In the United States, 260,000 people work in the solar energy industry, and 88,000 of them—more than the coal industry’s entire workforce—may be at risk of losing their jobs.

That’s the message the Solar Energy Industries Association (SEIA) is pushing ahead of January 26, the deadline for President Donald Trump to make a crucial decision that could shape the future of the U.S. solar industry. The question is whether China will continue to be allowed to abundantly and inexpensively export solar panels and solar cells to the United States.

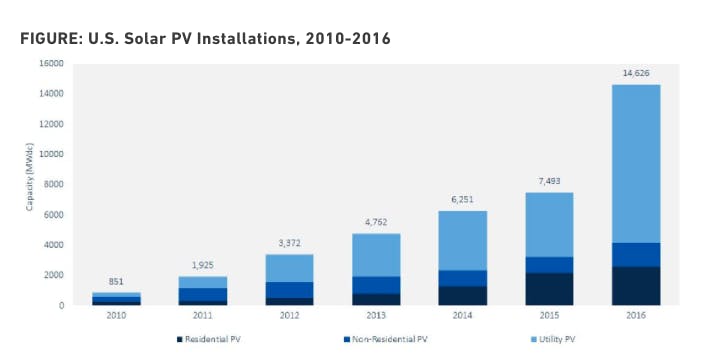

At least 40 percent of solar panels in America are Chinese-made, and their low cost is partially why the United States has seen stunning increases in the amount of solar-powered electricity, and concomitant price decreases, over the last decade. But in a petition filed in June, two foreign-owned solar manufacturing companies with operations in the United States—SolarWorld and Suniva—argued that Chinese companies are engaging in unfair competition. In October, the U.S. International Trade Commission agreed, and recommended the Trump administration limit imports and impose tariffs of 10 to 35 percent on Chinese solar products.

A draft White House document recently obtained by Politico signals that Trump’s White House is poised to accept these recommendations, which would force Chinese suppliers to hike their prices for American buyers. Though many Chinese solar products are already tariffed to varying degrees, the current situation still allows China to “unfairly profit from Americans’ use of renewable power and gain influence in the developing world’s energy infrastructure,” the document reads. Theoretically, new tariffs will level the playing field for American solar equipment manufacturers, allowing them to thrive.

This is a near-perfect representation of Trump’s “America First” trade policy. But SEIA, the solar industry’s trade group, says tariffs on Chinese solar products will take America from first to dead last. After all, China was the main reason why world prices of solar panels dropped 80 percent from 2008 and 2013, and those price reductions caused huge increases in U.S. solar installations. In 2016, solar became the largest source of new electric generating capacity for the first time. What happens if prices rise again because of tariffs?

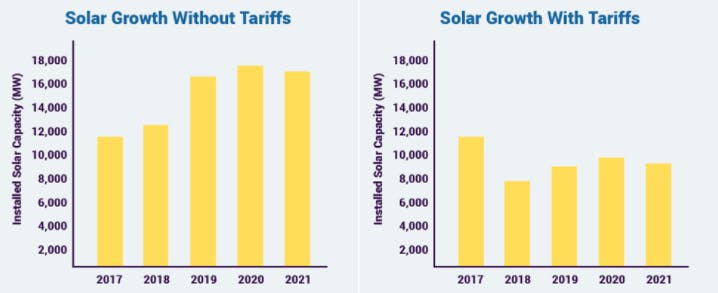

SEIA fears that higher equipment prices will decrease demand for solar energy, which would both stifle a growing job market and slow the growth of clean power. If utilities and homeowners can’t access cheap solar products, they’ll be less likely to choose solar for electricity generation. And if electric utilities and homeowners stop choosing solar, jobs in product installation and electricity generation—which make up the majority of U.S. solar jobs—will plummet. “As one of the least expensive energy sources in America, solar is a major force in the U.S. economy, spurring billions of dollars in investment each year,” the SEIA’s website reads. “This incredible growth will be stopped in its tracks if this petition prevails.”

Suniva and SolarWorld argue that cost increases won’t impact consumer demand for solar products. Rather, tariffs on Chinese goods would increase U.S. solar jobs, they say, because the U.S. solar manufacturing sector would grow to make up for lost business from China. But not all U.S. solar manufacturers agree. “The tariffs requested by Suniva would more than double the price of solar panels in the U.S., undercutting the cost-competitiveness of solar and reversing its high growth trajectory,” a group of 27 manufacturers wrote in a letter to the International Trade Commission. “We would be forced to cut our operations, seriously endangering manufacturing jobs at our factories.”

These arguments on their own are unlikely to sway Trump, who has a demonstrated preference for the fossil fuel industry over renewable energy. But in this rare case, solar advocates have the support of Republican lawmakers, monied conservative groups, and even Fox News host Sean Hannity.

The reason for their opposition varies. Free-market groups like the Heritage Foundation and the American Legislative Exchange Council are opposed to protectionist trade measures, believing global markets should work without government interference. Hannity says that because Suniva and Solarworld are both in financial turmoil—the former is bankrupt, the latter insolvent—and seeking a “bailout” from the government. And Republicans like Ralph Norman—one of 33 GOP congresspeople who signed a letter opposing solar tariffs last month—don’t want to stifle a growing industry. “It is predicted that these trade protections could cost South Carolina alone 7,000 jobs,” he said in an email, noting that his state only has 7,900 solar jobs to begin with.

ICYMI: Fox News host @seanhannity makes the case for President Trump to #SaveSolarJobs and deny foreign-owned Suniva & SolarWorld a bailout. pic.twitter.com/IZk1VuOugh

— Solar Industry (@SEIA) October 17, 2017

It’s important that America be able to compete with China in solar manufacturing. Concerns over outsourcing and national security aside, Chinese manufacturing and shipping is problematically carbon-intensive. Compared to the United States and Europe, China has weaker environmental regulations on manufacturing and uses a dirtier mix of energy sources to create products. A 2014 study found that a Chinese-made solar panel is about twice as dirty as a Europe-made panel. In order to compensate for the dirty energy used to make it, a Chinese-made panel solar panel must produce renewable energy for 20 to 30 percent longer that its European counterpart, the study said. Thus, Americans lose out on some of the climate benefits of solar.

Those who support higher tariffs believe that, if Trump accepts the International Trade Commission’s recommendation, Chinese companies will move to America to avoid trade costs. This is possible. One Chinese solar manufacturer, Longi Green Energy Technology, is reportedly considering opening a U.S. factory if tariffs are approved. And U.S. solar manufacturers have benefitted from tariffs in the past, as the New York Times notes: “After the imposition of tariffs beginning in 2012 that ranged from about 20 percent to about 55 percent for the largest cell and panel makers, manufacturers outside China and Taiwan—including those in the United States like SolarWorld and Suniva—saw their fortunes rise.”

But some experts are skeptical, believing Chinese companies don’t need the United States to make money—especially when other countries are increasingly turning to solar to meet their climate goals. “Tariffs are likely to just hurt demand for solar in the U.S.,” said John Rogers, a senior energy analyst at the Union of Concerned Scientists. “China will still make the equipment. They’re just going to go to supply other markets.” In other words, Chinese solar companies will continue to profit, while the U.S. market will be cut off from affordable solar products. Once again, in the name of putting America first, Trump will be isolating it.