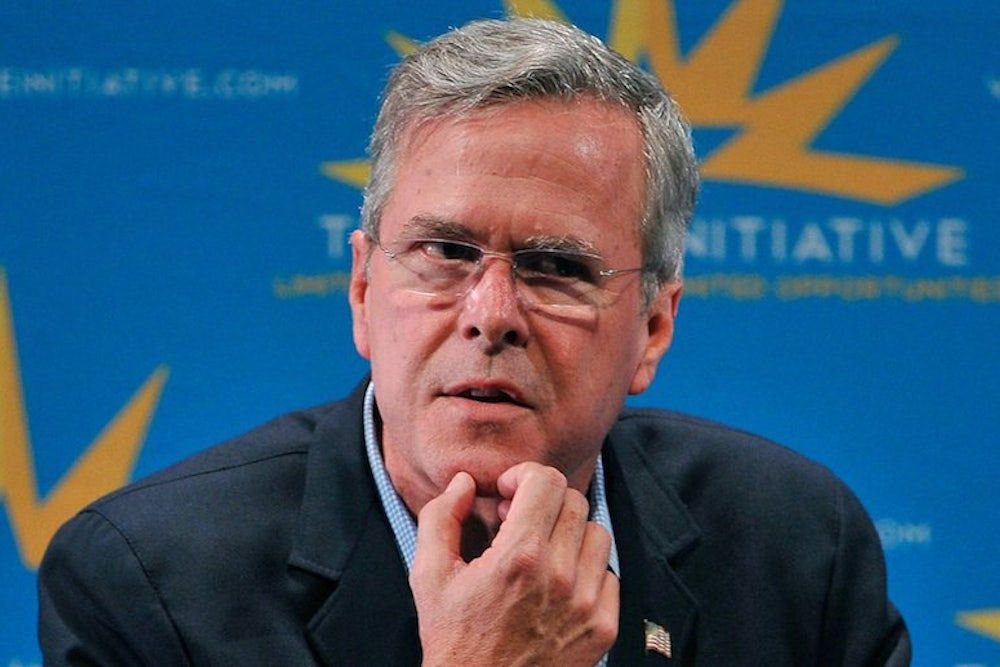

The economic concerns of ordinary Americans barely figured into the first two Republican presidential debates. In five hours' time, the GOP candidates uttered the phrase "middle class" only three times—well, four, if you count Jeb Bush's reference to "the great middle."

That's likely to change at the Wednesday-night debate in Boulder. Host CNBC has promised not only to make the economy the central focus of the two hours (including commercials), but also to press the candidates for details—and many of the questions are likely to revolve around the economic anxieties of both middle- and working-class families. The question is whether the candidates will have much to say that goes beyond familiar Republican boilerplate on tax cuts and the economic benefits of making rich Americans richer.

Reform-oriented conservatives—the so-called "reformicons"—have been urging the GOP for years to focus its messages and policies more on the middle. Some are already worried that it won't happen in 2016. The leading candidates seem intent on one-upping each other with larger and larger tax cuts weighted toward the wealthy—George W. Bush on steroids. By contrast, likely Democratic nominee Hillary Clinton has built her campaign around targeted benefits for the ordinary working families—mandating paid leave, expanding support for child care, lowering the cost of public college tuition, and cracking down on employers who intimidate their workers.

"The Republican presidential candidates have not built their campaigns on offering conservative ideas that would give any direct help to families trying to make ends meet," writes National Review's Ramesh Ponnuru. "Their tax-cut proposals are almost all focused on people who make much more than the average voter." Reformicons like Ponnuru say that promises of trickle-down benefits won't be enough to counter the Democrats' far more targeted and concrete proposals to help ordinary working families. Ponnuru gloomily concludes: "So far, Republicans do not seem to be even trying to erode the Democratic advantage on middle-class economics."

The irony is that economic discontent has been driving the Republican primary as much as it's ignited the Democratic contest; witness the white working class's embrace of Donald Trump. But when you look past the rhetoric—and implausible ideas like deporting 12 million illegal immigrants—Republican economic policy continues to center almost exclusively around tax breaks for the wealthy. Michael Strain, a resident scholar at the American Enterprise Institute, agrees that the party isn't doing itself any favors by fixating on the top marginal tax rate and just asserting that "growth" spurred by those tax cuts will somehow take care of the rest. "We don't need to be talking about statistical abstractions," he says.

Bush, Marco Rubio, and Trump have all released tax plans that they are trying to sell as a boon for ordinary families. (Ben Carson and Ted Cruz, the other two leaders in GOP polling, have yet to release detailed economic policies, but both have called for a flat tax, another highly regressive policy.) All three plans contain some appealing ideas for middle- and lower-income Americans: Bush, while axing a tax break that benefits hedge-fund managers, proposes to expand the Earned Income Tax Credit, which benefits the working poor, and to double the standard deduction, which about two-thirds of all taxpayers take. Rubio's plan creates a new $2,500 tax credit for families with children, though it also lets a 2009 expansion of the current child tax credit expire. Both are embracing the kinds of targeted tax breaks that reformicons have long been advocating for. Trump, for his part, has touted a new zero-percent tax rate for those earning up to $25,000 per individual or $50,000 per couple.

The three candidates are likely to play up these reforms in Wednesday's debate to sell themselves as the savior of America's middle class; their tax plans have already convinced some journalists of their "populist" bona fides. But when you do the math, their proposals are highly regressive and wedded to the old logic of trickle-down economics. In addition to slashing the top tax rate, all three plans would eliminate the estate tax, which overwhemingly benefits the top 0.1 percent of Americans. Rubio's plan would go much farther, ending taxation on capital gains and dividends entirely, also disproportionately benefitting the wealthiest.

Under Trump's plan, the middle 40 to 50 percent of Americans would see their taxes fall by 5.3 percent, while the wealthiest 1 percent would see a 21.6 percent decrease, according to the conservative Tax Foundation. Bush's plan, by comparison, would give the broad middle a tax break of 2.7 percent, while the top 1 percent would get a 11.6 percent break. The Tax Policy Center, a leading authority on the issue, says that Rubio hasn't released enough details about his new child tax credit to analyze the full impact of his plan. But the TPC's analysis of an earlier version of Rubio's plan concluded that it, too, was regressive—even before he proposed to eliminate the capital gains, dividends, and estate taxes.

The enormous tax breaks for the wealthy have also driven up the price tag of all their plans: The conservative Tax Foundation estimates that Bush's tax plan will add $3.6 trillion to the deficit over 10 years, while Rubio's will cost $4 trillion, and Trump's a whopping $12 trillion. The candidates will tell you, of course, that these estimates don't factor in the growth that will result from the cuts. In the first GOP debate, Bush served up some fuzzy math he'll likely repeat on Wednesday: "If we grow at 4 percent, people are going to be lifted out of poverty," he declared. "The great middle that defines our country will have a chance to be able to pursue their dreams as they see fit." (That would be impressive growth: The economy has grown an average of 2.7% per year since the beginning of the Reagan administration.) Trump, not to be outdone, has claimed that his plan will unleash 6 percent growth. But most economists simply don't buy these grandiose projections. The consensus is that Bush, Rubio, and Trump would blow up the deficit, which would be likely to dampen growth rather than spur it, as the fallout from George W. Bush's tax cuts has shown.

Strain believes that Republicans need an economic vision that's both broader—going beyond tax policy to embrace education and labor market reforms, for instance—and more specific. "I wish they would spend more time talking about their policy vision, and how their policies will affect real people. When they do talk about these things, it's not tangible," he says. Strain and other reformicons have called for policy reforms that would provide more concrete benefits to ordinary Americans. They want occupational licensing reform, for instance, to make it easier for manicurists, hairdressers, and whole host of other lower-income service workers to be eligible to work. They've floated relocation vouchers for long-term unemployed workers to move to states with more job opportunities, and a wage subsidy as an alternative to raising the minimum wage.

In a similar vein, Rubio has promised to expand investment in vocational training and make it easier to repay college loans. But such proposals are still the exception within the GOP field. Why? It's partly, no doubt, because such policies are not exactly high on the priority list for top GOP donors. The Republican base, meanwhile, still espouses an anti-tax orthodoxy that reinforces the party's obsession with tax cuts—an obsession that's also fueled by outside pressure groups like Grover Norquist's Americans for Tax Reform. The result is another round of GOP candidates like Bush, who has slammed Democrats for promising "free stuff" to black voters from the government—while planning his own massive giveaway to the wealthiest Americans.

This surely won't escape the attention of the debate's moderators on Wednesday—particularly John Harwood, who analyzed the major GOP candidates' tax plans in a New York Times column this month. His conclusion: The regressive nature of their proposals "reflects a party still wedded to the theories of supply-side economics 35 years after President Ronald Reagan championed them under far different circumstances." As Harwood noted in his most recent column, that hasn't worked too well for Republican presidents since then—or the economies they've presided over. And it won't be a winning message for the Republican nominee who tries to run against Hillary Clinton, the most likely opposition, and her smorgasbord of policy offerings for the middle class.