In the months leading up to the 2024 presidential election, political ethics watchers, an endangered breed, worried about the increasing number of ways in which Donald Trump seemed to be for sale. “Trump keeps creating avenues for people to quietly give him money,” ran a Washington Post opinion headline, referring to the glitzy, $100,000 watches that Trump had recently presented for sale—purchasable with bitcoin.

Steve Benen, an MSNBC columnist, suggested a dark scenario: “A hypothetical wealthy donor wants to give the former president a $100,000 donation—far in excess of the legal limit—so he or she buys an expensive watch. At that point, the nominee could take his cut and write a comparable check in support of his candidacy, since there is no legal limit on what candidates can spend on their own campaigns.”

In the era of unlimited super PAC giving—when Elon Musk could throw hundreds of millions of dollars; the influence of X, the social media platform he owns; and his personal celebrity behind Team Trump with barely a regulatory hiccup—these concerns seemed practically quaint. Trump-themed nonfungible tokens, golden sneakers, gaudy watches, and other branded tchotchkes were small-time stuff, new incarnations of the steaks, the university, the airline, and many other failed products that Trump hawked as a private citizen. Compared to the $2 billion that his son-in-law Jared Kushner’s private equity firm received from the Saudi sovereign wealth fund—along with a nine-figure bailout from the Qatari government for his deeply indebted Manhattan office tower at 666 Fifth Avenue—it seemed that Trump had failed to fully monetize the power of his office.

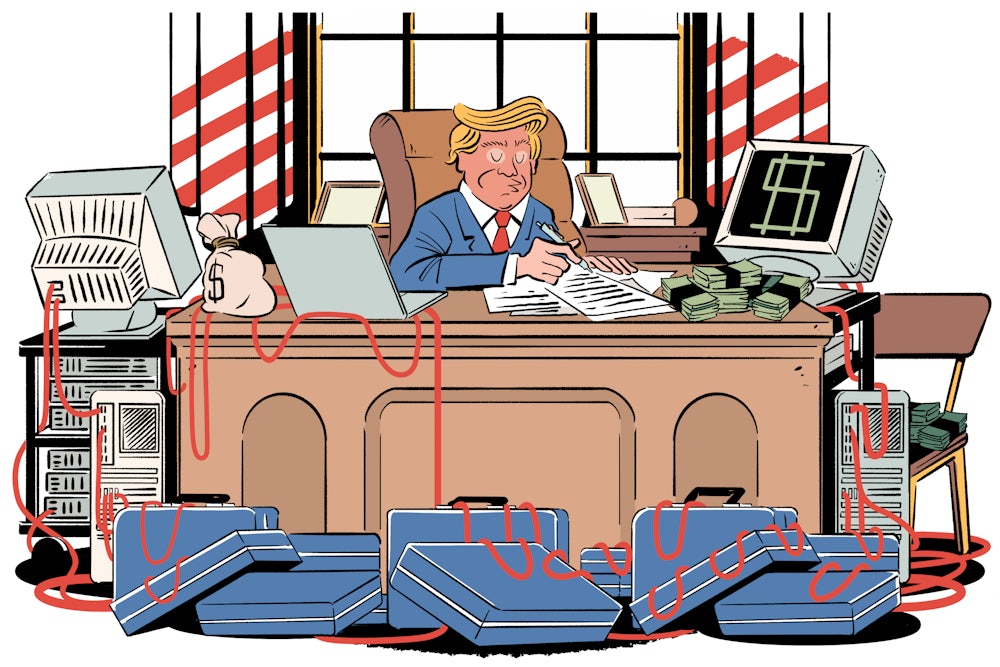

But Trump was already going after bigger prizes, pursuing potentially huge paydays while his donors and advisers developed plans to eliminate any legal, regulatory, and judicial obstacles still standing in the way of the ascendant American oligarchy. The new Trump administration wouldn’t just be open for business. With the aid of Musk’s DOGE wrecking ball, the administration would create the perfect environment for graft, self-dealing, and lucrative influence-peddling. And it would be legal, at least some of it. For now.

One of Trump’s biggest business deals in recent history took a couple of years of waiting and some financial engineering, but it was worth it. In March 2024, after surviving a Biden administration investigation involving the Securities and Exchange Commission, FBI, and Department of Homeland Security into the financing of its special purpose acquisition company merger, Trump Media & Technology Group, or TMTG, the parent of Truth Social, became a publicly traded company. It did so with an assist from Jeff Yass, the options king, ByteDance investor, and richest man in Pennsylvania. After helping Trump find religion on ByteDance’s mega-popular app TikTok, Yass’s firm became the largest shareholder of the holding company Trump Media was merging with, helping the venture survive a lean financial period when two Truth Social investors pleaded guilty to securities fraud as part of an insider trading investigation. Yass sold his TMTG shares soon after the company went public; Susquehanna, his investment firm, also sold its TMTG shares, but later bought back in.

Trump held onto his TMTG stock, which represented more than half of all issued shares. As of mid-February, his holdings were worth more than $3 billion, making them his most valuable asset—at least on paper. If Trump were to sell any of his shares, the already volatile Trump Media stock price would likely plummet. It’s possible that, like Musk and many other billionaires, Trump uses his holdings as collateral for large loans or other deals. Like much that underwrites Trump’s empire, the value of this collateral is pretty specious, a fiction of financial engineering. In 2024, Trump Media brought in only $3.6 million in revenue—a 12 percent decline from the previous year. Overall, the company reported $400.9 million in losses. Even so, Trump Media handed its employees $107 million in stock compensation while also instituting an executive stock buyback program. TMTG’s market capitalization was a nonsensical $6.59 billion.

For someone who has long been a highly leveraged pauper-billionaire, in arrears on his bills, the stock offering must have been a revelation. Without doing much at all, beyond posting on Truth Social, Trump had a multibillion-dollar asset. There was potential for so much more. In mid-October, weeks before Election Day, Trump released his first cryptocurrency token under the auspices of World Liberty Financial, or WLFI, a new venture with which Trump and his sons had partnered. (Its founders include Alex and Zach Witkoff, sons of Trump’s Middle East envoy Steve Witkoff.)

While it got off to a slow start, WLFI eventually sold tens of millions of dollars’ worth of tokens—with $30 million worth going to Justin Sun, a Chinese crypto entrepreneur with an exceedingly checkered career history and a taste for less regulated offshore markets. Sun is currently being sued—at least for the moment—by the SEC for fraud. He has every interest in becoming a business partner with the president who will appoint the next SEC chair. “Excited to have you part of the @worldlibertyfi team and our future working together,” wrote Steve Witkoff after Sun announced his investment.

By Election Day, it seemed that Trump was not just open for business but establishing new avenues of payment and possible bribery unavailable to past presidents. Gone are the days of political operatives like Robert Maheu handing over suitcases of cash to Nixon administration officials. The payoffs travel on crypto rails now, in the relative open. Or they come as hundreds of millions of dollars in super PAC donations.

After Trump handily won the election, the proverbial “For Sale” sign went up. Justin Sun, whose business interests include the TRON blockchain that is a favored money-laundering tool for global cybercrime, announced another $45 million purchase of WLFI tokens and began publicly advising Trump’s sons on crypto purchases. While Trump put his TMTG shares in a trust, there was little talk about his getting out of the crypto business or swearing off milking his voter base with fraudulent memecoin offerings. President Jimmy Carter putting his peanut farm in a blind trust seemed like the sort of accountability gesture that belonged to a far more naïve, less debauched era.

A few days before the inauguration, Trump crossed a Rubicon of grifting that seemed absurd even for him, releasing an official “memecoin”—more accurately called a shitcoin—an essentially worthless cryptocurrency token branded with the ticker symbol $TRUMP. The token had all the hallmarks of a pump-and-dump operation—dropped without warning and hyped by Trump’s social media accounts, with about 80 percent of supply reserved for insiders who would “dump” the tokens on retail traders after they surged toward a multibillion-dollar market cap. And that’s exactly what happened, with large holders quickly selling, while one company behind the coin reaped $100 million in trading fees. Most regular folks who bought and sold $TRUMP lost money.

Back in the White House, on January 29, Trump Media announced a new DeFi, or decentralized finance, venture called Truth.Fi. The new company would put $250 million into crypto tokens while offering crypto investment products to customers. It was at least his third distinct crypto company—not counting the $MELANIA shitcoin, which Trump also promoted.

As Trump throws himself into one of the world’s shadiest industries, his government is smashing the regulatory and legal apparatus that once might have kept him and his donors in check. While Musk and DOGE take aim at the Consumer Financial Protection Bureau—a major enemy of the crypto and banking industries—Trump is installing crypto executives, venture capitalists, and tech entrepreneurs in positions of authority across the government. A number of them come from Andreessen Horowitz, the venture capital firm that poured billions into the crypto bubble, and whose eponymous founders emerged as major Trump backers. The SEC, Commodity Futures Trading Commission, and other financial regulators will soon be heavily staffed by crypto lawyers, fintech executives, and former government employees who passed through the revolving door into the private sector and are now returning, bearing the interests of their erstwhile private-sector employers.

Against this backdrop, financial crimes and political corruption seem destined to receive minimal scrutiny under the second Trump administration. His Department of Justice has already tried to scrap criminal charges in the corruption investigation into New York City Mayor Eric Adams. The decision was announced as part of a brazen quid pro quo in which Adams, his legal fate held hostage to Trump’s goodwill, promised to devote more city resources to deporting migrants.

Attorney General Pam Bondi has made a point of halting anti-corruption work, while Trump signed an executive order stating that the administration would “pause” enforcement of the Foreign Corrupt Practices Act, which bans bribery of foreign officials and has been a useful check on wrongdoing by both U.S. and foreign companies (that can face prosecution in the United States for bribes paid abroad). The administration said that the FCPA “actively harms American economic competitiveness,” since multinational execs couldn’t pay the bribes needed to secure deals in competitive markets.

We’re witnessing a monumental and sudden transformation of U.S. legal and regulatory systems. Even white-collar defense attorneys seemed rattled, wondering if this newly permissive legal landscape will cut into their caseloads. “Abolishing globally focused investigative teams and restricting the scope of overseas bribery and foreign lobbying transparency probes will have a significant impact on what’s been a boon for the defense bar this century,” wrote Bloomberg Law.

With Musk and DOGE leading the push for austerity and privatization, Trump has established a form of corporate and political governance where financial crimes are tolerated, and even legal, if they redound to his benefit or that of his allies in tech and finance. At the same time, tech companies and their CEOs have offered more direct payments, giving millions to Trump’s inauguration committee. Amazon offered Melania Trump a $40 million documentary deal, which she negotiated with Jeff Bezos over dinner at Mar-a-Lago.

That deal was part of an unprecedented postelection flood of cash moving from private industry directly to the president and his family—some $80 million, according to The Wall Street Journal, “as defendants settle lawsuits the president previously filed against them and corporations enter into new business ventures.”

And rather than prepare to cover Trump critically, or to fend off the lawfare and intimidation he has long employed, large media companies seem in a rush to pay him off. After the election, Disney settled a lawsuit with Trump involving ABC News for $15 million. Meta shelled out $25 million in another settlement. CBS is reportedly considering negotiating a settlement with Trump over a 60 Minutes preelection interview with Vice President Kamala Harris that Trump falsely claimed was heavily edited in her favor, but executives at CBS’s parent company worry about the legal liability that might come with such a payoff. The Trump administration is duly applying pressure: Brendan Carr, the fiercely pro-MAGA, pro-Musk Federal Communications Commission chair, has been investigating the news program.

On February 12, X agreed to pay Trump $10 million to settle a Twitter-era lawsuit relating to his suspension from the platform over his role in the January 6 Capitol riot. While some of these settlement payments went to a future Trump presidential library, that $10 million allegedly went directly to Trump, who now employs Musk as an adviser and special government employee. It seemed less like a typical legal settlement than a gift. Trump is, after all, the boss, and the boss needs to be paid.