In the aftermath of the Great Recession, amid growing concerns about income inequality and wage stagnation, politicians and pundits on the left and right have blamed the problems of twenty-first-century America on a familiar populist scapegoat: big business. The solution, they say, can be found in the nation’s past—in particular, the reign of two twentieth-century presidents.

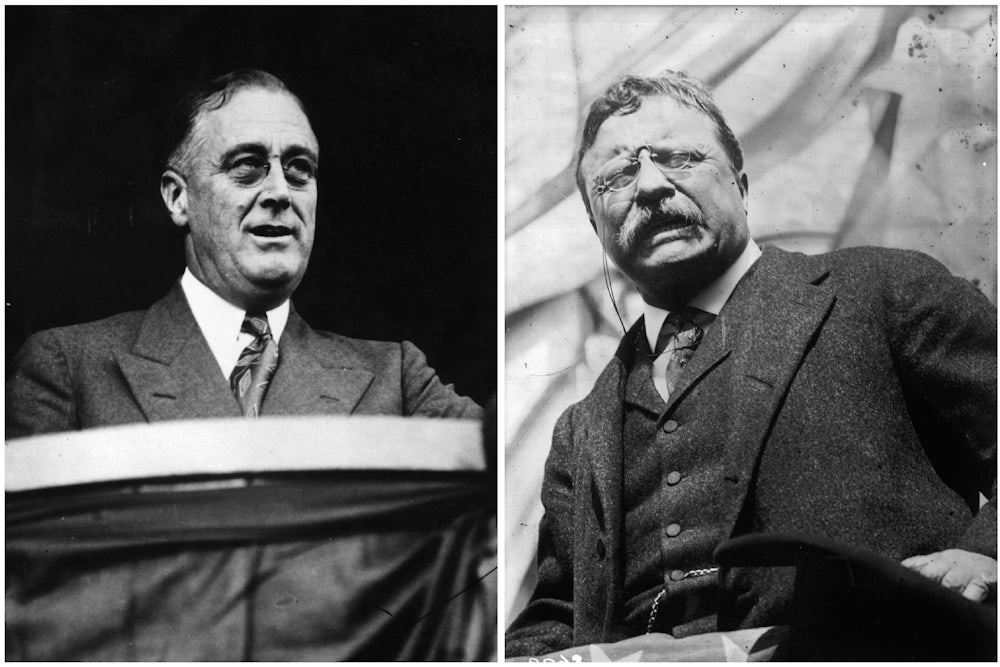

In the early 1900s, the narrative goes, Theodore Roosevelt waged war on corporate concentration as a crusading “trustbuster.” A generation later, during the Great Depression, his cousin Franklin D. Roosevelt stood up for small banks against Wall Street’s big bullies. The Roosevelts saved America from plutocracy and created a golden age for the middle class. Thus, many argue, we need a new generation of trustbusters to save us from the robber barons of tech and banking.

It makes for a compelling case. But it’s based on a false history.

Teddy Roosevelt was far from the business-bashing “trustbuster” of popular memory. The Republican president distinguished between “good” and “bad” trusts, telling Congress in 1905, “I am in no sense hostile to corporations. This is an age of combination, and any effort to prevent combination will not only be useless, but in the end, vicious…”

It is true that his administration brought 44 antitrust actions against corporations and business combinations, including the Northern Securities railroad company and the “beef trust” in meatpacking, which were ultimately broken up by the Supreme Court. But Roosevelt had profound doubts about antitrust, observing that “a succession of lawsuits is hopeless from the standpoint of working out a permanently satisfactory solution” to the problems posed by big business. Indeed, he wanted to replace antitrust policy with federal regulation of firms by a powerful Bureau of Corporations, whose decisions would be shielded from judicial review.

His Republican successor in the White House, William Howard Taft, initiated twice as many antitrust lawsuits in four years as Roosevelt had done in his seven and a half years in office. Privately, Roosevelt raged when the Supreme Court ordered the break-up of Standard Oil, in an antitrust lawsuit begun under his administration and completed under Taft: “I do not see what good can come from dissolving the Standard Oil Company into 40 separate companies, all of which will still remain really under the same control. What we should have is a much stricter government supervision of these great companies, but accompanying this supervision should be a recognition of the fact that great combinations have come to stay and we must do them scrupulous justice just as we exact scrupulous justice from them.”

Anger at Taft was one of the factors that motivated Roosevelt to run for president again in 1912 as the candidate of the Progressive Party. The party’s platform reflected his view that big business overall was a positive force, but needed federal regulation: “The corporation is an essential part of modern business. The concentration of modern business, in some degree, is both inevitable and necessary for national and international business efficiency.” The remedy for abuse was not mindlessly breaking up big firms, but preventing specific abuses by means of a strong national regulation of interstate corporations.

Like Roosevelt, FDR is falsely remembered as an enemy of big business. When running for office in 1932, the Democrat mocked the populists who supported antitrust: “The cry was raised against the great corporations. Theodore Roosevelt, the first great Republican Progressive, fought a Presidential campaign on the issue of ‘trust busting’ and talked freely about malefactors of great wealth. If the government had a policy it was rather to turn the clock back, to destroy the large combinations and to return to the time when every man owned his individual small business. This was impossible.” FDR agreed with his cousin that the answer was regulation, not breaking up big corporations: “Nor today should we abandon the principle of strong economic units called corporations, merely because their power is susceptible of easy abuse.”

In his first term, FDR in attempted to restructure the U.S. economy under the National Industrial Recovery Act (NIRA), a system of industry-wide minimum wages and labor codes, which small businesses claimed gave an unfair advantage to big firms. In his second term, after the Supreme Court struck down the NIRA in 1935, Roosevelt briefly fell under the influence of Robert Jackson, Thurman Arnold, and other champions of an aggressive approach to antitrust in the Justice Department. But when World War II broke out, such an approach became an impediment to enlisting major industrial firms for war production, and FDR sidelined the antitrust advocates.

Surely FDR wanted to “break up big banks,” though, given his support of the Glass-Steagall Act of 1933? That’s a myth, too.

FDR and Senator Carter Glass of Virginia shared the goal of separating commercial and investment banking, ending what FDR called “speculation with other people’s money.” But they were also hostile to what American populists loved—the fragmented system of small, unstable local “unit banks” protected from competition with big eastern banks by laws against interstate branch banking. To prop up local banks, Representative Henry B. Steagall of Alabama pushed an old populist idea: federal deposit insurance. Shortly before his election in 1932, FDR explained why he opposed the policy in a letter to the New York Sun: “It would lead to laxity in bank management and carelessness on the part of both banker and depositor. I believe that it would be an impossible drain on the Federal Treasury to make good any such guarantee. For a number of reasons of sound government finance, such a plan would be quite dangerous.”

FDR was so opposed that he threatened to veto the bank reform legislation if it included deposit insurance. In the end, in order to enact other reforms he favored, he reluctantly signed the Glass-Steagall bill. If FDR had prevailed, there would be no Federal Deposit Insurance Corporation (FDIC).

Today, the growth and consolidation of multinational corporations presents American democracy with genuine policy challenges. But the answer need not come from bogus history; real history will suffice. Teddy Roosevelt argued that “big trusts” must be “taught that they are under the rule of law,” yet added that “breaking up all big corporations, whether they have behaved well or ill,” is “an extremely insufficient and fragmentary measure.”

And FDR said: “Nor today should we abandon the principle of strong economic units called corporations, merely because their power is susceptible of easy abuse.” The answer to the problems caused by corporate concentration, the Roosevelts agreed, is prudent government oversight and using antitrust laws to police abuses—not to break up every big company simply because it’s big.