Private equity, venture capital, and real estate partners are such greedy pigs that they won’t invest in your town if they have to pay a 37 percent marginal tax on their earnings instead of a 20 percent long-term capital gains tax (23.8 percent if you include an additional net investment tax applied to families that earn more than $250,000).

That’s a terrible thing to say about anyone. But it’s what the financiers say about themselves, speaking through the U.S. Chamber of Commerce. A Chamber study last year concluded that taxing partners’ “carried interest”—that is, labor income—as, well, labor income...

...would result in a reduced incentive for partners to stay in the industry, as well as reduced incentives to invest in longer-term and riskier projects, thus reducing overall investments and reducing rates of return on projects undertaken. Additionally, many companies that would normally seek [private equity] and [venture capital] investments may be unable to find financing and fail (or downsize).

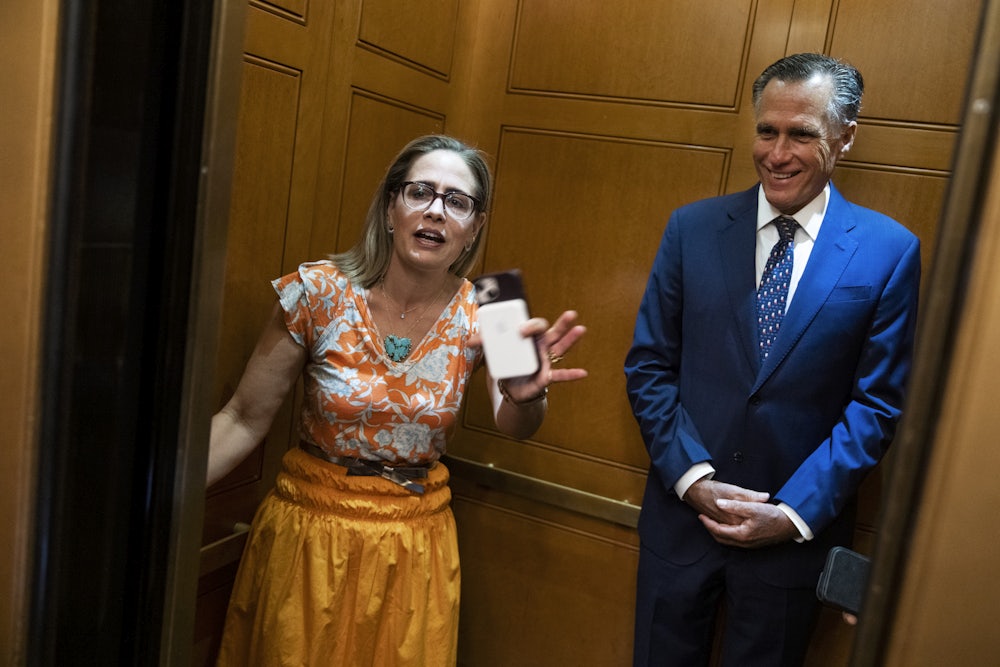

The Chamber revived this libel against its own members this week in full-page newspaper ads taken out in The Arizona Republic and the Arizona Daily Sun. That was enough to scare off Arizona Senator Kyrsten Sinema, who made the price of her vote for the Inflation Reduction Act (IRA) the removal of a de facto elimination of the carried interest loophole (and also some modifications to the bill’s 15 percent corporate minimum tax).

The resilience of this outrageous tax break for rich investors is one of the deeper mysteries of our age. I will pay more tax, percentage-wise, on the money I earn from writing this article than a private equity partner will pay on the money he earns from buying out a publicly traded company and loading it up with debt. Granted, my labors won’t likely create any new jobs, as a private equity partner will claim his will do. (I’m good, but I’m not that good.) But neither will I tidy up the balance sheet at The New Republic by firing half the staff, as private equity partners do routinely, despite their claims to be job creators. And of course, my salary wouldn’t cover a lunch tab at the Carlyle Group.

Not a huge amount of revenue would be saved by the IRA’s proposed change to the carried interest loophole, which would expand from three years to five the amount of time the earnings in question must be held before you could cash out. The Congressional Budget Office scores it at $13 billion over the next decade.

But the revenue isn’t the point. The lurid inequity of the carried interest loophole has been common knowledge since 2006, when Victor Fleischer, now professor of law at the University of California Irvine, called its preservation “an untenable position as a matter of tax policy.” The tax break, Fleischer explained, had been tolerable in the 1950s and 1960s because the private equity business was, back then, dominated by individual investors with limited access to capital. It became intolerable when these “risk-seeking investment cowboys” were displaced by large institutional investors, and as “regulatory gamesmanship” prompted general partners at these firms to reclassify management fees as carried interest.

It’s hard to find people—even rich people—who disagree with Fleischer’s analysis. JPMorgan Chase Chief Executive Jamie Dimon wants the carried interest loophole gone. So does Warren Buffett, the fifth richest human on Planet Earth. President Trump campaigned against the carried interest loophole in 2016, and in his otherwise regressive 2017 tax law, he imposed the three-year holding requirement that Congress now wants to extend to five years. If you’re going to tax carried interest at the rate for “long-term” capital gains, why not make the holder actually hold it for the long term? The five-year holding period would effectively repeal the carried interest loophole because few financiers will be willing to defer cashing out for that long. Remember, this is compensation for their labor, not a return on their financial investment. You don’t have to invest a penny of your own cash to receive carried interest, but even so it’s taxed as if it were an investment.

The private equity industry disagrees with Dimon and Buffett and Trump. It wants to preserve the carried interest loophole, for the simple reason that nobody ever wants to pay more in taxes. (Do you?) According to a Wall Street Journal review of securities filings, 28 executives at five of the biggest publicly traded private equity firms received a combined $760 million last year in carried interest compensation. Stephen Schwarzman, chief executive of the Blackstone Group, the biggest private equity firm, received nearly $150 million last year in carried interest compensation.

But why does Congress pay interested parties like Blackstone any mind? Because, dummy, they have more than enough money to kill reform efforts. When President Barack Obama proposed eliminating the carried interest loophole in 2010, Blackstone jacked up its lobbying budget from $6.7 million to nearly $9 million. The proposal died. Last year, Blackstone’s lobby budget was a more modest $5.4 million, but it also gave $25 million in political contributions to both Republicans and Democrats—with more going right now to Democrats—and $13,200 to Sinema so far this year.

Sinema’s a comparatively cheap date. Senate Majority Leader Chuck Schumer, who used to fight to preserve carried interest on behalf of his Wall Street constituents but gave that up years ago, has gotten $259,100. Still, Sinema, who sits on the Banking Committee, has collected $2.2 million overall from the financial sector since 2017, and much of that is a likely payoff for opposing repeal of the carried interest loophole. The private equity industry has spent $93 million on the current election cycle—similarly favoring Democrats over Republicans. Over the past decade, it’s spent nearly $600 million.

The nonprofit Accountable.US looked at some member companies of the Arizona Chamber of Commerce, which jointly funded with the U.S. Chamber this week’s Arizona newspaper ads, to see how much they paid in taxes. Amazon paid 6.1 percent. The Bank of America paid 3.5 percent. Microsoft paid 9.7 percent. Verizon paid 6.9 percent. Perhaps we should be grateful they paid anything. AT&T, AIG, and Dow, Inc. (you may know it as Dow Chemical, which made Agent Orange during the Vietnam War) paid nothing.

Senator Sinema, is $2.2 million all it takes to persuade you that private equity managers shouldn’t have to pay income tax at the same rate as you and your constituents? If so, maybe you’d like to buy London Bridge. Oh, wait, that’s already in Arizona.