Just before the Coronavirus Aid, Relief, and Economic Security Act passed into law, Republican Senators Tim Scott, Lindsey Graham, and Ben Sasse issued a press release demanding an “immediate fix” to what they regarded as a “life-threatening drafting error.” The proximate cause of their hyperbolic concern was the flat $600 in enhanced unemployment insurance set to be tacked on to preexisting state payments. The senators feared the added benefits, which in many cases would mean recipients would briefly receive higher compensation from the unemployment insurance than they had made from their jobs, would undermine the economic recovery by creating a perverse incentive for workers to remain unemployed. They threatened to stall the bill unless it was ensured that “no American would earn more by not working than by working.”

Democratic caucus members pushed back, with Senator Bernie Sanders issuing a particularly spirited rebuke: “I find that some of my Republican colleagues are very distressed, they’re very upset that somebody [who] is making $10–$12 bucks an hour might end up with a paycheck for four months more than they received last week. ‘Oh my God. The universe is collapsing!’ You haven’t raised the minimum wage in 10 years! You’ve cut program after program after program and now, horror of horrors, for four months, workers might be earning a few bucks more.”

The ideological schism, borne out in a rejected vote to amend the bill, ultimately ceded to bureaucratic realities: Every state administers its own idiosyncratic unemployment system, and many reported that they lacked the technological capability to nimbly allot the benefit so as to ensure it wouldn’t exceed a recipient’s prior earnings. Prioritizing efficiency amid a fast-developing economic crisis, Congress settled on boosting all unemployment checks across the board by $600—a figure that, combined with state benefits, would roughly replace the full wages for someone making the median U.S. income.

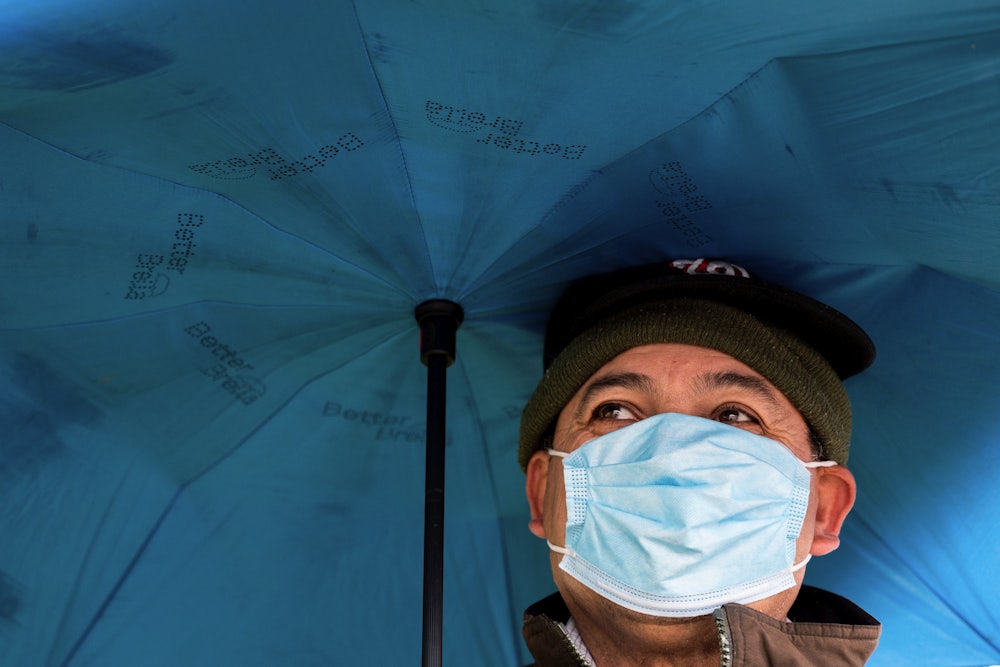

For a major fraction of the tens of millions of Americans who have sought unemployment insurance amid the coronavirus crisis, the CARES Act’s enhanced unemployment benefits have encouraged social distancing while providing much-needed economic relief, with benefits that rival or surpass what they had made through work. But millions of others have found their recent experiences with overloaded unemployment offices to be maddening and stressful encounters with a rusty and sometimes hostile bureaucracy. From this vantage, Congress’s bipartisan coronavirus action has been a revealing example of what happens to government systems—and the public’s expectations of those systems—when only those seen to benefit the wealthy are kept lubricated and in good repair.

Unemployment insurance and Social Security initially had much in common. Both were established as part of the Social Security Act of 1935. Both pool social risk to bolster economic security. Yet only Social Security has become firmly entrenched as a “middle class” program, said Chris O’Leary, an economist who studies unemployment insurance at the Upjohn Institute for Employment Research. By contrast, unemployment insurance has, in recent decades, increasingly been seen as a form of welfare—and as such, has fallen into neglect.

This has played out in funding for the two programs, whose tax bases have starkly diverged, a report O’Leary co-authored shows. In their New Deal–era infancy, Social Security and unemployment insurance both drew taxes on the first $3,000 of wages. As of 2019, Social Security’s minimum taxable wage base, which has increased steadily for decades and is now pegged to a national wage index, stood at $132,900. In contrast, since 1983, the federally mandated wages subject to tax for unemployment insurance has stagnated at $7,000, a figure many states barely surpass—effectively making it a regressive head tax. The program, as a result, has suffered from inadequate funding even when unemployment rates are low.

Meanwhile, in recent decades, a smaller percentage of unemployed people have used the program. This is partly a marketing problem. Whereas pay stubs reliably inform workers how much of their check was withheld for the benefit of Social Security and Medicare, unemployment taxes don’t come out of the employee’s side of the payroll in many states. In these instances, workers pay into the program indirectly, in the form of slightly lower wages. The difference in states where employees do pay directly—such as Alaska, Pennsylvania, and New Jersey—is substantial. O’Leary says that the reminder on their pay stubs that they’ve paid in to the unemployment insurance kitty contributes to the relatively high rates of unemployed people in those states who receive this compensation. “If you lose your job, you’re gonna go down [to the unemployment office] and get it,” he says.

The overall diminishing recipiency rates among the public reflect the diminishing quality of the unemployment insurance systems themselves, as state programs have generally become both less generous and more difficult to use. O’Leary’s report, along with other research from the National Employment Law Project, shows how states have disqualified workers from eligibility, shortened eligibility periods, reduced pay, and erected bureaucratic hurdles that make it more challenging to apply in the first place.

For instance, under then-Governor Rick Scott, Florida implemented a new unemployment website that made it harder to apply for benefits amid the recovery from the last recession. Like many other states, North Carolina has reduced the duration of benefits from 26 to 10 weeks, while increasing waiting periods before recipients receive benefits. Meanwhile, according to the Associated Press, many state unemployment systems still rely on COBOL, a “near-obsolete” 1970s-era programming language. In some states, when users forget their password online, they receive the information by which to update it in the mail.

Congress has not enacted a major reform to the unemployment insurance program in decades. Yet when the coronavirus crisis struck, leaving millions unemployed, it had few alternatives at the ready. While the “Fed has plenty of ways to quickly divert spending toward financial institutions and big corporations,” wrote Robin Kaiser-Schatzlein, “there are few mechanisms in place for getting money into the hands of people, no free public banks to disburse cash into, or dedicated Federal Reserve discount lending windows for small businesses.”

The unemployment insurance program’s nationwide implementation woes, from interminable wait lines to arbitrary-seeming rejections, have been legion—if predictable. Shayla McKnight, a bartender and mother of three, told The New Republic that she has been “treading water” for more than a month after dine-in service ended at the Log Cabin Bar and Grill in Lacey, Washington. For a few weeks in August 2019, McKnight had worked a side gig at a nearby bar that has since gone out of business, but which the state of Washington still seems to think currently employs her. As a result of this bureaucratic snafu, she’s been unable to obtain unemployment benefits, she said, despite daily attempts to prove her eligibility. In this infuriating and highly stressful ritual, she is far from alone. Of every 10 people who successfully applied for unemployment insurance benefits in recent weeks, more than six either tried to apply and failed in the attempt, found the process itself too daunting to complete, or were rewarded for navigating the system by having their application rejected.

What’s more, the rules of this ad hoc system, hastily jury-rigged at the last moment by federal and local governments, have made for an awkward fit for those employed as contract labor. An East Coast–based freelance writer, newly eligible for unemployment insurance under the CARES Act, told me he has been making fewer pitches to editors since getting his unemployment insurance benefits, which he thinks would no longer pay out if his income in a given week crossed a certain threshold. But even as he’s struggled to find work on account of frozen freelance budgets, he’s reluctant to stop pitching altogether: His career had been “on an upward trajectory” in recent years, netting him north of $30,000 annually. Thus, despite feeling some initial moral quandaries over adapting his work habits to keep receiving benefits, he’s taken the pragmatic approach and targeted his pitches at “prestige” publications that might offer compensation high enough to make getting knocked off unemployment for a week or two worth his while.

Meanwhile, for those in “essential” lines of work, resentments brew. A medical technician in St. Louis told The New Republic that she makes $13 hourly—but has seen these hours cut as her urgent care clinic receives fewer patients. She recalled talking on the phone with a friend, and over the course of the conversation “it became very clear that this person who was not working and was getting unemployment was making significantly more money than me.” At first, she was “pretty pissed” to make this discovery, but she’s since softened: It’s not that unemployment benefits should be less generous, she says. Rather, she believes that “frontline workers need to have hazard pay.”

And then there is the scenario conservatives fear most: generous unemployment insurance disincentivizing people from getting back to work. One such case was detailed in a widely panned NPR story in April about a café owner who said she is struggling to compete with the CARES Act’s generous enhanced unemployment benefits. The merits of that specific report notwithstanding, these situations are not uncommon and have compounded the woes of many small business owners, who have struggled to square the incoherent rules of the loans they received through the Paycheck Protection Program—another CARES Act initiative limited by the government’s atrophied administrative capabilities—with the generosity of the unemployment benefits their workers would receive on unemployment.

How much this should be a cause for concern, of course, is a different question. High unemployment payments have paired well with a fresh wave of thought challenging Americans’ weird hegemonic obsession with productivity and hatred of laziness. They’ve also cast a revealing light on the low wages many businesses offer. One woman’s $1,200 unemployment check led her to conclude that her previous job as a cook had underpaid her, The Wall Street Journal reported.

Ultimately, for all its limits, the CARES Act is “much more balanced than most things to come out of Congress,” said Josh Bivens, the research director at the Economic Policy Institute. “The real way that policy benefits the wealthy over everyone else is in the day-to-day grind of policymaking.” These benefits come in many forms, from laws limiting union power to the stagnant federal minimum wage to a tax code that has, remarkably, done little to offset the dramatic rise in income inequality in the U.S. over the last four decades. “When there’s less of a spotlight, then the people who have more resources to put on that pressure every single day, they just win those fights. There’s just not an apparatus of people waking up every day looking to fight for the economic interest of low- and middle-income workers.”

These diverging interests manifest in our public systems. “Rich people don’t want the IRS really funded well,” said Samuel Hammond, the director of poverty and welfare policy at the Niskanen Center. “The fact that it’s really complex to do their taxes doesn’t affect them because they have someone else do that for them.” Likewise, “they never touch the unemployment system, so they would never even know that it is built on ancient code.” It’s not hard to see how this logic extends to other aspects of American society, from schools to food stamps to public transportation to public libraries. Programs seen as benefiting the poor rust amid interminable debates around deservingness, while those benefiting the better-off carry on with frictionless repose.

Our recent experiences and experiments with pandemic-related economic safeguards raise an interesting question: How does the fact of this two-tiered system, where the wealthy benefit from state-of-the-art systems and the rest contend with the government’s worn-down administrative infrastructure, translate itself ideologically? How neatly does it map onto our own decaying sense of what’s politically possible? Although I don’t consider myself a conservative, I couldn’t help but note that, amid reports that unemployment benefits might in some cases eclipse normal pay, I felt some tingles of Republican-style skepticism. Was this a manifestation of a latent conservatism this country has instilled in me—ever-vigilant for discrete transgressions from the least powerful, while ignoring how society’s very structure tends to the benefit of the most?

I put the question to Bivens, of the EPI. “Because the U.S. social insurance and safety net system has been so stingy for so long,” he said, “I think people have come to expect very little from it.” People assume they receive so little for their trouble “because there is something unaffordable about doing better than that. So when, all of a sudden, you do get a response from the safety net that seems proportional—or even more than proportional—to the economic shock you just took, you just feel like something’s wrong.” You might even find yourself thinking, as Tim Scott, Ben Sasse, and Lindsey Graham’s statement put it, that “this isn’t who we are as Americans.” As states reopen, and move fastidiously to purge the unemployment rolls of allegedly undeserving beneficiaries, the statement does seem to at least have the merit of accuracy.