Earlier this year, Elon Musk ditched long-standing plans for developing a smaller, more budget-friendly Tesla. He opted instead, The Washington Post reported this week, to pursue “a massive purchase of computer chips, in a deal worth billions intended to enhance Tesla’s luxury cars (and a humanoid robot called Optimus) with energy-intensive artificial intelligence capabilities.” The move, the Post reports, reflects Musk’s evolving stance on the climate crisis. Having once positioned himself as singularly capable of fixing global warming, Musk has more recently called climate warnings “overblown,” and told Donald Trump—his prospective new boss at the so-called Department of Government Efficiency—that “we don’t need to rush” to reduce emissions.

Musk has clearly turned right in recent years, but one needn’t dive too deep into his psyche to figure out why the billionaire has cozied up to Trump and the GOP: Trump’s administration promises lower taxes and looser regulations, allowing Musk a longer leash for the kinds of environmental violations that his Texas Gigafactory has racked up. Trump offers a standing invitation for billionaires willing to come onside—particularly if they spend hundreds of millions of dollars to get him elected. Musk also has billions of dollars in federal contracts. Having a prominent role in the White House could sweeten and expand those deals. His DOGE job might offer invaluable opportunities to privatize large parts of the federal government and thus create even more business there for contractors like SpaceX, particularly in the defense sector.

Musk is an odd person, of course. Yet while few other tech magnates share his penchant for dated memes and performative jumping, their basic motivations aren’t so different: to make money. Although, for a while, Musk seemed to be on climate advocates’ side, even going so far as to call for a “popular uprising” against the fossil fuel industry in 2016, his current path is merely a reversion to type. And this career arc—specifically, the fact that Musk is now poised to join forces with the fossil fuel executives in the White House—should be seen as an important data point for policymakers and commentators focusing on emissions-reduction strategies.

Musk was seen by large parts of the liberal establishment as a climate savior. As New York Times columnist Thomas Friedman put it in 2021, decarbonization will happen “only when Father Profit and risk-taking entrepreneurs produce transformative technologies that enable ordinary people to have extraordinary impacts on our climate without sacrificing much—by just being good consumers of these new technologies,” he wrote. “In short: we need a few more Greta Thunbergs and a lot more Elon Musks.” The argument held sway with the likes of Bill Gates but also the Biden administration, whose green industrial strategy relied on an implicit techno-optimism.

After being pressured to embrace a more muscular climate and investment agenda by activists on the campaign trail, the Biden White House pitched the Inflation Reduction Act as a means of incentivizing the private sector to finally take the lead on decarbonization and follow in Tesla’s footsteps, mostly through tax breaks, loan guarantees, and basic research support. As former National Economic Council chief Brian Deese has written:

Tax incentives make the investments attractive, but businesses, along with rural cooperatives, nonprofits and others, must judge whether investing their own money in a hydrogen factory or a wind farm will pay off. In the end, the law will be only as successful as their appetite to invest at a scale that will meaningfully reduce emissions warming the planet and increase the nation’s energy security.

This is all well and good. The private sector is traditionally risk-averse. Offering them subsidies is a well-worn way to get them to do things they otherwise wouldn’t, including making much-needed investments in domestic supply chains for green energy technologies. I’ve written before that—on its own limited terms—the Inflation Reduction Act has been reasonably successful at driving additional investment in green export sectors. It didn’t seem to make much of an impression with voters, though. It also didn’t whet their appetites for more aggressive climate policy. Two-thirds of the IRA’s energy-related subsidies are expected to flow to corporations. Consumers hoping to take advantage of incentives for things like solar panels and energy-efficient appliances still need to have a decent amount of cash on hand to buy those things. Neither has Biden’s growth agenda endeared climate policy to many Republican lawmakers. Nine out of 10 of the congressional districts that have received the most new clean energy investment since the IRA passed are represented by Republicans; still, the 18 GOP congressional representatives urging their colleagues to preserve that law remain a lonely bunch.

In retrospect, the prospect of U.S. industrial strategy getting preoccupied with creating “a lot more Elon Musks” should have sounded scarier. The dangers of leaving decarbonization up to some mercurial billionaires should have been clear even before Musk turned MAGA. Exciting as it is, the billions of dollars’ worth of investment that the IRA directed toward cleaner manufacturing and energy production has not created some novel political constituency for decarbonization, including in C-suites. Musk is arguably representative of a broader shift in so-called “green capital,” an increasingly meaningless category that may well include anyone looking to make money in 2024. Even companies who’ve benefited from IRA funds, like Ford and Oxy, seem happy to swallow Republican attacks on that law in exchange for massive corporate tax cuts and looser regulations.

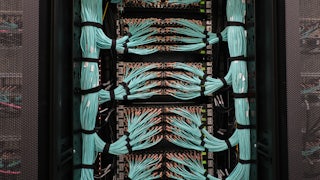

As the Biden years showed, too, fossil fuels and zero-carbon energy can grow simultaneously. Growing electricity demand from data centers, for instance—including to power AI—could be lucrative for energy providers of all kinds. OpenAI founder Sam Altman has been trying to enlist investors in the United Arab Emirates, Asian chip makers, and U.S. officials in his quest to build a global fleet of data centers that could use as much as five gigawatts of electrical power each, about a thousand times more than the average data center. At the White House earlier this fall, Altman reportedly presented an OpenAI report titled, “Infrastructure Is Destiny,” orbiting around the need to start building such facilities in the U.S. for the sake of competing with China and “re-industrialization.”

Tech giants have been investing in companies that could help power their data centers without carbon down the line. In October, Alphabet alum Eric Schmidt and Stripe founder Patrick Collison joined the board of nuclear start-up Pacific Fusion, having contributed to the company’s $900 million Series A. Even the more conventional nuclear deals that companies like Microsoft are pursuing, however, won’t start generating zero-carbon power until the end of the decade at the earliest. But new data centers are being built now, meaning that much of the new electricity demand they’re creating will be met with fossil fuels. Meta is working on a $3.2 billion deal to fuel a Louisiana data center with new gas-fired generation. “Quite frankly, in the next five years, we’re going to see a lot of new gas turbines being built,” Cy McGeady, a fellow at the Center for Strategic and International Studies, told Heatmap.

If you’re invested in firms on either end of these sorts of deals, this is all great news. What it means for actually reducing emissions is a bit murkier. In general, executives’ interests can align with but aren’t synonymous with decarbonization—and they certainly don’t depend on it to get rich. Not all CEOs are as weird as Elon Musk, but they shouldn’t be counted on to be any more reliable allies to the climate cause, either.