The city of Geneva is known for many things. It is the birthplace of the Geneva Conventions, which steer the laws of war toward more humanitarian considerations. The original home of the ill-fated League of Nations, the city remains a primary hub for the United Nations, providing a platform dedicated toward dialogue, toward compromise, toward restoring relations after bloodied battles and geopolitical fractures. The city’s ethos can be found in its motto: post tenebra lux—“after darkness, light.”

But as journalist Atossa Araxia Abrahamian writes in The Hidden Globe, there is another side of Geneva that is far more pernicious, and that points directly to the kinds of slipstreams the world’s elite use to hide their lucre—and sometimes even people—while bankrolling wars. “On one hand, Geneva’s composition epitomizes a familiar kind of internationalism: the tangible, imperfect, often lovely kind that brings people of the world together in one place at one time, in peace,” Abrahamian writes. “But there is something else at work here—something you can’t see, but whose influence on the world around it is as potent as the globalism of flesh and blood.” It is, as Abrahamian dubs it, a “spectral economy”—a weightless world, where the familiar contours of time and space disintegrate, where the basic gravity of modern economics disappears, replaced by a universe of invisible transactions and entire economies that leave no discernible footprint.

Geneva, where Abrahamian grew up, is the perfect microcosm of this hidden economy—a world offshored, purposely obfuscated from anyone who would try to hold it in check. As she writes in her introduction, she set out to find how Geneva’s “infamous dullness squared with its endless repository of secrets,” as well as “to understand why I, a citizen of Geneva, felt so drawn to those other nowheres: city-states like Singapore and Dubai, Caribbean tax shelters, island offshore centers, airport bars, hotel lobbies, diplomatic compounds, and customs depots.” The result is a survey of all the world’s purposely hidden crannies and crevices, the places where chronologies collapse and laws are loosened and entire nations are put up for sale.

In a sense, the book is of a piece with other recent treatments of the world of secretive finance, works such as Nick Shaxson’s Treasure Islands or Oliver Bullough’s Butler to the World (or even my own American Kleptocracy). Much of The Hidden Globe covers similar territory, but where Abrahamian pushes things forward—or backward, at least in terms of timing—is in tracing the world of offshored finance to its roots and taking us back to the country, and even the city, where it all began.

Switzerland is the nation that birthed an entire suite of offshore services, mercenary bankers, and merciless legislators, keen to hide as much global wealth as the world would allow. Since the earliest days of Swiss confederation in the thirteenth century, Swiss “free ‘lancers’”—brigades of Swiss troops who could be sold to the highest bidder—cavorted around Europe, bringing much-needed wealth back to Switzerland itself. Ideology didn’t matter, nor did the origin of their clients’ wealth; all that mattered was business, for whichever bidder came calling. It was an ethos seeded in the earliest days of Switzerland’s independence—and it was one that would later infect the country’s burgeoning banking sector.

It is that sector, perhaps among all others, that Abrahamian holds responsible for all of the ills of Swiss-inspired offshoring that followed: a world of hidden finance that now hosts, and disappears, trillions of dollars, out of sight of the rest of us. It is, by some estimates, a world whose financial heft is now on par with China’s gross domestic product, making it effectively an invisible superpower. And it is one that is revered in Switzerland. “We consider a man’s financial affairs to be just as sacred, and as important, as his soul or body,” one banker from Bern commented in a 1963 Atlantic article. “Why should we not give sanctuary to persecuted money, as well as souls?”

This, of course, has long been the Swiss banker’s defense: that the black box of Swiss finance is available to people of any background, meaning that persecuted populations can find the financial safe harbor they need. After all, as the Swiss are keen to point out, providing persecuted Jews with a safe home in the 1930s was what birthed the country’s banking secrecy policies in the first place. With origins this humanitarian, who could oppose them?

It’s a nice defense, but it’s also, to use a technical term, bullshit. As Abrahamian deftly details, the origins of Swiss banking secrecy had nothing to do with aiding those fleeing genocide but instead stemmed directly from concerns that wealthy French clients in the 1930s would have to repatriate their wealth to Paris, gutting Switzerland’s GDP in the process. While much of the history of Swiss banking generally mirrored other European countries’, it was these concerns that finally convinced Swiss legislators to criminalize the sharing of any identifying information about clients, regardless of the provenance of their wealth. (In the early 2010s, the United States successfully cracked open Swiss banking secrecy by forcing the Swiss government to share information about wealthy American clients—a policy that the U.S., now a tax haven of its own, does not reciprocate.) All of it set a precedent, and an ironclad secrecy regime, that the world’s most brutal kleptocrats would soon be eager to take full advantage of. “Blood may not run down the walls” of Swiss banks, one analyst tells Abrahamian. “But it’s as if it did: the relative well-being of Swiss people is financed by death, fear, and famine.”

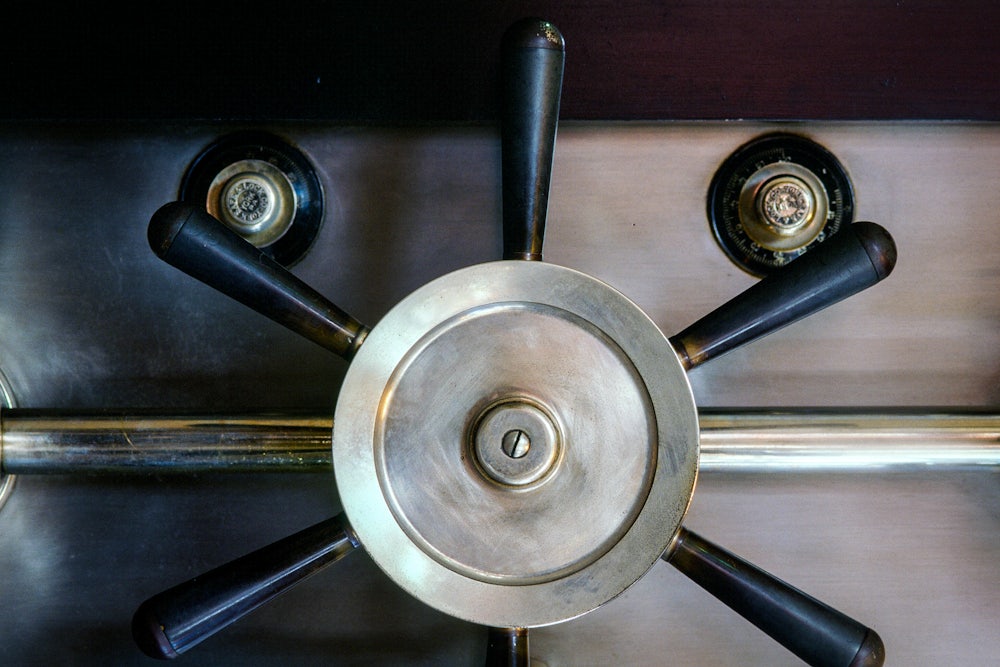

The book, though, is not solely Swiss-centered. The offspring and echoes of Switzerland stretch far and wide, among cities and countries trying to grab their own slices of the offshore pie. In Singapore, we see a nation-state built on the back of its own forms of financial chicanery, building out a pro-secrecy edifice that is somehow even stronger than Geneva’s. In the process, we watch Singapore transform into a bolt-hole through which much of the world’s illicit wealth slips. Singapore has pioneered secrecy surrounding so-called “freeports,” which allow anyone, from anywhere, to hide anything in Singapore from any prying eyes. Art, gold, wine—it doesn’t matter. All of it is kept secret, and kept safe. “When you go to a bank and rent a safe, nobody knows what goes in,” said one Singaporean businessman. “It’s the same thing here.… There’s no value, no ownership, no inventory list—all details are confidential. We offer more confidentiality than Geneva.”

Jumping over to Dubai, we see a country rapidly transforming into the go-to haven for sanctions evasion and illicit wealth. Starting in 2004, Emirati authorities and Western advisers pioneered a new type of court, in which the judges have no connections to local laws or even local jurisdictions but can “beam in” under whatever auspices, and for whatever reasons, they need. (It “no longer makes much sense to speak of only a law of the land: the two have, in the modern parlance, consciously uncoupled,” Abrahamian writes of one Dubai-based court. “The law no longer has a particular connection to the place it happens to govern; it is in Dubai, but not of Dubai.”) Rather than produce transparent rulings, such a court provides a legal imprimatur for any and all who need it, wherever they may be. It’s a model that has since been replicated around the world, from Qatar to Kazakhstan to Kosovo, prioritizing the needs of the extremely wealthy. All of it has created, in effect, a series of “offshore courts of law,” available only to the deep-pocketed figures and firms already taking advantage of other offshore services elsewhere.

Liberia does not market itself with the patina of luxury or high finance associated with Switzerland and Dubai, but it’s an essential stop in Abrahamian’s tour of the hidden globe. A country that has endured devastating civil wars in its recent history, Liberia also happens to provide global oceanic shippers with so-called “flags of convenience.” Liberia’s shipping registry allows any ship to fly the Liberian flag, for a small cost, without providing even the bare minimum in terms of regulations or oversight. Any ship can hide behind the flag for whatever reason. Rather than carrying an American flag—and being subject to American laws, American regulations, and American environmental and labor protection—these ships are suddenly attached to a country that doesn’t have any similar enforcements. It’s a small price, and a small slice of Liberian sovereignty, in return for ample secrecy and cover for as many environmental, labor, and financial abuses as are needed.

Yet there’s a further layer of obfuscation in this arrangement: The ships in question are never really in Liberia, anyway. “Liberia is fake,” one of Abrahamian’s interviewees says. “The [shipping] registry is located in the U.S., there are no real authorities in Liberia, and many companies take this flag because there’s no responsibility for anything.” Small wonder, then, that nearly 75 percent of the world’s shipping (as measured by gross tonnage) now operates under one of the “flags of convenience” models pioneered out of Liberia.

Opportunities to profit from secrecy do not stop on earth. The nation of Luxembourg, for instance, is challenging the notion that the resources in space, such as those in the asteroid belt, are part of the global commons—a view enshrined by Cold War–era treaties, and long supported by countries that don’t have the ability to reach the stars. Enter Luxembourg. After the U.S. passed legislation in 2015 that recognizes American companies’ claims to ownership of space resources—“the world’s first ‘finders keepers’ law” in space, Abrahamian writes—Luxembourg immediately followed suit and announced it would provide the same rights to multinational corporations, wherever they may be based. The country became, in essence, a Liberia for the stars, providing “a sort of flag of convenience for spacecraft,” Abrahamian writes.

The world Abrahamian depicts is truly visible only to those who know where to look—it is simultaneously everywhere and nowhere and, to swipe a phrase, almost too big to see. Some of the book’s sections feel shoehorned in: a chapter on immigration detention centers used, and abused, by Australian authorities draws on powerful reporting but has little bearing on, as the book’s subtitle promises, how “wealth hacks the world.” Still, other explorations—of how Singapore has transformed into a center for money laundering via the antiquities trade, or how U.S. authorities reinforce Puerto Rico’s colonial status via a series of tax loopholes that only benefit wealthy Americans—are newly revealing.

If anything, for all of its global breadth, the book is an overdue reminder of how, and why, Switzerland is crucial to understanding today’s latticework of offshore jurisdictions and other networks analyzed in other recent treatments. (There’s a reason that America’s own offshoring centers, such as South Dakota, are often referred to as the “new Switzerland.”) Switzerland, Abrahamian observes, “is a unique construct—an international mercenary state, first of feudal militarism, and now of world capital.”

The country was the first to create the cracks that Abrahamian details, these crevasses through which wealth can disappear, often for good. It is the country that first brought the shrouds of financial secrecy to the world of global finance, blanketing it all in unending shadows. Because contrary to Geneva’s city motto—but as evidenced by the world Switzerland birthed—sometimes, after darkness, all you get is more darkness.