Republicans determined to help the poor and the unemployed? That's so last week.

On Tuesday, two proposals to extend jobless benefits for the long-term unemployed failed to get past key procedural obstacles in the Senate. One proposal would extend benefits until the end of 2014, offsetting the cost by tacking on an extra year of sequestration cuts in 2024. The other proposal would extend benefits for just three months, without offsetting cuts or revenue, but in the hopes that future negotiations would produce another extension that was fully paid for.

Prospects for passage of such a proposal seemed better last week, when Democrats and a half-dozen Republicans voted to begin debate on a benefits extension, providing the 60-vote majority necessary to overcome a filibuster. But on Tuesday, when it came time to end debate and move ahead, Democratic leaders couldn't win over the same handful of Republicans. They had only 52 votes to proceed—a majority, but short of the super-majority it takes to pass most legislation these days.

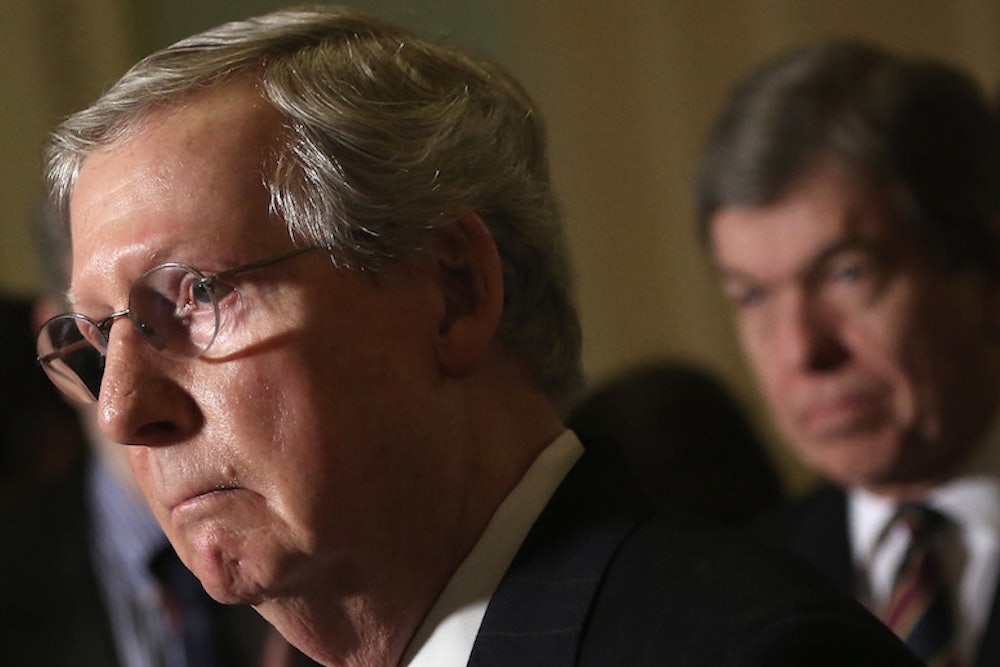

Mitch McConnell, the Republican leader in the Senate, complained that his counterpart, Majority Leader Harry Reid, was using parliamentary tricks to deny Republicans a fair chance to modify the measures via amendment. The back-and-forth soaked up a lot of time on Tuesday, enough to insure that coverage plays up procedural conflict and plays down philosophical differences.

But the differences here are big—and important. The proposals would provide much-needed financial assistance to several million people who have been out of work for many months. These sorts of extensions are routine during economic hard times and, in the past, Congress has never let the benefits expire until the long-term unemployment rate was well below 2 percent. Right now it's well above 2 percent.

The insistence on finding offsetting cuts or revenue is also new. Previously, lawmakers saw these benefits as a form of emergency spending—and reasoned, plausibly, that pure deficit spending during periods of higher unemployment make good economic sense. And while paying for benefits with cuts or revenue in the future is perfectly reasonable, Republican commitment to such fiscal conservatism seems less than genuine when some party leaders (particularly those in the House) have suggested they would pass an extension in exchange for a delay of the medical device tax—a move that would, you guessed it, drive up the deficit. And that's to mention the fact that Democratic leaders proposed offsets, only to have them rejected.

Some conservatives also make substantive arguments against more benefits: unemployment checks, they say, make people lazy and keep them out of work. There's something to that argument when jobs are plentiful. But in conditions like these, the arguments simply don't hold up to scrutiny. As Paul Krugman noted recently, "The view of most labor economists now is that unemployment benefits have only a modest negative effect on job search — and in today’s economy have no negative effect at all on overall employment. On the contrary, unemployment benefits help create jobs, and cutting those benefits would depress the economy as a whole."

One way to see the effects of cutting benefits for long-term unemployed is to look at North Carolina, where, Bloomberg's Evan Soltas writes, a similar cut preceded the "largest labor-force contraction [the state has] ever seen ... Cutting unemployment insurance apparently hasn’t encouraged the unemployed to look harder for work: It has caused them to drop out of the labor force altogether."

Is that the end of the story? No. A senior Democratic staffer tells the New Republic that "Both sides are still going to talk and see if something can be worked out." But House Republicans will be an even tougher sell. If Republicans are truly committed to helping Americans in need, they have a funny way of showing it.