On Monday, Politico’s Ben White and Katie Glueck reported that Wall Street is becoming increasingly concerned at the idea of Senator Rand Paul in the White House. Paul has been barnstorming around the country promoting his “Audit the Fed” bill and making ignorant statement after ignorant statement about monetary policy. His libertarian audience has eaten it up, which has only reinforced the fear that Paul is a real threat to the economy.

But he's not the only Republican that Wall Street should worry about. While the Kentucky senator has the most dangerous economic views of any 2016 candidate, thanks to his rabid disdain for the Fed, his views aren't that different from the GOP establishment or the rest of the primary field.

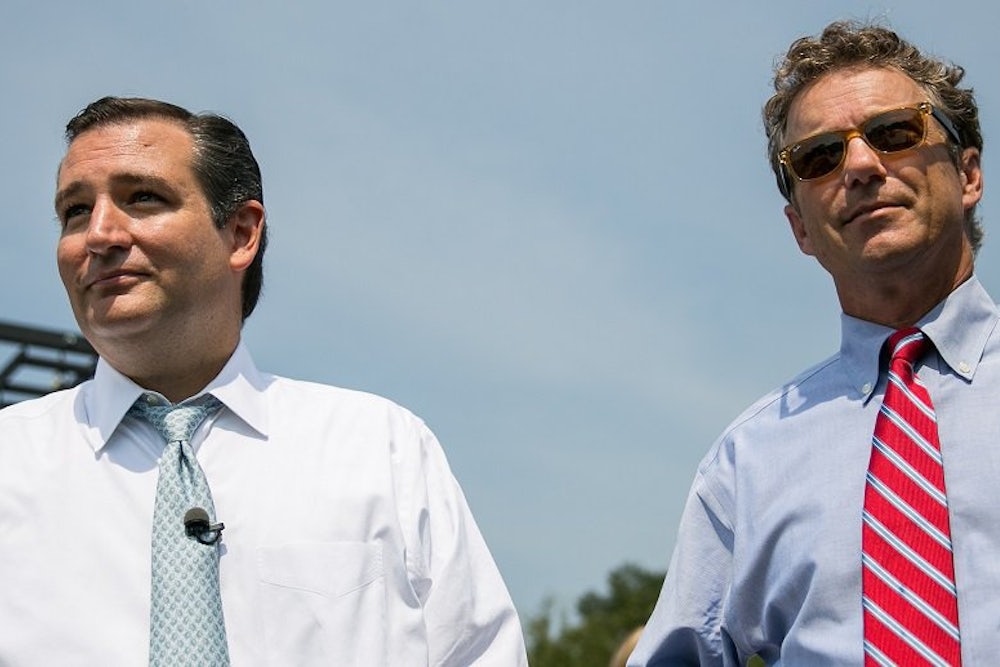

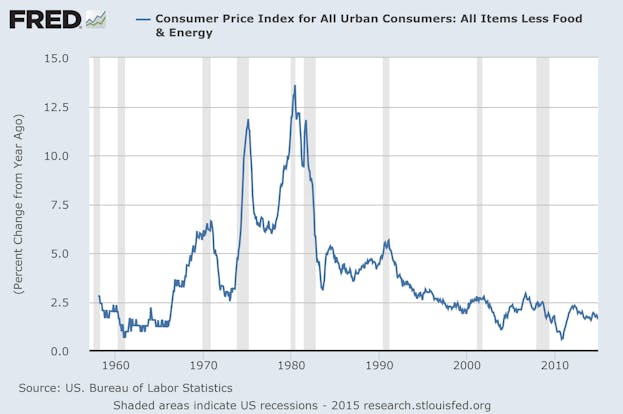

Consider Texas Senator Ted Cruz, a major supporter of Paul’s “Audit the Fed” bill. “Enough is enough,” Cruz said in a statement in January. “The Federal Reserve needs to fully open its books so Congress and the American people can see what has been going. This is a crucial first step to getting back to a more stable dollar and a healthy economy for the long term.” In 2012, just after he was elected to the Senate, Cruz gave a speech in which he worried about the debasement of the dollar. “We've seen the cost of living for those struggling to climb the economic ladder get higher and higher and higher,” he said. “And every bit as problematic, the savings and investments of those people climbing the ladders have been devalued.” That’s nonsense: Core inflation, which excludes volatile food and energy prices, has been below 3 percent for almost 20 years and, right now, deflation—falling prices—is a much larger concern than inflation is.

“Audit the Fed” has 29 other co-sponsors besides Cruz—one Democrat and 28 Republicans, including Florida Senator Marco Rubio. Rubio has been quiet about monetary policy during his political career, and avoided the topic altogether in his recent, policy-heavy book. But Rubio touched on it in 2012. “The arbitrary way in which interest rates and our currency are treated is yet another cause of unpredictability injected into our economy,” Rubio said at the Jack Kemp Foundation Dinner. “The Federal Reserve Board should publish and follow a clear monetary rule—to provide greater stability about prices and what the value of a dollar will be over time.” Those comments echo many speeches Paul and Cruz have given over the years.

But as National Review’s Reihan Salam posited at the time, they are also not inconsistent with the arguments many conservative economists have made for nominal GDP targeting, in which the Federal Reserve conducts monetary policy so that nominal growth increases at the same rate each year. NGDP targeting, as it is known, has garnered support from economists on the left and right over the past few years, but has yet to be endorsed by a major politician. If Rubio were to endorse it, it would represent a major break with traditional Republican monetary policy (and a smaller, but still significant break with Democratic monetary policy). It would also give him a far more coherent and smart economic platform than any GOP candidate. Yet, it’s hard to imagine Rubio explicitly supporting NGDP targeting, at least in the primary, since it would be a huge political risk (conservative primary voters are very receptive to Rand Paul’s views).

And that leaves the rest of the GOP field. In 2011, as then-Texas Governor Rick Perry was gearing up for his presidential run, he called the Fed’s policies potentially “treasonous” and offered a veiled threat at then-Fed Chair Ben Bernanke, saying he would receive “ugly” treatment if he visited the Lone Star State. Former Florida Governor Jeb Bush did not mention the Fed in his first major policy address two weeks ago in Detroit and has made almost no other comments about the central bank in recent years.

Most current GOP governors have been equally quiet. I used Nexis to search for any recent comments on the Fed, monetary policy, or inflation by Republican governors Chris Christie, Scott Walker, Bobby Jindal and Mike Pence. There wasn’t much. In 2013, Walker was heavily criticized for misusing a statistic from the Philadelphia Federal Reserve. Pence, as a congressman, introduced legislation that would strip the Fed of its dual mandate, requiring it to just focus on price stability and not full employment. In June 2012, Christie approvingly cited Bernanke’s position against tax increases. And that’s about it.

Whenever the GOP faces criticism for Rand Paul’s unorthodox position (on vaccines, for instance), it can distance itself by pointing at his libertarian credentials. But it can’t do that on monetary policy because Paul’s views and the party’s views are one and the same. After all, the Republican Party’s 2012 platform even included a plank that implicitly called for returning to the gold standard.

We don't know whether the Republican primary candidates will toe the official GOP line on monetary policy, but we do know that Hillary Clinton will adopt a platform similar to President Barack Obama's. In fact, besides the small group of economists pushing for NGDP targeting, there is very little disagreement on the left about monetary policy. The biggest fight during the Obama years was about whom to nominate to succeed Bernanke: Larry Summers, the former Treasury Secretary under Bill Clinton, or Janet Yellen, who was vice president of the Fed under Bernanke. That was pitted as a major battle between mainstream Democrats and Elizabeth Warren progressives, but it was vastly overrated since Summers and Yellen's positions on monetary policy are almost identical. Summers has frequently urged the Fed to show patience over when to raise rates. Yellen, given her position, has had to be less forceful in her comments on monetary policy, but has demonstrated a commitment to delaying interest rate hikes until there's evidence of wage growth.

Wall Street, Big Business and even conservative economists might worry about the regulatory agenda or tax-and-spend policies of a President Clinton. But they should be downright scared of a President Walker or President Cruz, whose nomination of some hard money crank for Fed chair and Fed Board positions could upend the U.S. economy—at the very moment when it's finally regaining its balance.