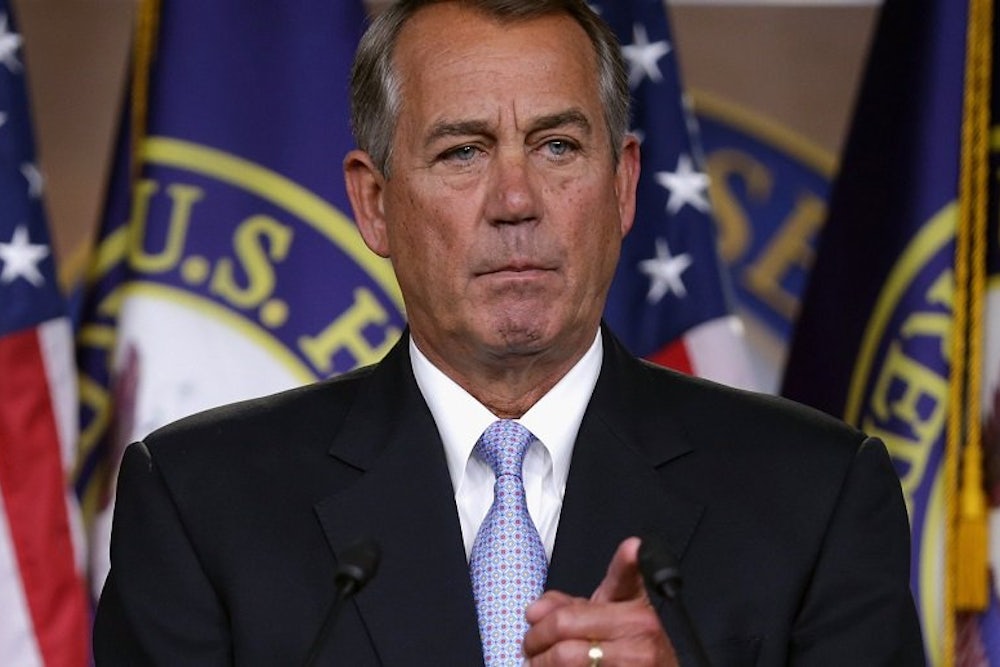

After President Obama released his 2016 budget on Monday, House Speaker John Boehner published a list of ten things that are “newer than Obama’s ideas.” Instagram, Angry Birds, Frozen, and the selfie stick all made the cut. Boehner’s office even created a clunky hashtag for the list—#NewerThanObamasIdeas. The irony is rich: Republican ideas have hardly changed since the 1970s.

It’s true that many proposals in Obama’s budget, like increased infrastructure spending, comprehensive immigration reform, and universal pre-kindergarten, were in his previous budget too. But there were many new ideas, as well. He proposed a new, 19 percent minimum tax on foreign corporate profits—a big move towards the GOP’s preferred territorial tax system. He also wants to expand a tax credit for child care while increasing the capital gains tax rate from 23.8 percent to 28 percent. He put forward a major overhaul of the unemployment insurance system.

None of these represent radical departures from Obama’s previous agendas. But Obama is a Democrat, not a Republican. He wasn’t suddenly going to abolish the Internal Revenue Service and repeal the Affordable Care Act, just as Republicans won’t suddenly wake up and support a single-payer system and higher taxes on the rich.

And Republican ideas on the economy have aged even worse than the Democrats' stale agenda. Take monetary policy. Throughout Obama’s presidency, GOP lawmakers have frequently criticized the Federal Reserve for low interest rates and its recently-ended bond-buying program. Those policies, they have argued, would send inflation shooting upwards. That, of course, has not happened. Inflation has remained below the Fed’s 2 percent target for years. The greater risk is actually deflation—falling prices.

Of course, in the 1970s, inflation was a very real concern. Then-Fed chair Paul Volcker raised interest rates, causing a recession, but stamping out inflation. Republicans, fearing pre-Volcker inflation, are trying to apply those lessons during a very different time, when the far greater risk to the economy has been a weak labor market. If the Fed had implemented them, it would have led to a disastrous economic contraction.

Or consider taxes. Most of the Republican Party has a laser-like focus at lowering the top marginal tax rates. But some reform-minded conservatives also want to finance a huge expansion of the Child Tax Credit (CTC)—a tax credit available to parents. They believe that the Reagan tax cuts in the 1980s that lowered the top marginal tax rate from 70 percent to 50 percent was a smart move. But they see far fewer benefits in lowering marginal tax rates now. “Let’s say we cut the 15 percent federal income-tax rate faced by much of the middle class to 10 percent,” Robert Stein writes in the reformicon’s new conservative agenda, titled “Room to Grow.” “Instead of keeping 85 cents for a dollar of extra effort, a worker would get 90 cents—an improvement of only 5.9 percent.… For these workers, cutting the 15 percent rate to 10 percent would make absolutely no difference in work incentives.” A CTC expansion would put money directly into the pockets of parents who need it. While a few prominent members in the Republican Party have adopted Stein’s tax proposal, most notably Senator Marco Rubio, the vast majority of the party would rather lower marginal rates further instead of expanding the CTC. In other words, Republican tax ideas are still stuck in the 1970s as well.

At the end of Boehner’s listicle, his office writes, “The simple truth is this: The federal budget shouldn’t be cobwebbed by the policies of the past. It should be focused on the future—a future where our kids and grandkids can grow up free from the fear of never-ending debt and a bloated Washington bureaucracy.” His party should listen to that advice.