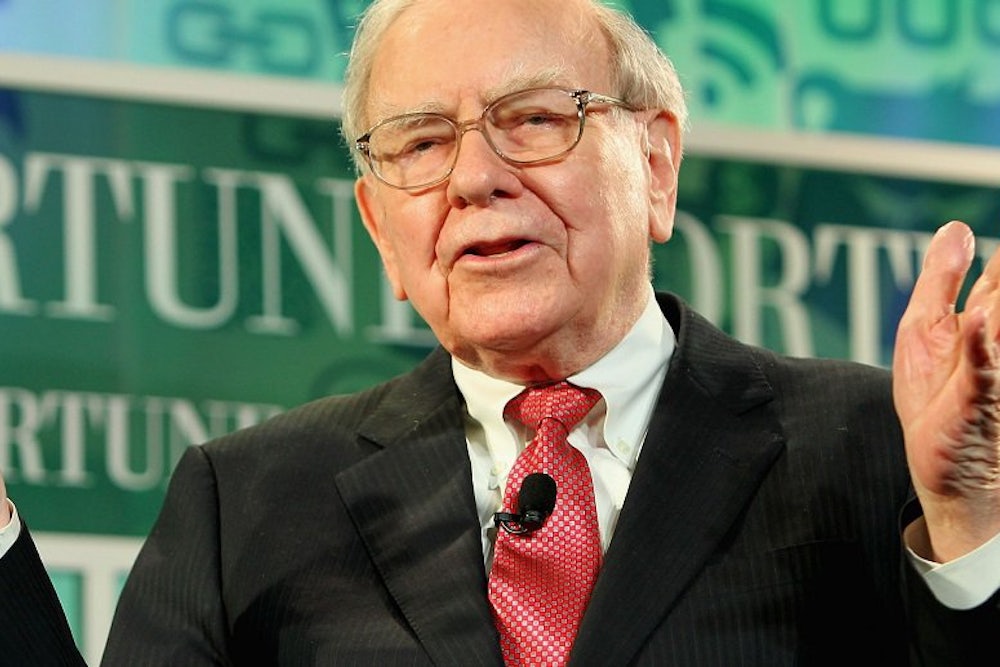

In the Wall Street Journal on Friday, famed investor Warren Buffett made an argument you often hear against raising the minimum wage: increase the Earned Income Tax Credit (EITC), instead.

“I may wish to have all jobs pay at least $15 an hour,” Buffett writes. “But that minimum would almost certainly reduce employment in a major way, crushing many workers possessing only basic skills. Smaller increases, though obviously welcome, will still leave many hardworking Americans mired in poverty.” He continued, “The better answer is a major and carefully crafted expansion of the Earned Income Tax Credit (EITC), which currently goes to millions of low-income workers.”

Buffett is right, to a point. Congress should expand the EITC, particularly for childless workers who can barely collect any benefits from the program. But Congressional Republicans have shown just about no authentic interest in expanding the EITC. If Buffet, a Democrat, wants to help out low-income workers, he needs to look elsewhere.

Republicans are the ones who typically broach the subject of expanding the EITC in lieu of raising the minimum wage, particularly in response to anyone on the left proposing an increase. And some top GOPers have proposed plans to expand the EITC independently. Senator Marco Rubio’s antipoverty plan, for instance, would convert the EITC into a similar program, called a wage enhancement, which would apply equally to working parents and childless workers. Representative Paul Ryan has also proposed expanding the EITC.

Yet, expanding the EITC costs money—and that’s where problems with those plans arise. Rubio just ignores this altogether. His plan would somehow increase benefits for childless workers, keep benefits constant for everyone else, and still be deficit neutral. That’s mathematically impossible. And Ryan’s plan would take money from other antipoverty programs. Meanwhile, Republicans have been in control of both houses of Congress for a few months now, and there are no signs that they are interested in expanding the EITC. The only bills any Republicans have introduced related to the EITC would instead limit it, mostly to prevent undocumented immigrants from collecting benefits (especially those that received deferred status under President Barack Obama’s executive action on immigration).

On the other hand, the president included the EITC expansion in his budget for the 2016 fiscal year. Representative Richard Neal, a Democrat, also has introduced a bill so that childless workers can collect more in benefits from the program.

Given all of this, which party seems more serious about expanding the Earned Income Tax Credit?

Whatever the feasibility of Buffet's EITC proposal, he's right to be concerned about raising the minimum wage all the way to $15 per hour. Los Angeles’s plan to do just that carries serious risks of unintentionally hurting low-income workers. That’s a dangerous experiment to run in as big of a city as Los Angeles. To do so across the country—where incomes vary much more—would be foolhardy and potentially very cruel. But smaller minimum wage increases, as Buffett hints at, would still help millions of workers, with a far smaller chance of an employment effect.

Labor unions and progressive groups have done an impressive job organizing around the minimum wage and forcing both low-wage employers and local governments to raise their minimum wages. Buffett’s op-ed, in effect, discourages that organizing by promoting a different government policy. But it’s a policy that has no chance of passing Congress and thus no chance of helping those workers. The policy analysis of it may be correct, but the politics of it are wrong—and that makes it counterproductive.