporary market could open up vast new revenue streams. They began to function more like luxury brands. Christie’s was in fact purchased in 1998 by François Pinault, the owner of the European luxury retail conglomerate Kering whose brands include Gucci, Saint Laurent, and Balenciaga. The houses began aggressively hyping a never-ending flow of new inventory, and with it, a jet-set lifestyle of multi-million dollar auctions, exclusive gallery dinners, and VIP art fair vernissages.

Auction houses also began to expand into financial services for this expanded range of “UHNWI” clients, offering collectors lines of credit, allowing them to borrow against the value of their collections, and sometimes selling works with third-party guarantees, in which the house effectively pre-sells a lot before the auction and may split some share of the proceeds with the guarantor if it ultimately goes for more than the agreed-upon price. The result is that the prices for contemporary art have risen higher and higher, which in turn attracts new buyers, many of them drawn in by the money alone. “I know some Rothko buyers—some of the key market makers today—who didn’t know who Rothko was until he reached $40 million,” says former Phillips auction house chairman Simon de Pury, quoted in Dark Side of the Boom. “When they saw a good work could sell in the $40 to $60 million range, they suddenly said, ‘this is really interesting!’”

Critiques of the art market’s rise often revolve around anxieties about art’s commodification: What happens to the notion of art as a public good when its value is primarily measured in dollars? But that isn’t the only thing at stake. In the book’s final section, Adam examines the ways in which the notoriously secretive art business, coupled with lax regulatory oversight, has enabled vast sums of money to change hands without public scrutiny. She cites a number of high profile scandals involving money laundering, stolen property, and shady self-dealing. There is, for instance, the so-called “Bouvier Affair,” a legal dispute between the Russian oligarch Dmitry Rybolovlev and the Swiss “Freeport King” Yves Bouvier, the owner of an art shipping and storage empire, which is still unfolding in multiple international jurisdictions.

Like the doormen in Park Avenue co-op buildings, art shippers are frequently privy to the secrets of the extraordinarily rich. After meeting Rybolovlev in 2002, Bouvier offered to use his connections and insider knowledge to help him build a world-class collection by discreetly locating artworks and negotiating deals. In 2008, in the midst of a messy divorce and facing difficulties with the Russian government, Rybolovlev began pouring money into art with Bouvier’s assistance, shifting some of his wealth into portable assets. It later emerged that Bouvier had charged Rybolovlev multi-million dollar markups on his purchases. In one particularly egregious example, Bouvier charged Rybolovlev $118 million for Modigliani’s 1916 painting Nu couché au coussin bleu, but had acquired it for only $93.5 million. Rybolovlev accused Bouvier of fraud; Bouvier insisted, as Adam puts it, that “he was acting as a dealer, that this was clear to both sides, and that he was entitled to make what he could.”

Yet the most troubling examples of the exploitation of art for financial gain are perfectly legal. As Adam outlines, collectors and their agents have continually found creative ways to use their art holdings to defer paying taxes, including the establishment of private museums and foundations, storing artworks in offshore freeports where they can be exchanged without incurring customs duties or VAT, and loopholes in the tax code such as “like-kind” exchanges. Originally set up in the 1920s to aid farmers by enabling them to defer taxes on livestock trades, “like-kind exchanges” are now regularly invoked by art collectors in order to avoid paying taxes on the sale of artworks: So long as a collector uses the proceeds of the sale of one work to purchase another within 180 days, the tax obligation can be perpetually kicked down the road.

Adam brings both an insider’s perspective

and a well-sourced reporter’s eye to Dark

Side of the Boom, using legal documents, auction records, and firsthand

interviews with art-world players to shed light on the seemingly inscrutable

workings of the art market and the various tertiary industries—art advisors,

investment funds, collection management software, storage, shipping,

insurance—that have opportunistically sprung up around it. She opens chapters

with scene-setting anecdotes—the unveiling of a freeport in Luxembourg, a

lavish party celebrating a new Shanghai art fair—offering a privileged, behind-the-scenes

view into the places where art’s value is produced and maintained.

But while Adam paints a detailed and convincingly dire picture of the art world’s excesses, she never fully probes its implications. Perhaps ironically, its central weakness is her narrow focus on the activities of the art market itself: Her book largely brackets an exploration of the art market from the broader context of rising income inequality, economic exploitation, and staggering concentrations of wealth in the hands of the very few, all of which have enabled activity at the its upper reaches to continue unabated despite global downturns in other financial sectors. According to the sociologist Olav Velthuis, the art market ultimately benefits from an unequal distribution of wealth, as newly minted billionaires turn to blockbuster art purchases as a means of announcing their arrival.

Moreover, the question of where the money comes from and where it ultimately goes is only a passing concern here. It’s no coincidence that the world’s most prominent art collectors include Walmart heiress Alice Walton; the Sackler family; Poju Zabludowicz, whose family fortune has its origins in arms dealing; and hedge fund founder Daniel Och, whose firm paid millions of dollars in bribes to government officials in several African countries in exchange for mining rights. No doubt they’d rather be remembered for their patronage of the arts than for profiteering off human misery.