Amid Russia’s war in Ukraine and surging energy demand as Covid-19 restrictions have ebbed, there’s hardly a country on earth that hasn’t been hit by rising fuel prices. In the U.S., the main concern has been what drivers pay at the pump. In Europe, heating and electricity costs will take center stage this winter, as the continent grapples with a prospective cutoff in the Russian gas supplies that have been a staple of its energy diet. Bills are already climbing. And while the UK may not face the kinds of acute shortages that stand to rock countries like Germany, the idiosyncrasies of its energy system already threaten a national crisis around the cost of living.

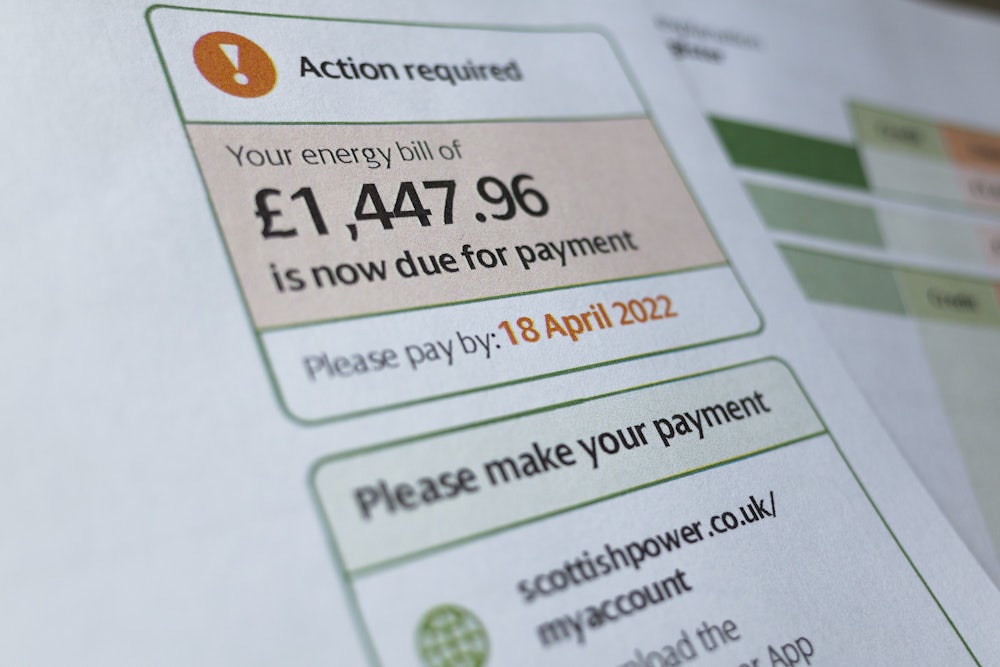

As energy prices rose this past winter, the UK’s Office of Gas and Electricity Markets—tasked with overseeing the country’s privatized grid—raised its price cap on energy bills, or the maximum amount energy suppliers can charge each year, by 54 percent to $2,383. The price cap system was first introduced in 2019 as a response to rising concerns about fuel poverty, when households spend more than 10 percent of their income on energy bills. Now it’s taken on new importance. When the current cap expires in October, Ofgem is expected to raise it by another 70 percent, resulting in a $4,331 yearly bill for the typical home. By April, that could reach $5,352. More than half of UK households could face fuel poverty, and a new campaign is proposing a novel solution to the problem: Don’t pay.

In just a few weeks, Don’t Pay UK—organized by volunteers and funded by donations—has collected nearly 108,000 pledges from people to cancel their automatic payments if Ofgem lifts the price cap and raises rates this fall. By that time, they hope to have one million people signed on, and exert enough pressure on both companies and the government to deliver real relief to struggling households and an end to the rate hikes. As countries across Europe face sky-high bills, nonpayment could be a trend that catches on.

Lewis Ford, an IT consultant who lives in Hull with his wife and young children, was on a fixed-price yearly contract with his energy supplier for both gas and electricity that ended in January. When he went to get a new contract, estimates had gone up by around $1,200, to roughly $4,232 a year. “When the cost of food goes up you start buying cheaper food. If the cost of fuel goes up you drive less,” he told me. “With energy bills there’s not much you can do about it.” The promise of the UK’s thoroughly privatized energy system was that it would allow customers to shop around for the best deal rather than rely on monopoly state providers. Now, Ford says, that’s not an option. He got involved with Don’t Pay UK “because, like most people, I was just fed up with rising prices.”

The country’s biggest energy providers, meanwhile, have enjoyed rising profits. In May, National Grid—the company controlling the country’s transmission lines—reported a 107 percent rise in annual pre-tax profits during the financial year, which ends in March. They raked in $4.1 billion in profits. Centrica, the company that owns British Gas, has increased its profits fivefold over last year. That those companies chase profits at all is a somewhat recent development. In the 1980s, Margaret Thatcher’s Conservative government kicked off a sweeping overhaul of the British energy system that brought formerly public utilities into private hands, introducing opportunities for profit at virtually every point where electrons might change hands. Each corner of the country’s energy system is now dominated by private actors that all skim a bit off the top. Today, the UK has the only fully privatized transmission system in Europe outside of Portugal, whose government was forced to sell its stake in the country’s grid as a condition of a $79 billion IMF bailout in 2011.

“There’s been a massive increase in the wholesale price and that’s been filtered through an energy system where at each level there’s an extractive layer transferring wealth on a huge scale from ordinary households to the shareholders of these companies,” says Mathew Lawrence, director of the UK-based think tank Common Wealth.

Unlike in other countries, where governments are doing more to offset surging wholesale power prices, UK consumers are bearing most of the brunt of rising energy costs there. Home heating and electricity prices in the UK are rising faster than anywhere else on the continent. Where UK households are set to experience a 215 percent rise in average energy prices over 2021, they’re due to increase in Germany by 23 percent, and in France by 4 percent. The latter case presents a particularly cruel irony. EDF—France’s state-owned electricity provider, now on track to be fully renationalized by September—has a British arm that supplies electricity to the island. It raised rates in April by 54 percent, in line with Ofgem lifting the price cap. Its profits rose 200 percent over the previous year. Not every company has made out well. Unlike the UK’s “Big Six” energy providers, upstart suppliers like Bulb have gone bankrupt as wholesale prices have skyrocketed, with many small firms requesting bailouts from the government.

In response to rising rates and profits, Ford is one of many volunteers starting to organize people in his town to sign the pledge. Don’t Pay UK won’t follow through on the pledge unless it signs up one million people across the UK by October 1. “The risks are too high if we don’t get a big enough number,” Ford says. Unlike in the U.S., shutoffs for nonpayment are exceedingly rare in the UK, so penalties come in different forms: Those who cancel payment can be fined and have their credit score docked, which can make it difficult to rent or buy a home, obtain a loan, or even get a job.

“Energy companies are allowed to make record profits while regular working people are paying for these profits,” Lewis said. “We’re being told to sacrifice our holidays and our savings while companies like Centrica and Shell can make record profits.”

Don’t Pay UK isn’t calling for nationalization, but groups like Common Wealth and the non-profit We Own It have long advocated for public ownership of the energy system—a rallying cry that has garnered a few new recruits as prices have exploded. Former Labour Prime Minister Gordon Brown recently penned an op-ed in The Guardian calling for exactly that. To reach its own net-zero goals, the Tory government already began the process of renationalizing a part of National Grid under the auspices of the Future System Operator, a new public body charged with planning and managing energy distribution. Two-thirds of Conservative voters, moreover, favor temporary nationalization as well as a price freeze. Another poll, conducted for We Own It, found that just 12 percent of the public would oppose renationalization.

Advocates of public ownership say that while it’s not an immediate solution to the cost-of-living crisis—there should be price stabilization policies for that—it offers an opportunity to tackle structural challenges that are driving both inflation and carbon emissions. “The freeze is all well and good, but there really has to be a rapid expansion of renewable supply,” Lawrence says. “If you’re leaving those decisions in the hands of companies—where investment is organized by the profit motive, at a time when fossil fuel production is so profitable—unless there’s very significant intervention, these companies are going to be biased toward plowing money into reproducing the status quo.” A publicly-owned generation company, he adds, could plan out and invest in a massive renewables build-out, “rather than letting those three goals of energy security, affordability and sustainability be at the mercy of what is profitable.” Alternately, the government could issue a bond and buy up distribution and transmission firms directly.

The Conservative government, meanwhile—now in the midst of a tense leadership battle—has offered relatively little in the way of support thus far. Its flagship scheme has been a $484 loan to households struggling to pay their bills, part of a larger $19 million package. The Labour Party this week proposed using the revenue from a beefed-up windfall tax on energy company profits to freeze energy prices at current levels. Labour Party leader Keir Starmer has remained reluctant to endorse the demand, which his predecessor in that role, Jeremy Corbyn, embraced. “They just need to make a decision and do something,” Ford says of the government’s approach to rising energy prices, noting he recently got a $242 loan. “When energy prices have increased by [$1,200] that’s not enough.”