Over the past six months, economists have debated whether the long-term unemployed would find work as the economy recovered. Slowly, but surely, we’re getting the answer. So far, it’s not good: Long-term unemployment is quickly growing from a national crisis into a national tragedy.

After the financial crisis, long-term unemployment—workers unemployed for more than six months—skyrocketed to record levels. In fact, even today, long-term unemployment is higher than at any point before 2008:

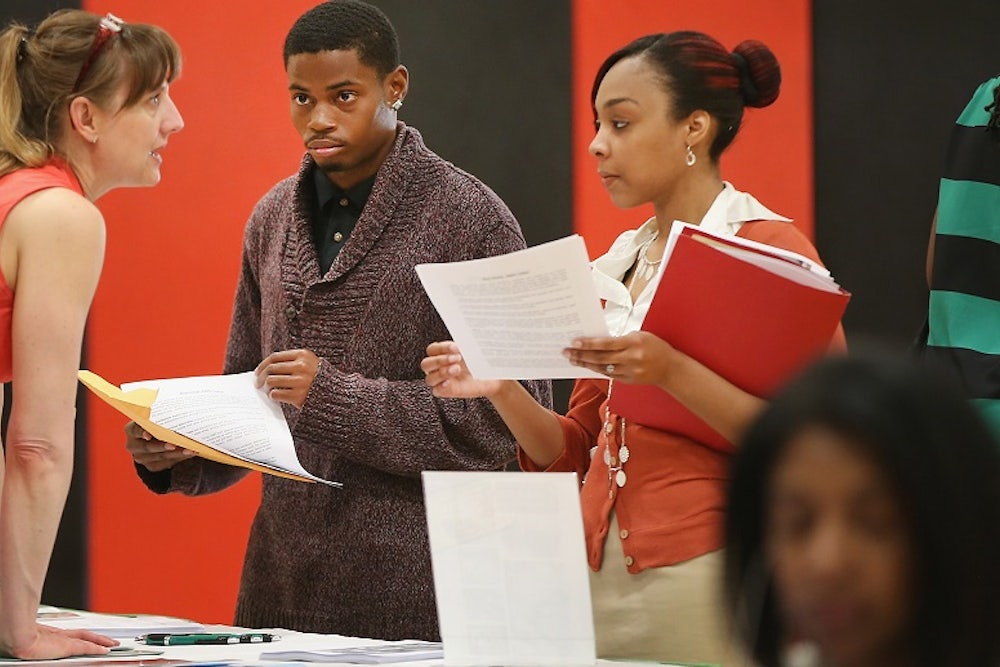

We know a lot about these workers. They are slightly older than the short-term unemployed and are more likely to be a minority. They also work in similar industries to the short-term unemployed and have similar education levels. 55 percent of them are male and 37 percent are married. As of June, there are more than three million long-term unemployed workers, although many more have dropped out of the labor market altogether. From both anecdotal and empirical evidence, we know that the long-term unemployed struggle to put food on the table and are prone to depression. We also know that the most likely cause of their long spell of unemployment was bad luck.

Now that recovery summer seems finally to be upon us economists are watching intently to see whether employers will actually hire the long-term unemployed—or whether the financial crisis has doomed them to a lifetime of misfortune. Here are four scary signs that it’s the latter.

1. Academic evidence. Why have the long-term unemployed had such trouble finding work? In 2012, two economists published a paper at the Boston Fed with an answer to this question. They sent out 4,800 false job applications to employers, varying how long the applicants had been out of work. They found that workers unemployed for more than six months rarely received a call back from employers, even if they had the requisite job qualifications. In other words, employers discriminate against the long-term unemployed.

This doesn’t mean that such discrimination persists today. When that study was conducted, unemployment was still high. Employers did not have to compete for scarce workers. The hope was that as the labor market tightened, such discriminatory policies would no longer be economically viable and employers would have no choice but to hire the long-term unemployed. But that may not be happening, according to a paper by Princeton economists Alan B. Krueger, Judd Cramer, and David Cho. They found that among workers who reported being part of the long-term unemployed between 2008 and 2012, only 11 percent had found a full-time job a year later. They also examined the rates of long-term unemployment in states with low and high unemployment rates. They found that even in those states with tighter labor markets, long-term unemployment had still not recovered.

2. Labor market dropouts. Since March, the ranks of the long-term unemployed have fallen by 700,000. That has led some conservative commentators to wrongly claim that the end of federal unemployment insurance in December has spurred the long-term unemployed to find jobs. At Five Thirty Eight, Ben Casselman found that while the short-term unemployed are finding jobs at a quicker pace, there has been no corresponding increase in the job-finding rate for the long-term unemployed. “If they aren’t finding jobs, what’s happening to the long-term unemployed?” Casselman writes. “They’re dropping out of the labor force altogether."

3. Beveridge Curve. Over the past week, there has been a lot of good economic news. Tuesday was no different. The Bureau of Labor Statistics reported that there are more than 4.6 million job openings in the economy, the highest total in years. That’s great news for the unemployed, who now have more opportunities to find work, and for workers, who have more leverage to demand higher wages from their employers. But not everything was good news. Masked within the report is a scary indication that the financial crisis may have permanently damaged the labor market.

The indicator, known as the Beveridge Curve, is a chart that maps unemployment versus job vacancies. Unemployment is measured by the unemployment rate and job vacancies are measured by the job openings rate—that is the number of job vacancies in the economy relative to total employment. Here’s the graph:

A quick word about how to read this: Every dot represents the unemployment rate and job openings rate in a certain month over the past 10 years. Before 2008, the unemployment rate generally fluctuated between 4 and 6 percent while the job openings rate stayed between 2.5 and 3.5 percent. Then the Great Recession hit, sending unemployment skyrocketing and the job openings rate plummeting. The recovery has seen the opposite. The unemployment rate has slowly decreased and the job openings rate has slowly risen.

But a funny thing happened during the recovery: The Beveridge curve shifted out. In other words, for a given number of job vacancies, unemployment is much higher than its pre-crisis trend. For instance, in May, the job openings rate was 3.2 percent and the unemployment rate was 6.3 percent. Before the crisis though, a 3.2 percent job openings rate was associated with a much lower unemployment rate. For some reason, a greater number of job openings are needed to reduce unemployment. This trend may indicate that there is a newfound mismatch in the supply and demand for labor in the economy. One potential explanation: Employers are refusing to hire the long-term unemployed, keeping unemployment high even while job vacancies are plentiful.

Before we become too worried about this curve, Nick Bunker, a policy research associate at the Washington Center for Equitable Growth, notes that a 2010 Cleveland Federal Reserve paper found that Beveridge Curve shifts are common after recessions. “One potential reason for this,” the authors write, “could be that even though some unemployed workers start filling the available job openings, workers who had left the labor force might get encouraged by the recovery and start looking for a job, thereby keeping the unemployment high.” But in the four years since that paper was released, the Beveridge Curve has not shifted backwards. That may be the result of the slow, drawn out recovery. Or it could indicate larger structural problems with the labor market.

4. Wages. One specific area that economists are monitoring closely for signs of a tightening labor market is wage growth. Once employers have to compete for scarce labor, workers can demand higher wages. If employers are not willing to hire the long-term unemployed, that means the labor market is tighter than previously imagined and wages will rise sooner. In June, the year-over-year growth in wages was 2 percent. That’s still very low—approximately equal to inflation. But there are also many anecdotal signs that wage growth will pick up over the next six months. If that’s the case, it will indicate that the long-term unemployed are disconnected from the labor market. That would make them the greatest casualty of the Great Recession.