With painstaking planning and tenacious execution, Donald Trump’s return to the White House hit with an almost immobilizing impact, as he issued over a hundred executive orders, cut funds to vital agencies, laid off thousands of federal workers, rescinded long-standing policy, and directed the gross violations of liberty and law now contested in federal courts. The “dictator for a day” was plainly determined to establish himself for much longer as a strongman ruler, perhaps for even more than two terms in office.

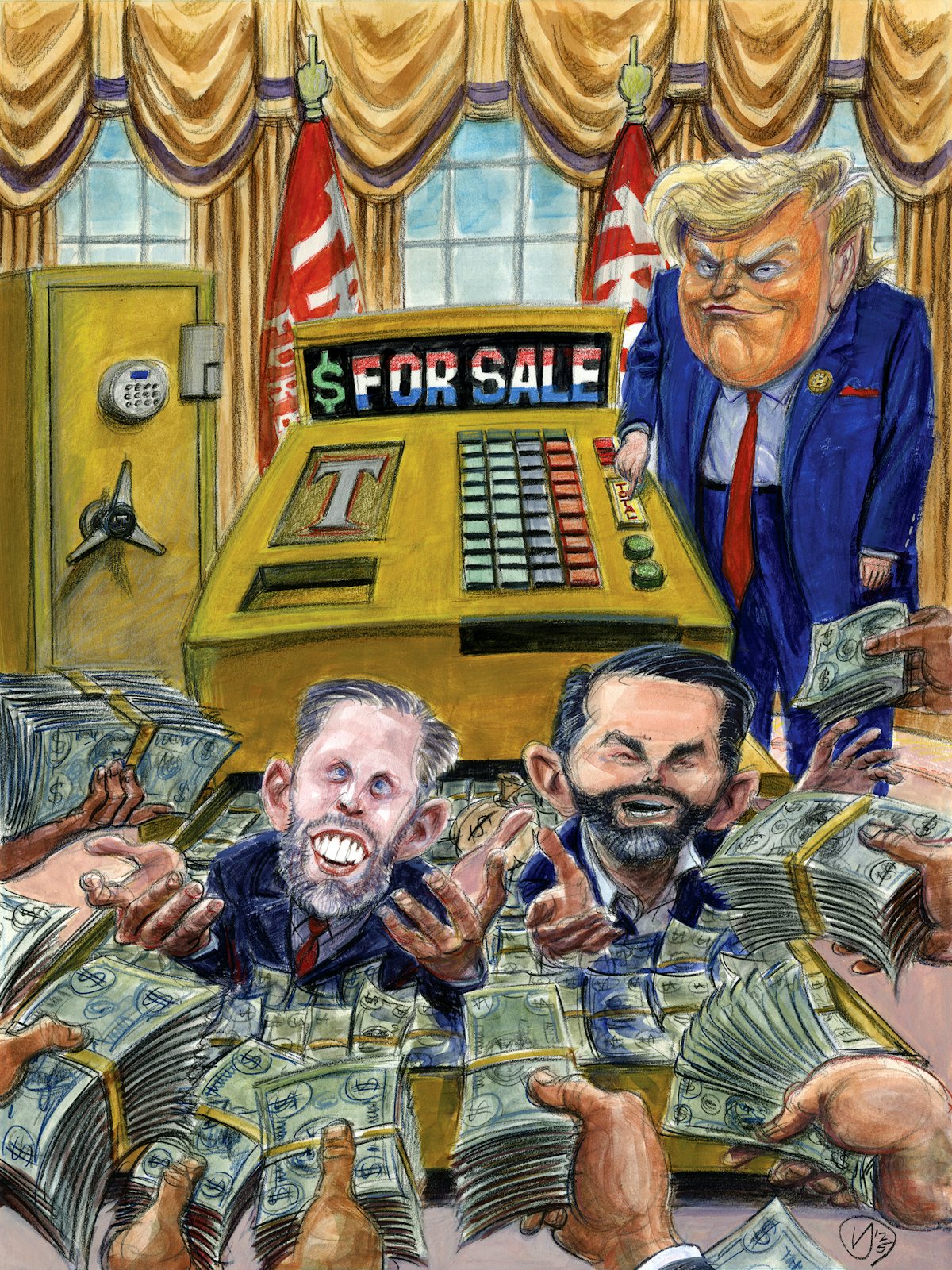

But even before Trump had launched what his minions hailed gleefully as “shock and awe,” the restored chief executive sent an unmistakable signal of his second term’s highest priority. Like every modern autocrat, Trump is preoccupied with asserting authoritarian power to advance his illicit accumulation of wealth. He, too, will abuse state power to enrich his backers and cronies, even when that may mean impoverishing everyone else. Indeed, a central message of his new regime is that such grasping must be valorized and protected—never questioned, impeded, investigated, or prosecuted.

Late on the evening of January 17, when most presidents-elect are wholly focused on the immense task before them, Trump found the time to post a jolly advertisement on his Truth Social website:

“My NEW Official Trump Meme is HERE! It’s time to celebrate everything we stand for: WINNING! Join my very special Trump Community. GET YOUR $TRUMP NOW.”

Festooned with an image of him brandishing his fist and the words FIGHT FIGHT FIGHT, which adorn the $TRUMP memecoin, the post directed supporters to a website where they could buy their very own—as hundreds of thousands promptly did. Within hours, the virtual token had gained a market capitalization of more than $7 billion; by early the following day, its sales price had soared by more than 500 percent, with a face price of $30 and a market value, on paper, of roughly $30 billion.

With the Trump Organization and its affiliates holding about 80 percent of the Trump memecoins (including a second token dubbed $MELANIA that also enjoyed a stratospheric launch over inaugural weekend), it seemed there would be no more scoffing about the billionaire status of the once (or twice, or six times) bankrupted real estate mogul. Suddenly Trump was inching closer toward the kind of incomprehensible wealth of a Buffett, a Gates … or a Musk.

The Trump coin quickly diminished in value, only to briefly rocket back up in late April when its website promised an “intimate private dinner” with the president for the top 220 coin buyers, and a “Special VIP” White House tour for the top 25 customers.

Yet the promotional materials and the astonishing early numbers posted by $TRUMP obscured the basic fact that this new memecoin, like most forms of cryptocurrency, has no inherent worth at all. It isn’t an actual coin, of course, and its virtual existence is nothing more than an opportunity for speculation. Nobody knew this better than Trump, who told Fox News years ago that he suspected cryptocurrencies “may be fake” and Bitcoin was “a scam” used by drug gangs, as well as a potential threat to the dollar and U.S. national security. But that was before his sons Eric and Donald Jr., both crypto enthusiasts, persuaded him that instead of being a crypto mark, he could become a digital pirate himself.

Trump learned what his elder boys meant in late 2022, when he made an initial foray into the blockchain economy online, shilling his own assortment of “nonfungible tokens,” or NFTs—a set of digital doodads that featured heroic images of him in comic-book style as an athlete, a soldier, and a superhero. So conspicuously trashy were these items (and Trump’s manic hawking of them) that even Steve Bannon protested. But Trump pocketed over a million dollars from their sale, even as their price eventually crashed and left other buyers at a loss.

On the eve of his ceremonial oath-taking, Trump’s crass display of greed appalled the nation’s leading crypto investors. Speaking off the record, some feared its impact on an industry that already wears a reputation for fraud, opacity, and criminality. “It’s absolutely preposterous that he would do this,” Nic Carter, a partner at a major crypto investment firm (and strong Trump supporter) told Politico. “They’re plumbing new depths of idiocy with the memecoin launch.”

But that embarrassed crypto financier had entirely missed the point. As Americans would soon learn, the audacity of Trump’s rapacity—and his encouragement of the same shamelessness in Musk and the other billionaires surrounding him—simply underlined the “new abnormal” of the second Trump presidency. With all ethical and legal constraints swept away by a supine Congress and a corrupted Justice Department, Trump now acts as if he enjoys absolute impunity, like his admired friend Vladimir Putin. For the foreseeable future, he almost certainly does.

And he proves again an old truism that applies to authoritarian regimes throughout history. When we think of such tyrannies, we remember first how they curtailed civil liberties, targeted supposed enemies of the state, and repressed disfavored groups. But they share another characteristic that is every bit as endemic as those toxic traits: Their leaders enrich their already rich friends—and most of all, they enrich themselves and their families.

The Scammer in Chief, in Training

From early in his career, Donald Trump has always presented himself as astronomically wealthy, a feat of imagination he has tried to impose on the world for decades, even via litigation. That personal fantasy is only now approaching reality as he exploits his second presidency. Today he is certainly a billionaire—and having pushed away nearly all of the strictures, agencies, and traditional norms that constrained previous presidents, there will be few, if any, limits on his agglomeration of illegitimate riches.

“Donald measures himself by the size of his financial net worth, or his imagined wealth, since he once testified under oath that the size of his fortune is influenced by his emotions,” said Trump biographer David Cay Johnston. “Having that third comma, indicating he’s a billionaire, is central to Trump’s identity and always has been. He told me one day in 1990 he was worth $3 billion.… Later that day he told another reporter he was worth $5 billion, two-thirds increase in his net worth in a matter of hours.”

Trump inherited a huge fortune, estimated at more than $400 million, from his father, Fred, whose political connections also laid the financial groundwork for Donald’s real estate career. Less than two decades later, his real estate and casino companies faced bankruptcy, as did the various airline, football, and hotel enterprises on which he had squandered so much of his inheritance.

Only the success of The Apprentice—the reality TV show that mythologized his persona for a mass audience—saved Trump from complete financial ruin. In the alternate video universe, Trump became the titanic hero of The Art of the Deal, the bestselling and highly fictionalized 1987 memoir penned by ghostwriter Tony Schwartz. Although the nation’s business publications had reported thoroughly on his financial failures, millions of viewers remained sold on the myth of Trump spoon-fed to them in prime time for over a decade.

Running for 15 seasons, this TV flimflam rebuilt Trump’s personal fortune while transforming him into a cultural icon (and ultimately a viable presidential candidate). He swiftly took full advantage of the trust inspired among his audience of celebrity-worshipping rubes. The Apprentice constantly promoted Trump enterprises of all kinds, from hotels and golf clubs to casinos and branded items like Trump Ice bottled water, while collecting big promotional fees from other brands mentioned on the show. To its deluded viewers, the “Trump” brand meant wealth and luxury—everything tacky and gold-plated that he had loudly proclaimed “the best.”

Shunned by banks, however, Trump could no longer function as an actual real estate developer. Even so, his renown was an exploitable commodity not only in the United States but around the world, allowing him to license his surname on luxury properties as a symbol of success and opulence. In the United States and abroad, the Trump Organization could attract prosperous chumps who were susceptible to its hyperbolic sales pitch. Later investigations by ProPublica and others revealed that those projects often failed—sometimes due to fraud—but not before the Trumps walked away with their share of profits up front. In at least one instance, they barely escaped prosecution. Monetizing the public that trusted in “Trump”—who was desperate for money in that era—became his updated business model.

His most notorious rip-off was “Trump University,” the dodgy real estate seminar that touted an opportunity to “learn from the master.” Its advertising featured Trump himself claiming that he had personally overseen the Trump U. staffing. “My hand-picked instructors will share my techniques, which took my entire career to develop,” promised a direct-mail solicitation bearing his oversize, angular signature.

Thousands signed up, only to be hustled and then insulted. “At one seminar, attendees were told they’d get to have their picture taken with Trump,” according to reporter Matt Labash. “Instead, they ended up getting snapped with his cardboard cutout.” The cardboard Trump’s face flashed a characteristic smirk.

With so many swindled victims, the inevitable litigation arrived. Channeling his inner Roy Cohn, Trump attempted to bluster and bully his way out of it. He publicly vowed never to settle the complaints and even pursued countersuits against the plaintiffs, claiming they had “defamed” him. Only months after he entered the 2016 presidential primaries, the overwhelming evidence of chicanery provoked National Review to publish an investigative report with a bluntly damning headline: “Yes, Trump University Was a Massive Scam.” One of its most persistent critics was Senator Marco Rubio, now secretary of state, who said the episode proved Trump should never become his party’s nominee, let alone president.

Trump didn’t entirely escape the legal consequences of the scam rampage that had preceded his presidential campaign. In the wake of his historically narrow victory—achieved via the Electoral College despite a stinging loss in the popular vote to Hillary Clinton—Trump settled the lawsuits brought against Trump University. Dropping his repeated vows to fight the charges in court until the very end, he agreed to pay $25 million in restitution to the plaintiffs.

Presidential Grifting 1.0

Early in Trump’s first presidency, the telltale evidence of grift was as obvious as lipstick on a collar. Before he was even sworn in, roughly $40 million of the money raised from high-rolling inaugural committee donors simply went missing. Then the president himself adamantly declined to divest his private business holdings, as all his modern predecessors had done. His promise to “[leave] my great business” in the hands of his adult children proved hollow, as it quickly became clear that he would persistently use his authority to promote and enrich the Trump Organization—much as the Founders had feared a tyrant might someday do, which was why they had written a specific ban against the acceptance by the president and other federal officials of anything of value (what they called “emoluments”) from foreign or domestic interests, unless specifically approved by Congress.

He utterly ignored that constitutional prohibition, along with most other ethical rules and norms. During the first term, he spent nearly one out of every three days on visits to his luxury resorts, hotels, or golf courses, at a cost of millions to taxpayers. He and his staff used public resources to promote those establishments on scores of occasions. And he accepted millions of dollars poured into his hotels and resorts by foreign governments and other foreign entities as they sought favors from his administration.

Although Trump complained constantly of the fortune he had supposedly forfeited by serving as president (and made an annual display of donating his federal salary to the Treasury), analysts calculated that giving back $400,000 a year represented less than 0.1 percent of the approximately $1.6 billion he had glommed as revenue and income during those first four years. (Prominent among those critical analysts were the watchdogs at Citizens for Responsibility and Ethics in Washington, a nonprofit that had released detailed reports on Trump’s White House self-dealing. Within weeks of resuming the presidency this year, Trump ordered that the IRS seek to cancel CREW’s tax exemption.)

After Trump and his family departed the White House in 2021, their grifting nevertheless continued to expand by orders of magnitude. His obsession with the “Big Lie” that he had actually won the 2020 presidential election reflected not only egomania but greed. The Wall Street Journal complained when Trump continued “conning his supporters” as he did on January 6. But the con had a powerful pecuniary motive, too.

Shortly after Election Day 2020, son-in-law Jared Kushner—who had supervised the campaign’s digital strategy—told the staffers who had overseen online fundraising that he wanted a new daily financial tracker for the Trump Make America Great Again Committee. Known internally as TMAGAC and pronounced “T-Magic,” this joint committee had directed fundraising proceeds to both the Trump campaign and the Republican National Committee.

When Kushner sent that message, the campaign had just seen three of its best fundraising days, on November 4, 5, and 6, with over $100 million arriving in response to shrill appeals warning that Democrats were “trying to STEAL the election.” Yet that fund never existed, and the money donated to Save America PAC could not be used to contest the 2020 election as advertised. Instead, it could be used for almost anything Trump wished—including payment of his huge legal and criminal defense bills. From the election to the insurrection, Trump and his Republican partners banked a total of $255.4 million, a record-setting haul drawn by online ads and dozens of daily email appeals to fight the nonexistent fraud.

A New Grift Nearly Every Day

The Trump family’s return to power turbocharged their drive for profit with the immense influence wielded by the president, who stood to benefit directly despite the nominal control of the Trump Organization and related entities by Eric and Don Jr. To describe their flurry of real estate deals, corporate startups, cryptocurrency ventures, and media shakedowns as “frantic” would grossly understate the pace and scale of Trump family dealmaking in the initial months of his second term. It’s hard to think of anything even remotely resembling their grab for cash in the history of U.S. government, not even when they first came to power.

Tracking the conflicts of interest and coercive profiteering that have erupted in Trump’s orbit over the past several months is a massive challenge for media organizations and public interest groups. Nearly every day, a new and preposterous grift seems to materialize, especially since he and his family have inserted themselves so forcefully into the crypto industry. Many of these schemes emit a strong stench of bribery, extortion, or blatantly violate the emoluments clause, or both.

In addition to Musk, whose hundreds of millions in campaign donations were rewarded with unprecedented authority to reshape government agencies that regulate his businesses (and that might award contracts to them), several of the world’s biggest corporate entities have delivered payoffs to Trump and his family since last November.

Amazon boss Jeff Bezos, for instance, has been eager to cultivate the Trumps after clashing with the vengeful president during his first administration. Melania Trump made him an offer he evidently couldn’t refuse, pitching a documentary about her inspirational life. While other studios made offers ranging from zero to $14 million, Amazon coughed up $40 million, most of which she will pocket. Not satisfied with that big payday, however, Melania’s agent has been peddling “sponsorships” that begin at the bargain price of $10 million to other billionaires seeking Trump’s favor. A Bezos associate told the Financial Times last March that the mogul was “doing a deal, offering money to buy the Trump family’s affection and flattering the president. If you think about it in terms of costs versus benefit, it is pretty low. It’s a smart investment.”

Don Jr. and several partners—including Zach and Alex Witkoff, the sons of Middle East envoy Steve Witkoff—opened a private club in Washington, D.C., where high-rolling political donors, lobbyists, and business executives can expect to socialize with Trump Cabinet members and other administration officials. The new hangout is reminiscent of the exorbitant Mar-a-Lago club memberships, whose price went up to $200,000 in 2017, and the former Trump International Hotel down Pennsylvania Avenue from the White House, where foreign governments spent millions on rooms and events. To join the exclusive “Executive Branch” (as the new club is known) will set you back $500,000, but you might run into Pam Bondi, the attorney general of the United States, who showed up for the launch party.

The Trump Organization has announced several business partnerships with overseas corporations, including some with ties to foreign governments in the Middle East. A new venture to build a golf course and luxury tower in Qatar, announced just prior to an official visit there by Trump, also includes a Saudi-linked company as the principal construction contractor.

That is merely one of what CREW estimates will be 19 such deals in the works in coming months. In an agreement inked in November 2022, the Trump Organization is also building a Trump resort on the coast of Oman, working directly with that country’s government and Dar Global, a builder tied to the Saudi government. Similarly, Trump is also partnered with the Saudi Public Investment Fund in the LIV Golf Tour and tournament, which brings considerable revenue to his Doral resort in South Florida. And a new Trump Tower is under construction in Jeddah, Saudi Arabia, with yet another just announced for Dubai in the United Arab Emirates.

More troubling than any of Trump’s media and real estate enterprises, however, is his family’s rapidly expanding cryptocurrency business—which seems almost designed to foster bribery, money laundering, and criminality. World Liberty Financial, the company set up by Eric and Don Jr. in partnership with Witkoff’s sons and others, has in fact already received a suspicious-looking investment from a Chinese crypto entrepreneur named Justin Sun, who advises the firm. He plowed $75 million into the project, a move that was followed in due course by the Securities and Exchange Commission’s suspension of an investigation into his business practices.

Meanwhile, other crypto companies have flocked to do deals with World Liberty, presumably in recognition of Trump’s power over their industry and in appreciation of his promise to make the United States into the “crypto capital.” Most recently, World Liberty announced that it would issue its own “stablecoin,” a category of crypto pegged to the value of a fiat currency, in this case the U.S. dollar—and promptly saw an Emirati firm, controlled by the UAE’s royal family, buy up billions of those coins to finance an investment in the Binance crypto exchange, which has been employed in the past by terror groups, drug cartels, and sanctions busters.

Trump has rewarded the crypto industry by dismantling much of the federal oversight, regulation, and prosecution that its advocates find burdensome and by promoting legislation to advance its interests. Among those bills is a plan to create a “Crypto Strategic Reserve,” meaning a stockpile of various cryptocurrencies, notably including Bitcoin, Ether, and various denominations held by World Liberty Financial and other Trump-allied firms. Unlike a strategic oil reserve, which has obvious utility, the crypto reserve has no public purpose that mainstream economists can detect. But it would pump Treasury revenue into supporting crypto currencies, thus raising their price—as it already did as soon as the Trump administration indicated its backing.

The Crypto Jungle

In a forthcoming paper examining the appeal and dangers of cryptocurrency—and Trump’s proposed reserve—former Council of Economic Advisers Chair Jared Bernstein and former CEA member Ryan Cummings show why crypto’s blockchain technology is cumbersome and mostly useless. Yet while inefficient as a method of exchange and “extremely volatile” as an investment, they write, “there absolutely is a use-case for crypto, wherein the benefits of anonymity and the lack of a centralized authority are well worth the inefficiencies. And that is if you want to transfer money to commit crimes.”

Bernstein and Cummings, who are familiar with Justice Department and National Security Agency reports on crypto, note that the blockchain, despite its cumbersome features, is “an increasingly popular way of moving funds by drug cartels” in Central and South America. They point to an estimate by Chainalysis, a data firm that surveys crypto trades, that since 2022 criminals have used “roughly $140 billion” for illegal activity.

Bernstein foresees a potential danger in the first family’s gung ho promotion of crypto currencies that goes beyond the risk for small investors and the squandering of federal funds. At present, they don’t pose an obvious systemic risk because they’re not yet integrated with the global financial system, as mortgage debt was before the 2008 crash. That could change, however. “Could Trump’s legitimizing them lead to systemic risk? Of course,” the former White House economist told me. “If banks and nonbank lenders started to hold significant amounts on their ledgers, it’s easy to imagine, given their volatility, their value tanking—and all of a sudden the institutions that hold them have liabilities that exceed their assets. But we’re not there yet.”

The volatility of Bitcoin and other cryptocurrencies—all of which are subject to manipulation on social media by Trump—is exacerbated by the blockchain’s stunningly inequitable distribution of its swelling wealth. Glaring inequality may prove to be the most significant characteristic of the blockchain phenomenon, in a country where income has been distributed unfairly upward for decades.

A major study released in 2022 by the National Bureau of Economic Research showed that a microscopic fraction of investors—0.01 percent—controlled 27 percent of the Bitcoin then in circulation. Bad as U.S. income distribution may be, with the top one percent of Americans possessing about a third of the nation’s dollar-denominated wealth, the crypto pie chart looks far more lopsided. There is no reason to believe that problem has lessened over the past few years—and many anecdotal examples suggest it may have grown even more extreme.

Consider what happened when Melania Trump released her own memecoin, dubbed $MELANIA, a couple of days after her husband’s announcement of $TRUMP last January. According to an investigation by the Financial Times, a handful of traders raked in a windfall of nearly $100 million by snapping up her memecoin less than three minutes before she announced the token in a Truth Social post on January 19 (an event that, suspiciously enough, those traders somehow anticipated). They took their profits when her post sent the price skyward—and then dumped most of their tranche rapidly, sending the price down and leaving small investors with an almost worthless token.

So much for the crypto industry’s utopian claims of a decentralized and democratic new currency—unless your notion of the perfect society is a wilderness dominated by the superrich and ruthless.

With Authoritarians, It Is Ever Thus

Trump’s second-term dispensation of unbounded corruption, blatant conflicts of interest, and shameless money grabbing starkly illustrates an axiom long known in other countries: Autocracy enables the extraction and upward redistribution of a nation’s wealth.

It is a fact of political life that I first saw illustrated up close in the regime of Ferdinand Marcos, the late dictator of the Philippines whose secret New York real estate holdings I helped to expose with William Bastone more than four decades ago in The Village Voice. Marcos and his wife, Imelda (who, incidentally, maintains a mutually admiring friendship with Trump), had broken their country’s democracy, established a martial law regime, and then proceeded to loot its gold, minerals, agricultural monopolies, and aid dollars for the benefit of themselves and their cronies. What would now be hundreds of millions of dollars were stashed in major New York City buildings as well as other investment properties. Among their Manhattan holdings was 40 Wall Street, a landmark that is currently owned in part by Trump. The Washington lobbyists who fattened their foreign aid appropriations and protected them from scrutiny were none other than Trump political guru Roger Stone and Paul Manafort, who was Trump’s 2016 campaign manager for three months and later received a presidential pardon for keeping his mouth shut about the Kremlin’s campaign interventions.

Just as Trump is doing now by firing inspectors general and abolishing federal watchdog agencies, Marcos dismantled and crippled all the institutions that represented democratic authority and might have stopped or punished his depredations. The Philippine dictator threatened and brutally repressed his critics, as Trump seems equally keen to do.

What eventually brought down Marcos was a determined electorate and a peaceful movement known as “People Power,” motivated by popular fury at his abuses and specifically by anger over his larcenous misrule. Filipinos endured more than a decade of despotism, economic collapse, and a sense of hopelessness much deeper than any we have experienced before they seized control of their country’s fate against what appeared to be impossible odds. Americans still have the power to ensure that a similar wave of activism finally drops Trump and his enablers into history’s dustbin—the only way to curtail their unbridled looting.