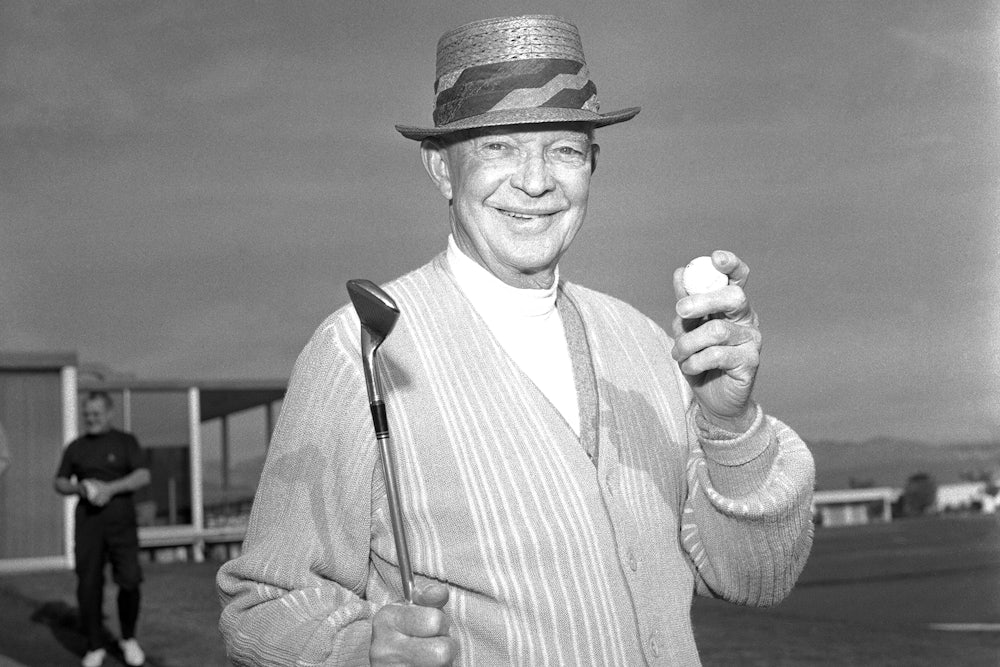

Those of us who grew up in the 1950s retain an enduring image of President Dwight D. Eisenhower as an avuncular old fellow who accomplished little in his two terms, spending most of his time on the golf links. But this vision of Ike comes in for radical revision in Stephen S. Cohen and J. Bradford DeLong’s 2016 book Concrete Economics. According Cohen and DeLong, economists at Berkeley who are among the key sources of the economic development strategy underlying the Green New Deal, the Eisenhower years were perhaps the most economically consequential in modern American history. What’s more, Eisenhower presided over this far-reaching transformation without also creating the sort of extreme economic inequality that attended the great industrial growth spurt of the early twentieth century—or the financialized economic polarization of the present day.

As Cohen and DeLong explain, Eisenhower managed to do all this while governing mostly as a moderate-conservative Republican. But to conserve in the 1950s meant to shore up a social-democratic welfare state: Ike thus consolidated the best aspects the New Deal (such as Social Security and strict regulation of finance) and made “big government” a permanent feature of American life. One immediate result was the creation of the legendary leafy suburban America—thanks to the interlocking subventions of the Interstate Highway System, created under the Federal-Aid Highway Act of 1956, and government-sponsored mortgage financing of single-family homes.

More important, however, virtually all the core technologies that characterize the digital age we live in now—computers, semiconductors, software, fiber optics, artificial intelligence, transistors, satellite technology, packet-switching, and above all the internet—were developed in the postwar R&D laboratories of the federal government. For Cohen and DeLong, the adoption of such breakthroughs by the private sector epitomizes the way capitalist economic development actually operates, as opposed to the fairy-tale idea of the completely free, unregulated market as the sole progenitor of economic innovation.

The first major American statesman to defy Adam Smith’s theory of the “invisible hand” was Alexander Hamilton, who put the federal government in the business of guiding national economic development. Hamilton swiftly implemented a high tariff to protect America’s infant industries, rejecting David Ricardo’s principle of “comparative advantage.”

The reason for the recent anemic performance of the American economy, Cohen and DeLong argue, is twofold. First, emerging East Asian countries adopted the Hamiltonian program of development subsidized by high tariffs. Armed with those lethal weapons, they targeted American industries made vulnerable by the free-trade regime the United States adopted—for the first time in its modern history—after World War II.

Second, the United States transformed its own economic base. A nation can willingly cede the industries of its past to up-and-coming countries, Cohen and DeLong stipulate—but only so long as it shifts its own economy into higher-value-added industries of the future. (A key instance of this strategy would be the new industries that would spring into being if our political leaders vigorously embraced the core concept of the Green New Deal.) The United States, starting around 1980, began shifting its economy into other areas—except that they were exactly the wrong ones. The choice of finance as the main focus of expansion was particularly misguided, and ultimately disastrous.

Finance, as DeLong and Cohen note, is an intermediary, facilitating industry—in and of itself, it produces nothing. The finance sector, which in Eisenhower’s day represented 3.7 percent of the economy, today constitutes about 8.5 percent. By 2005, finance represented, absurdly, 40 percent of all corporate profits.

Finance is also the most volatile part of the economy, as the history of American capitalism amply attests. The uncalled-for expansion of the financial sector came about via the systematic dismantling, over three decades, of New Deal regulatory safeguards, enacted in the immediate aftermath of the American banking system’s collapse in the early 1930s. The result was the near-complete destruction of the international financial structure, and the system of capitalism it sustains.

Cohen and DeLong titled their book Concrete Economics to distinguish their ideas from the purely abstract, empirically untethered nostrums of the unfettered free market. Economist Mariana Mazzucato—another key adviser on the Green New Deal—in her 2013 book The Entrepreneurial State, goes them one better, proposing that the federal government (and thus American taxpayers) share in the profits of companies (such as Apple) that achieve success thanks to technologies developed in federally financed and administered laboratories. This would not, she insists, be a step in the direction of dreaded socialism, but—since all successful capitalist countries have had activist states—“pure and plain capitalism.” In other words, the architecture of any viable Green New Deal will revive the sort of mixed economic development that Eisenhower minted into historic levels of mass prosperity.