By all accounts, 2022 would seem to be a banner year for the U.S. gas industry. Following a strong year in 2021, demand for America’s abundant supply of methane gas exploded after Russia invaded Ukraine. Europe scrambled to replace flows of Russian fuel, and other countries sought to comply with sweeping Western sanctions. Companies have raked in record profits as prices rose accordingly. Any high that drillers might have felt after this winter’s boost, though, seems to have settled into a begrudging acceptance that not everything has changed. Or worse.

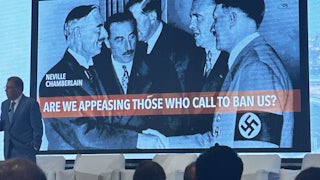

At the North American Gas Forum in D.C. this week—where the industry largely talks to itself—executives painted themselves as facing threats from an array of forces that simply fail to understand their industry’s prime importance, including to decarbonization. They fear, in a word, cancellation. How precisely that would happen is less clear, but a Democratic White House, attendees argued, would deserve no small part of the blame.

Longer-term concerns for the industry haven’t disappeared. Investors in the sector are still sour about companies’ having burned through their cash during the shale boom and are reluctant to let firms make big new investments just because it looks like a good idea in the short run. That’s compounded now by supply chain issues and difficulties attracting talent. Looming still is the challenge posed to fossil fuels by an energy transition and climate policy, which preoccupied the industry in the lead-up to U.N. climate talks held last year in Glasgow. Several speakers mentioned the need for an “emissions transition” rather than an energy transition, through ”decarbonizing carbon,” “making sure goals are achievable,” and “helping policymakers understand the importance of domestic energy production as a part of the climate solution.” Even the notoriously industry-friendly International Energy Agency, in its most recent World Energy Outlook, projects that global gas demand should decline by 10 percent by 2030 if countries follow through on already announced pledges under the Paris Agreement.

Per modeling compiled in the Intergovernmental Panel on Climate Change’s most recent report, limiting warming to 1.5 degrees Celsius (2.7 degrees Fahrenheit) would require global gas use to decline by 45 percent below 2019 levels by 2050—even factoring in the bullish projections to capture carbon built into most of the IPCC’s scenarios. A two-degree target implies a more modest 15 percent reduction, along the same timeline.

Oil and gas companies are arriving at a loose consensus on how to navigate a future where their core business model should be shrinking: They believe the United States can reduce its own emissions by integrating more renewables into the grid, but also—perhaps more importantly—by finding ways to zero out emissions from coal, oil, and gas through emerging, yet fledgling, technologies like green hydrogen, renewable natural gas, and carbon capture and storage. These will be exciting business opportunities for incumbent energy companies since they utilize much of the same infrastructure and expertise. Any gas not sold at home will be shipped abroad and outcompete dirtier coal power. And because of the considerable advantages gas offers to the climate and for energy security—and the promise of new technologies—it’s no longer the “bridge” or “transition” fuel it was thought to be a decade ago. It should be considered a “destination fuel,” as one speaker at the Forum put it, entirely simpatico with a low-carbon tomorrow.

That overly optimistic story, though, doesn’t quite square with the kinds of grievances palpable at the conference held this week in Washington. American energy producers are “being attacked on a daily basis,” as one keynote speaker put it: by environmentalists, meddling regulators, the Biden administration, and a generally hostile atmosphere. During a break, one attendee quipped to another that “Russia blew up its pipeline. We blow up ours in the courts.”

Octávio Simões, president and CEO of the U.S. gas exporter Tellurian, sees the challenges facing his industry as due mostly to U.S. politicians’ insufficient, inconsistent support. When asked about the barriers to new fossil fuel investment, he told me, “In our cycle of elections, [politicians] keep saying these incorrect signals about how reliable we want [our energy supply] to be.” Biden pledging to ban fracking early on the presidential campaign trail and Energy Secretary Jennifer Granholm periodically raising the specter of export restrictions send the wrong message, says Simões. They discourage both investors and international buyers who are reluctant to “put their energy security at risk with a country like the U.S.” Another problem, he said, “is this narrative that says that anything related to fossil fuels is bad and should be abandoned immediately.”

Such signals from on high, the argument holds, shape decisions made by investors who are already nervous about finding returns in an industry with a rocky track record of delivering them. Plenty of projects have already been approved by regulators, Simões added. They just can’t raise the money to build them: “Equity investors—the buyers—say, ‘Wait a minute. If I put equity into that project, how long is the U.S. government going to let me benefit from it?’”

Not everyone saw the industry’s relationship with the White House as being quite so dysfunctional. Charlie Riedl, executive director of the Center for LNG, a trade association, said he’s found the Biden administration receptive to calls for boosting fuel production and exports, referencing specific actions taken since Russia invaded Ukraine: a pledge to replenish the Strategic Petroleum Reserve, the new U.S.-EU task force on energy security, and recent approvals from the Federal Energy Regulatory Commission, or FERC, and the Department of Energy. “I think the tone and tenor is in line with all of those things we would say would be advantageous for companies trying to build export facilities.… I think there’s a desire to help solve the problem,” he told me. “If there’s this undertone of animosity toward the administration, I think that’s unfortunate.” Two administration officials were featured speakers at the gas conference, which was sponsored by companies including Shell, BP, and Cheniere.

Determining precisely what material barriers the Biden administration has posed to new gas investment is a little harder to discern. I asked Paul Sweeney, a lawyer for Golden Pass LNG who handles regulatory compliance, what has changed since Biden took office. Export rules, he told me, “haven’t changed, I don’t think. The orders still pretty much read the same as they did under the Trump administration, which actually read pretty much the same as they did in the Obama administration.” What’s “really changed” is the ability to build interstate infrastructure, overseen by FERC, an independent agency. He referenced an unusually long approval process (“well over a year”) for a process improvement at a Golden Pass facility, as well as a rule FERC proposed early this year to evaluate greenhouse gas emissions in the approval process for gas infrastructure. It was withdrawn and is now in the process of being rewritten.

FERC chairman and Trump appointee James Danly was similarly critical of longer approval timelines and the commission’s attempt to consider greenhouse gases. He argued that it constituted a violation of major questions doctrine, a legal theory aimed at limiting the executive branch’s ability to interpret federal statutes that was invoked in the Supreme Court’s West Virginia v. EPA decision. “It’s not our job. It is outside our jurisdiction. We should not be doing it,” he told attendees at a lunchtime address on Wednesday.

While fossil fuel infrastructure routinely faces challenges at the state level, in courts, and from activist groups, there aren’t obvious federal policy changes that have made it more difficult to build interstate natural gas infrastructure or export facilities. “I couldn’t really say, other than at the FERC, those policy statements,” Sweeney said when asked about substantive changes in his purview. “But beyond that, I can’t think of any specific regulations that the Commission has adopted since 2021.”

Simões similarly downplayed the centrality of permitting challenges, which were invoked frequently throughout the conference. “We have 100 million tons of LNG projects permitted in the United States. We don’t have any of them with equity to finance it and build it,” he said. The bigger problem—in so many words—is bad vibes.

On some level, the government is an easy target for the industry’s ambient discomfort with its changing role in the world, especially given the sector’s historic alignment in the U.S. with the Republican Party. What’s also true is that the Biden administration has not been especially elegant in its attempts to find a middle ground between environmentalists, a voting public upset about higher gas prices, and companies it now desperately wants to help drill more. “They’re incapable of just shaking your hand without slapping you across the face,” said an executive at a midstream company who spoke on the condition of anonymity. “They are going out of their way publicly and at the highest levels to say, ‘Increase production,’” the executive said, referencing Biden’s recent announcement to release more oil from the Strategic Petroleum Reserve and replenish it when prices drop below $72 per barrel, effectively creating a price floor to encourage investment. “I take it as an unambiguous effort to send a calming message. But it’s at the same time, ‘Stop [price] gouging.”’

The midterms might help change them. Heather Reams, president of the “right-of-center” Citizens for Responsible Energy Solutions and CRES Forum, mused on a panel about upcoming elections that a divided government could keep Democrats from “assuaging the keep-it-in-the-ground crowd.”

The industry is also bracing for a Democratic White House without a congressional majority to double down on regulatory action, from a forthcoming EPA methane rule to climate disclosure requirements being considered by the Securities and Exchange Commission. “Our industry already sees a coming regulatory tsunami,” said Anne Bradbury, CEO of the American Exploration and Production Council. “We’re really just seeing the very tip of that. That regulatory agenda and administrative action is where this administration doubles down.”

A Republican majority in Congress, though, could also use its newfound control of oversight committees to slow that rulemaking down. “All those things really can disrupt and slow down the administration,” said Michael Catanzaro, president of the lobby shop CGCN. “We have a status quo on balance tilted against natural gas. That status quo largely remains.”

If the gas industry is indeed being canceled, it seems to be following in the footsteps of the standup comedians and Substack bloggers who came before it: weathering some momentary bad press before moving on to potentially even more lucrative ventures. Despite repeated warnings to the contrary, regulatory environments in the world’s biggest and most polluting economies are not on track to align their climate goals with science that suggests a radical decline in the use of fossil fuels, including methane gas. The richest ones are speeding in the opposite direction, rushing to green-light polluting infrastructure that will stay online for decades to come. While they don’t seem to want to, executives should take some solace in knowing governments aren’t engaging with climate reality, either.