In 1971, Annie Jeminson had good reason to believe that the house she was buying in Detroit was nicer than her small, moldy apartment in public housing. It had been approved for mortgage insurance by the Federal Housing Authority, and her real estate broker had signed a list of its broken things, promising to fix them before she and her three kids moved in. But on moving day, her new home was uninhabitable. None of the promised repairs had been made, water was running down walls, rats lived in the basement, and there was no furnace. Jeminson then learned that her realtor had purchased the house two months before she bought it for less than half of what she paid and simply repainted the walls.

Jeminson told her story to reporters, who had been chronicling similar horrors for months. By then, the HUD Act, an ambitious partnership between the U.S. government and the real estate industry to open the housing market to low-income black families, had become a true disaster. Eventually, the FBI and Justice Department opened more than 4,000 investigations and imprisoned hundreds of local officials and lenders from Philadelphia to Detroit to Seattle. In the early 1970s, newspapers in cities across the country were filled with stories of realtors and banks preying upon families in desperate need of good homes.

But despite this extensive reporting, as well as the hundreds of arrests, a very different narrative of what transpired ultimately took hold. As the federal government accounted for the program, public officials vilified the homeowners as incompetent. “It is amazing what goes on,” George Romney, then the Secretary of Urban Housing and Development, which oversaw the partnership, told a congressional committee in the winter of 1972. “Some of these people that buy homes never go in to inspect the home.”

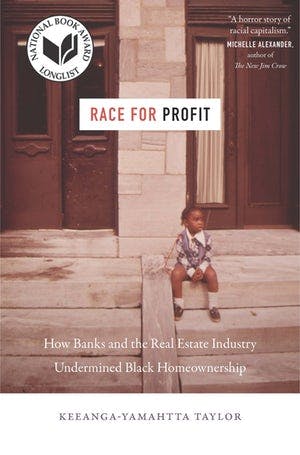

This story—of the failure of the system and of many powerful people to understand it—is the subject of historian Keeanga-Yamahtta Taylor’s book Race for Profit: How Banks and the Real Estate Industry Undermined Black Homeownership, which was long-listed for the National Book Award in September. It’s a devastating account of how the government and the real estate industry worked together and made many of the country’s most vulnerable residents’ lives worse. It also deserves to be read beyond as an inquiry into American mythology and the American Dream. People in power were so devoted to the idea of homeownership as a cornerstone to life, liberty, and the pursuit of happiness that they could not, or would not, see the racism fueling the housing market. They preferred to forge new myths of inferior homebuyers than question their assumptions and beliefs, or failed programs. Which is why Race for Profit tells the stories of so many women like Annie Jeminson alongside its government history: to rewrite what and who we see.

The federal policy at the center of Taylor’s book is the 1968 Housing and Urban Development Act, which President Lyndon Johnson signed into law four months after he signed the Fair Housing Act. Both policies were part of Johnson’s Great Society programs, which aimed to eliminate poverty and racism in the U.S. When he signed the 1968 HUD Act, Johnson called it the “Magna Carta of Cities.” It promised the construction or rehabbing of 26 million units of housing in cities across the country, including 6 million units of low-income housing, all within ten years.

It was an incredibly ambitious and necessary program. After World War II, millions of white families began to leave cities for new suburbs, where they cashed in on federal tax breaks; meanwhile, millions of black families began to arrive in redlined, disinvested ghettos, the only neighborhoods in which they had the chance to obtain leases. Their inner-city houses and apartments were often falling apart and infested with rats, prone to bite kids while they slept. When black residents rioted in cities throughout the 1960s, terrible, unsafe housing was a major reason why.

Johnson’s HUD Act aimed to ameliorate this rage, but not through then-familiar programs like public housing. African Americans had been excluded from the housing market for generations, which was a source of the incredible wealth gap between white and black Americans. The Johnson administration believed that including low-income families in the housing market could solve multiple, historic problems—and make money, too. At the signing, Johnson described the program as a, “federally-chartered private, profit-making housing partnership.” Through the HUD Act, the government provided mortgage insurance to lenders to encourage them to loan in the inner city, and it subsidized all interest payments beyond one percent for participating homeowners.

One of Taylor’s contributions is that she documents how deeply wrong it was for the government to protect the lenders’ risk rather than the homeowners’ risk, particularly given the real estate industry’s longstanding, systemic racism. This was one of the government’s epic blind spots: At least initially, many officials did not, or would not, understand the degree to which racism was baked into the foundation of the housing market, including the thriving suburban market. Property values were high in postwar suburbs partly because they were not located in the inner city. It was a dialectic, Taylor writes: “The greater the sense of ‘crisis’ in American cities, the greater the perceived value added to exclusive white suburban communities.”

Everyone else, on the ground, understood this dynamic very well. The real estate industry commissioned multiple reports touting the superiority of segregated neighborhoods over integrated ones, to discourage the government from integrating the suburbs and destabilizing the market there. Internal reports also documented realtors’ racial prejudice; many spoke openly about their belief that new black buyers were “undeserving” of good quality housing. Likewise, many suburban communities fought to keep new low-income housing out. Gradually, government officials became aware of the widespread racism, but they decided not to challenge their private partners, which meant not enforcing their own Fair Housing laws.

Protecting the exclusivity of the suburbs underpinned the criminality and abuse in the cities, where, once again, black buyers now had limited options. An investigation in Berkeley and Oakland found that old homes were sold to low-income families for three to four times more than they were worth; one Congressional investigator later reported that speculators across the country sold homes at a “1000% markup.” Some of these old homes had even been recently condemned; in one instance, a DC slumlord with 8,000 citations for code violations received more than $9 million from the federal government to rehabilitate his condemned properties. In Taylor’s words, “The real estate industry wielded the magical ability to transform race into profit with the racially bifurcated housing market.”

And then there was the kicker: foreclosure. As more and more poor families found themselves unable to pay for repairs, cities’ foreclosure rates skyrocketed. The structure of the public-private partnership actually made it profitable for lenders to foreclose; mortgage insurance protected their investments, and lenders could collect new sets of fees, including one from the government to maintain a foreclosed home until it was re-sold. (This maintenance didn’t tend to happen.)

Taylor calls this constellation of practices and conditions, “predatory inclusion.” It packs a rhetorical punch, partly because it evokes the enabling belief-system. While exclusion from a market can be financially devastating, so too can inclusion in it. Taylor teaches us that, contrary to conventional wisdom, inclusion in a market is not an inherent good, especially when that market is guided by prejudice.

Like many historians, Taylor stays close to the history she documents and doesn’t set out to address the present day in a sustained or direct way. She doesn’t propose a solution to these perpetual abuses, and certainly not a neat, bipartisan policy move. In her telling, the problems are deep and abiding. They have to do with the degree to which the “American Dream” has become synonymous with the big yet also small accomplishment of owning a house.

Throughout her discussion, Taylor brings into focus defining narratives of American culture, including ideas of “home” and “progress,” and shows how and for whom these narratives continue to fall far short. Homeownership has been central to “fulfilling the promise of the American creed or American exceptionalism,” Taylor writes. “The enduring obstacles faced by African Americans in pursuit of fair housing defy the narrative of the eventuality of progress over time in the United States.” From redlining to segregated suburbs to foreclosure crises to contemporary displacement from increasingly expensive urban centers, the story of homeownership for black Americans has been primarily one of instability, not growth or advancement.

Taylor is excellent at cracking open specific mythologies. We like to think that capitalism thrives on risk, but lots of lenders quite liked insurance against risk and found very creative ways to profit from their mortgage insurance. We also like to think that the problems with Johnson’s Great Society stemmed from “big government.” But Taylor shows that the HUD Act’s biggest failures stemmed from the government’s indulgence of its private partners, which included not enforcing Fair Housing.

There is also the enduring myth that the housing market, or any market, is a more neutral or pure space than the public realm, that a desire to make a profit is somehow at odds with biases like racism. Taylor’s complex portrait of George Romney (father to Mitt), who oversaw HUD in the late 60s and early 70s, poignantly captures how his idealized view of a colorblind housing market impaired his ability to see banks’ and lenders’ early abuses and then, later, to identify the forces behind his program’s failures.

It is by attending to these myths that Taylor achieves a rather incongruent task: making the case for the importance of government while telling a story about the failure of a government program. There is no such thing as a neutral market space, which means it is up to our elected officials, accountable to constituents, to protect all of us. This protection is part of the American Dream, too. Or, it should be.