Just two months into the United States government’s historic multi-trillion dollar response to the damage wrought by the coronavirus pandemic, leading congressional Republicans have lost their appetite for deficit-financed spending. On Tuesday, House Democrats, led by Speaker Nancy Pelosi rolled out another enormous rescue package, a $3 trillion proposal that includes aid to state and local governments, more direct cash payments to households as well as expanded unemployment insurance, SNAP and vote by mail funding. But they are already facing growing calls to hit the “pause button,” as Senate Majority Leader Mitch McConnell put it, in the name of fiscal responsibility.

“We’ve got to figure out now how we’re going to pay for it, we’re going to ruin this economy,” Senator Rick Scott of Florida told Bloomberg News. It’s a sentiment that, despite growing calls from many economists that superpowers like the United States can manage large debts, is largely shared by his Republican colleagues in the House, including the powerful Republican Study Committee, which is pushing for any relief package to offset all new spending with long-term budget cuts.

For the senior Democratic staffers now tasked with pressuring Republicans into supporting these rescue measures, which can’t pass Congress without their support, this reincarnated finger-wagging over deficits from conservatives is not only dangerous—especially with unemployment hitting record highs as states and cities run out of funds necessary to support essential services—but also brazenly disingenuous coming from a party that hasn’t had a president in office who presided over a balanced budget since Dwight D. Eisenhower.

“We’re not dealing with people that deal with facts,” a senior Democratic aide close to the leadership’s discussions told The New Republic. “If they honestly believed in fiscal conservatism, then they wouldn’t have voted for the tax scam,” the senior aide said, referring to the tax cuts passed in 2017 without a single Democratic vote and signed into law by President Trump, which were not similarly paid for and that could cost taxpayers more than $5.5 trillion over 10 years.

Representative Mark Walker of North Carolina, the chairman of the Republican Study Committee in 2017, said of deficit concerns back then, “It’s a great talking point when you have an administration that’s Democrat-led,” and that “it’s a little different now that Republicans have both houses and the administration.”

It was yet another odd twist in this era of alternative facts: The appearance of telling the truth apparently mattered so little to Walker that he had no problem frankly admitting a cynical lie. One would imagine that Republican legislators and Trump might mesh seamlessly over their shared debt opportunism. After all, Trump, a self-proclaimed “king of debt” who has long been understood as both self-interested and ideologically unprincipled, should plausibly have no problem pushing his loyal followers in Congress to use the cover of this emergency to pass bipartisan bills with trillions of dollars in economic support with his shaky reelection prospects on the line and many swing states badly affected. As the most popular Republican in the country, with a cult-like loyalty from his base, just one tweet from him could pressure conservative skeptics in his party to keep up these expansionary fiscal policies.

And yet something different is brewing in Washington. Democratic Representative Ro Khanna, a leading voice from the Progressive Caucus, has found there are some aspects within this political moment that suggests the sudden re-emphasis from Republicans on deficit-financed spending may, at least in part, be a genuine ideological expression among their rank and file.

“What I find perplexing,” Khanna said, “is that it’s in Trump’s self interest to be keeping the economy going and not having massive cuts to state budgets, which aren’t just going to affect blue states but also red states.” That’s not happening so far, he explained, because many Republican congressmen are sincerely “anxious” over the sticker shock from the trillions in spending enacted so far. And they are waiting to see how the states currently edging closer to “re-opening” fare economically.

“That’s not only what McConnell is saying but what I’m hearing in private conversations with Republicans that I’m talking to,” Khanna said. It “needs to be challenged,” he added, but “it’s their worldview. A lot of these people literally came to Congress to tackle the deficit.”

Trump’s interest in keeping up bold measures at the federal level has also waned as the stock market has settled since its March plunge and because, as Khanna sees it, McConnell “has managed to convince the president that the people who will shoulder the blame for the state budget cuts” that are inevitable without federal aid “are not him but the governors.”

Such a political plan relies almost entirely on perpetuating fundamental misunderstandings about how deficits, debts and federal spending operate—but because these misinterpretations are so common, and historically have been spread by leaders in both parties, it just might work.

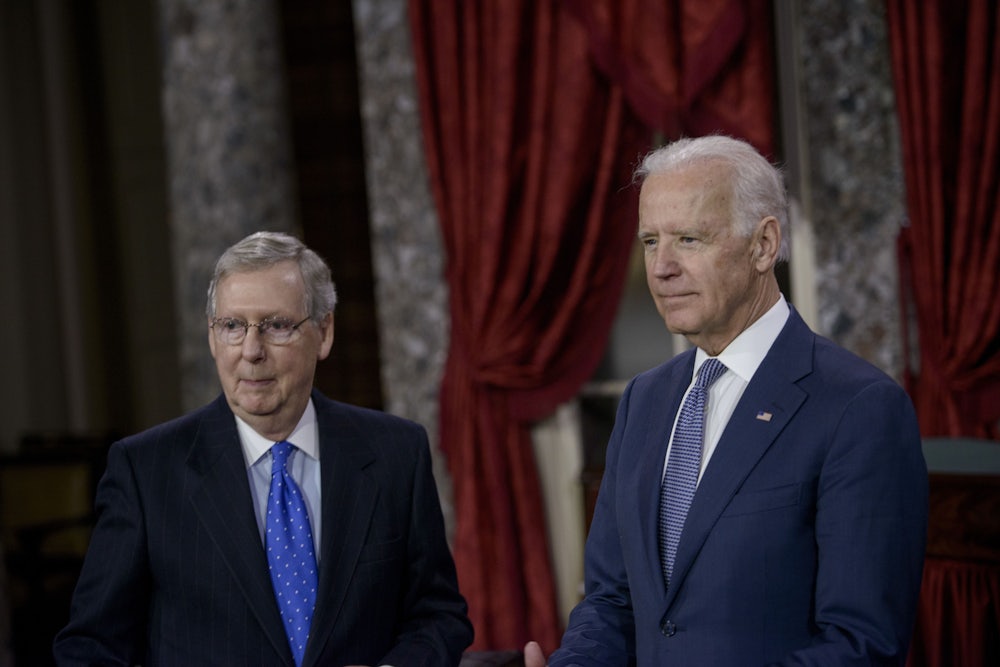

As part of his public messaging attempt to portray states and municipalities as profligate spenders rightfully exposed by the virus, McConnell recently told Hugh Hewitt, “There’s not going to be any desire on the Republican side to bail out state pensions by borrowing money from future generations.”

There are multiple rhetorical sleights of hand in this statement. For one, over 40 states have laws mandating that both the state’s overall budget and the budgets of nearly all cities be balanced because, unlike the federal government, states cannot simply create more dollars through the Federal Reserve. McConnell made a point of specifically attacking California for its supposedly overgenerous benefits to public employees. But in reality, as California Gov. Gavin Newsom has explained, the state, which when counted alone is the fifth largest economy in the world, was “projecting a $6 billion budget surplus” only 90 days ago. Now, the state has doled out more than $12 billion in unemployment benefits and is expecting a deficit of $54 billion—not because of its own policy missteps but rather, those of an ill-prepared federal government. Now, without federal help, teachers and police officers, healthcare workers fighting this virus, and firefighters on the verge of fire season are likely to be laid off.

McConnell headlined a recent press release “Stopping Blue State Bailouts.” However, his red home state of Kentucky is bracing for a revenue shortfall too: one of nearly $500 million. If McConnell’s opposition to state aid continues, local economists like Jason Bailey, the executive director of the Kentucky Center for Economic Policy, expect severe budget cuts and pain for Kentucky families. In turn, the majority leader has offered that, if necessary, states like his might file for bankruptcy instead, which currently is a legal impossibility. The 78-year-old senator has also tried to demonize states’ future pension liabilities, which are a real but much longer term concern. As The Atlantic has noted, “Reducing future pension liabilities will not replenish lost revenues or reduce suddenly crushing social-welfare burdens.”

The third, and potentially most effective, talking point McConnell is using is the age old line, used by members of both major parties in recent history, that increased federal spending is “borrowing money from future generations.”

As the economist Stephanie Kelton explains in her forthcoming, zeitgeist-capturing book The Deficit Myth, this “future generations” riff, meant to imply prudence and providence, generally sounds sensible to people who naturally think of budgets in household terms. This is why this particular rhetorical feint has been echoed across decades by not only Ronald Reagan, Bill Clinton, Barack Obama, Nancy Pelosi and Joe Biden, but even at one time by Biden’s recent electoral opponent, Bernie Sanders, who said years ago, “I am concerned about the debt. It’s not something we should be leaving to our children and grandchildren.” It’s why as recently as 2013 Pelosi insisted that “the deficit and debt are at immoral levels,” and why in 2019 she passed PAYGO, a House rule that allows the administration to make cuts to some mandatory spending to offset any net annual deficit increase caused by congressional legislation, with few Democratic party defections.

But when the national debt-to-GDP ratio was at its highest in America, during the expansion that followed World War II, an era of unmatched prosperity unfolded in which 92 percent of the Americans who turned 30 in 1970 earned more than their parents had at that age. Much of those deficits were generational investments, not burdens—and they were paired with high taxes on the rich.

For economists and investors, a primary concern about increasing debts and deficits over the past decade has been that it could eventually cause too much inflation, which eats away at consumers’ purchasing power and undercuts growth. “But the negative things that would happen if you had too much deficit spending—inflation, the crowding out of private investment, some other things—just haven’t happened,” said Heather Boushey, president and CEO at the Washington Center for Equitable Growth, a center-left think tank whose economists are advocating for fiscal spending that automatically continues until specific triggers, like a certain lowered unemployment rate, are met.

Even former Goldman Sachs CEO Lloyd Blankfein—nobody’s model of a Modern Monetary Theorist—remarked on Twitter that “despite the trillions the U.S. is adding to our budget deficit and national debt, investors (many foreign) will lend the US a virtually limitless supply of [dollars] for .6 pct for 10 years.” That’s a fancy way of saying that U.S. dollars are so widely seen as a rock solid financial asset that the entire world is fleeing to safety amid this pandemic by storing its money in U.S. Treasury bonds, which in turn makes the cost of deficit-financed federal spending incredibly cheap. As it happens, these costs have been declining for decades.

Nevertheless, deficit hawks persist. On Sunday, Larry Summers, the treasury secretary under Bill Clinton who presided over the bank deregulation that spurred the 2008 crisis (who then became a top Obama adviser and encouraged an early, growth-zapping pivot to deficit reduction, and who is now also advising the Biden campaign), told Fareed Zakaria on CNN, “Fareed, we can’t sustain the level of spending we’re engaged in this summer in relief.” Progressives, aware of how Biden voted for a balanced budget amendment to the Constitution as a senator in the 1990s, are worried he may soon agree.

The problem for Democrats, whose brand relies upon helping the wage-earning masses, is that the entire country is depending upon them to avoid a depression for the second time in a dozen years and that, once again, to meet the moment, they will have to beat back harmful yet effective rhetoric on deficits that their own party leaders, backed by many of their cocktail party peers in the elite press, help to legitimize.

Democrats might be able to push through some version of this forthcoming aid package by leveraging the popularity of well-liked Republican governors like Maryland’s Larry Hogan, Utah’s Gary Herbert, and Massachusetts’ Charlie Baker to make an effective bipartisan case for more state and municipal emergency help, as a senior democratic aide told me they plan to do.

“The idea is to put out a bill that is Covid related, that meets the test of what we’re facing as a country right now,” the aide said.

Meanwhile, Federal Reserve Chairman Jerome Powell, who has been lauded by markets for the central bank’s swift action so far, has also urged lawmakers to make use of their “great fiscal power” to tamper the virus down. Still, he added, there would eventually come a moment of reckoning: “The time will come again, and reasonably soon, where we can think about a long-term way to get our fiscal house in order, and we absolutely need to do that.”

It’s ominous, given what the nation may be facing at a time elites define as “reasonably soon.”

It could be a time when student loan debt, medical debt and credit card debt are spiraling further; when unpayable back rent and mortgages are sinking countless families. In six months, if Democrats are lucky, a President Joe Biden, still mid-crisis, will be faced by Republicans who have fully become deficit hawks again, demanding offsets for new spending no matter how bad the economy is. Can Democrats’ effectively argue against them if Pelosi’s PAYGO rule, which effectively demands the same, is in place?

While the speaker’s office declined to offer a comment to The New Republic on the record, there seem to be emerging signs that the Democratic brass is changing tack on the issue. “Republicans have proven that they have no problem being hypocrites on deficit spending or making tax breaks rain on corporations and the richest Americans when they’re in power,” said Brandon Gassaway, the national press secretary at the DNC. “Democrats have learned that lesson and will focus our energy on rebuilding the economy with working people at the forefront.”

Khanna, who along with Rep. Alexandria Ocasio-Cortez, opposed the 2019 House rules in protest of PAYGO, told The New Republic, “Every member of Congress who is a Democrat should be asked ‘Do you still think PAYGO is a good policy?’ I can’t imagine any democrat voting for PAYGO again. They were able to waive it in this crisis. But we should never have that provision again.”

Still, Khanna further added that deficit doves need to start doing some serious public relations work to shift the goalposts that bipartisan hawks have kept in place for decades. “We need an explainer on why the inflation that came in the Carter years and early Reagan years, isn’t right around the corner,” he said. “What would be too much? At what point would there be inflation risk? What are the new factors? Why has the world changed?”

Claudia Sahm, a macroeconomic forecaster at the Federal Reserve from 2008 to 2019 as they spent trillions to stabilize the economy, who left the Fed precisely to improve the left’s policy messaging, offered this short-term, shorthand explanation: “The U.S. can only keep spending a bunch if we remain an economic powerhouse and the only way to ensure the U.S. remains an economic powerhouse by the end of this pandemic is to respond to its dire effects—boldly.”