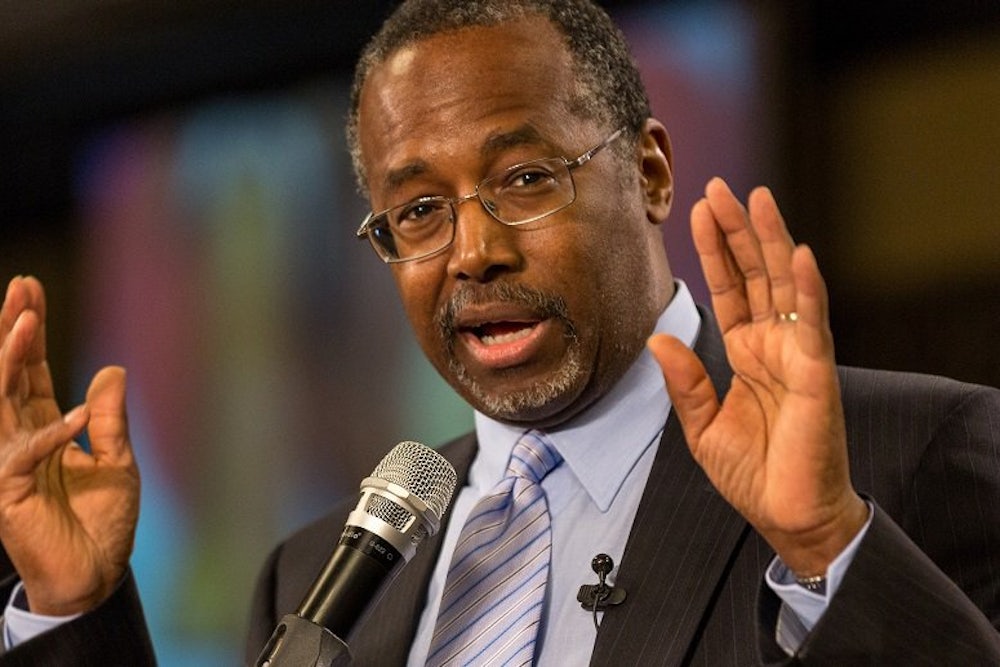

On Sunday night, Ben Carson, the retired neurosurgeon, announced his candidacy for president, joining a GOP field that is getting more crowded by the day (Carly Fiorina announced her campaign Monday and former Arkansas Governor Mike Huckabee will do so Tuesday). He's a longshot, but not because his views differ much from his fellow Republicans'.

Carson burst onto the conservative scene two years ago with a scathing speech at the National Prayer Breakfast in which he denounced Obamacare—while President Barack Obama sat directly beside him. The next day, the Wall Street Journal published an editorial titled “Ben Carson for President.”

But Carson didn’t just harp on the president’s health care law in his 2013 speech. He also called for a flat tax, citing the Bible as his inspiration. "What we need to do is come up with something simple. And when I pick up my Bible, you know what I see? I see the fairest individual in the universe, God, and he's given us a system. It's called a tithe,” Carson said. "We don't necessarily have to do 10 percent but it's the principle.… So there must be something inherently fair about proportionality. You make $10 billion, you put in a billion. You make $10 you put in one.” He also called for eliminating tax loopholes, and has called for eliminating the IRS.

To be fair to Carson, he wasn’t putting forward a white paper or a fully formed policy proposal. But he’s not the only Republican presidential candidate who has suggested moving to a flat tax. Last week at the Weekly Standard, Stephen Moore, the chief economist at Heritage Foundation and one a leading flat tax proponents, touted the flat tax’s comeback.

“A number of GOP candidates, including Rand Paul, Rick Perry, Ted Cruz, and Scott Walker, are looking to go flat with a radically simplified postcard tax return,” he wrote. “Mike Huckabee wants a low flat-rate tax too, but he would use a sales tax, not an income tax—i.e., no tax return at all.” Moore criticized the “usually sensible” Marco Rubio for his tax plan that expands the Child Tax Credit instead of focusing solely on cutting marginal rates. (Rubio’s plan would also condense tax brackets and eliminate capital gains rate.) But even Rubio has suggested that his ultimate goal is a flat tax. Another potential candidate, Ohio Governor John Kasich, said this weekend that he was interested in the flat tax as well.

In the 2012 election, Herman Cain proposed a “9-9-9 tax plan”—a 9 percent federal sales tax, 9 percent income tax and 9 percent business tax—and former Texas Governor Rick Perry and New Gingrich both proposed flat taxes. But none of them were ever serious candidates for the nomination. Mitt Romney offered a tax plan that defied the laws of math—but it wasn’t a flat tax.

2016 is shaping up very differently. Rubio and Walker are widely considered two of the top three candidates most likely to win the nomination (former Florida Governor Jeb Bush is the other). Cruz and Paul both have strong bases of support, though it’s more difficult to see how they round up enough votes to win. Perry, Huckabee and Carson are all long shots. Nevertheless, the widespread support of the flat tax across the different candidates shows how far the Republican Party has moved on taxes in just a few short years.