When President Barack Obama unveiled his budget a few weeks ago, Republicans dismissed it immediately as unserious. “With even all of these tax increases, you don’t even balance the budget, not even in ten years, because you don’t get spending under control,” Rep. Paul Ryan, the chairman of the House Ways and Means Committee, said. Ryan and his Republican colleagues, you see, are very concerned about the deficit. Any budget that doesn’t balance is unacceptable.

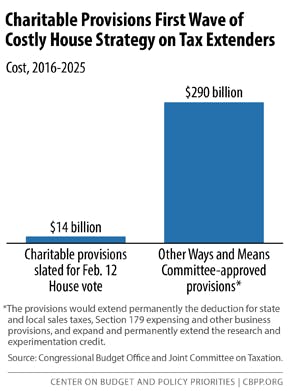

Or maybe they aren’t so concerned. On Thursday, the House passed a tax break for charitable giving that did not include a spending offset. Also on Thursday, the Ways and Means Committee—the same one Ryan chairs—passed three other tax breaks that would increase the deficit by nearly $300 billion over the next 10 years, according to the left-leaning Center for Budget and Policy Priorities. The House is expected to take up that legislation after next week.

The bill would make permanent a tax break for research and experimentation that would increase the deficit by $177 billion over 10 years and also make permanent the deduction for state and local sales taxes, at a cost of $42 billion. The tax break for charitable giving would cost $14 billion. Despite Republicans' frequent fearmongering about the deficit, they propose no spending or revenue offsets.

Congress typically renews these tax breaks, along with another couple dozen tax breaks that generally benefit corporate America, every year. You may remember when these so-called tax extenders last expired at the end of 2013. Last year, House Republicans passed multiple bills that would expand and make permanent some of the tax extenders, so that Congress wouldn’t have to revisit them every year. That’s a smart goal but Republicans hypocritically didn’t include offsetting revenue in those bills. Even worse, the stimulus made changes to the Child Tax Credit so that low-income families could benefit from it. Those changes expire in 2018 so Democrats wanted to make them permanent. But Republicans rejected those efforts.

In the end, Congress scrambled and passed a retroactive extension of the tax extenders so that businesses could benefit from them in 2014. But that means legislators will once again have to address them in 2015—and once again, Republicans are being hypocritical.

"We don't believe that keeping the tax code as it is should require you to raise taxes on other Americans or other businesses," said Rep. Kevin Brady. But Republicans aren’t keeping the tax code “as it is.” These tax breaks technically expired at the end of 2014, despite the fact that Congress is almost certain to renew them. By making them permanent, they’re implementing a big tax cut. "It seems disingenuous,” Brady continued, “to say if we extend it for one-year, it costs nothing. But if we make it permanent and recognize that these are key, critical, truly permanent parts of our tax code, that that somehow is fiscally irresponsible." The one-year extensions don’t cost nothing though. They cost billions of dollars.

I don’t happen to think that a $300 billion, 10-year tax cut is fiscally irresponsible. I’d rather use some of that money in other ways. But the federal government is going to collect more than $40 trillion in revenue over the next decade. Three hundred billion doesn’t make a huge difference in the end. But Republicans supposedly care a lot about the deficit. Their position on the tax extenders just proves those cares aren’t real.