President Donald Trump may have temporarily walked back his recent disparagement of Federal Reserve Chair Jerome Powell, but the damage was done: The president spooked stock market investors, caused the value of the dollar to plunge, worried economists the world over, and raised the threat that the nation’s central bank may no longer be insulated from the vicissitudes of electoral politics.

Trump has threatened to fire Powell—whom he nominated to be chair during his first term in office—despite the dubious legality of such a move, and on Monday called him a “major loser.” He later backed off, saying on Tuesday that he had “no intention” of terminating Powell, after reportedly hearing from advisers that doing so could throw the markets into chaos and spark a costly legal fight. The respite was short-lived: On Wednesday he renewed his criticism, telling reporters that Powell is keeping interest rates “too high,” adding that he “might call him” to discuss the issue. Much like the confusion over the implementation of sweeping tariffs, the whiplash with regard to Powell has caused the markets to dip and swell in recent weeks, with a downturn this Monday followed by swift rallies on Wednesday and Thursday.

The daily ups and downs of the stock market can seem like a distant concern to the average American, particularly since the Federal Reserve itself may seem an obscure organization for those not intimately acquainted with the nation’s monetary policy. But the decisions of the Federal Reserve Board, and Trump’s actions, will have repercussions that echo locally as well as globally.

So, yes: You should probably care about the Fed, and not only so you can sound smart at parties. (Especially because you shouldn’t be talking about monetary policies at parties. Unless you work in monetary policy, in which case you wouldn’t read this explainer anyway.)

The Federal Reserve, more commonly known as the Fed, is the nation’s central bank. It regulates banks and financial institutions, oversees the country’s monetary policy, and—most importantly for the purposes of this explainer—sets interest rates. Its mission is directed by a “dual mandate”: to maintain stable prices and achieve maximum employment. (For a more thorough rundown of what the Fed is and what it does, check out this explainer from the Council on Foreign Relations, which provides a fair amount of detail without being excruciatingly mind-numbing.)

“The interest rates they set ricochet through the whole financial system, and affect everything from what the government pays to borrow money to finance the deficit to what we pay on credit cards or mortgages,” said David Wessel, a senior fellow in economic studies at Brookings Institution. “In bad times, when the economy really needs help, they cut interest rates. That makes it easier for people and businesses to borrow and spend. But when times get too good, when the demand for goods and services … exceeds the economy’s capacity to supply them, they slow down the economy by raising interest rates.”

Wessel compared the Fed to a self-driving car on the highway trying to maintain a steady speed: When it goes up a hill, it hits the gas, but on the way back down, it will pump the brakes.

The Fed sets the interest rate that banks use to borrow from each other; it does not control interest rates such as the prime lending rate, which is set by banks individually. For the average reader’s purposes, that means that it does not directly determine the rate a person pays for their mortgage or auto loan, or on their credit card purchases. However, the interest rates it sets affect what rates banks set for those kinds of loans or lines of credit.

When the Fed sets higher interest rates, banks tend to not make as many loans—and they’re more “picky” about whose loans they approve, said Ellen Meade, a research professor of economics at Duke University. This will slow the economy.

“Similarly, if the economy is looking like it’s not doing so well, or it’s in recession, the Fed will lower interest rates, and that’ll make borrowing less expensive. And banks will do more of it, but they have to do more of it in order for the economy to improve,” said Meade, who previously served as a special adviser to the Federal Reserve Board of Governors.

In the wake of the economic upheaval spurred by the coronavirus pandemic, the Fed has been working to lower the rate of inflation, and has done so by raising interest rates. Late last year, the Fed lowered interest rates, but it has kept them steady in the months since—and therein lies the issue for Trump.

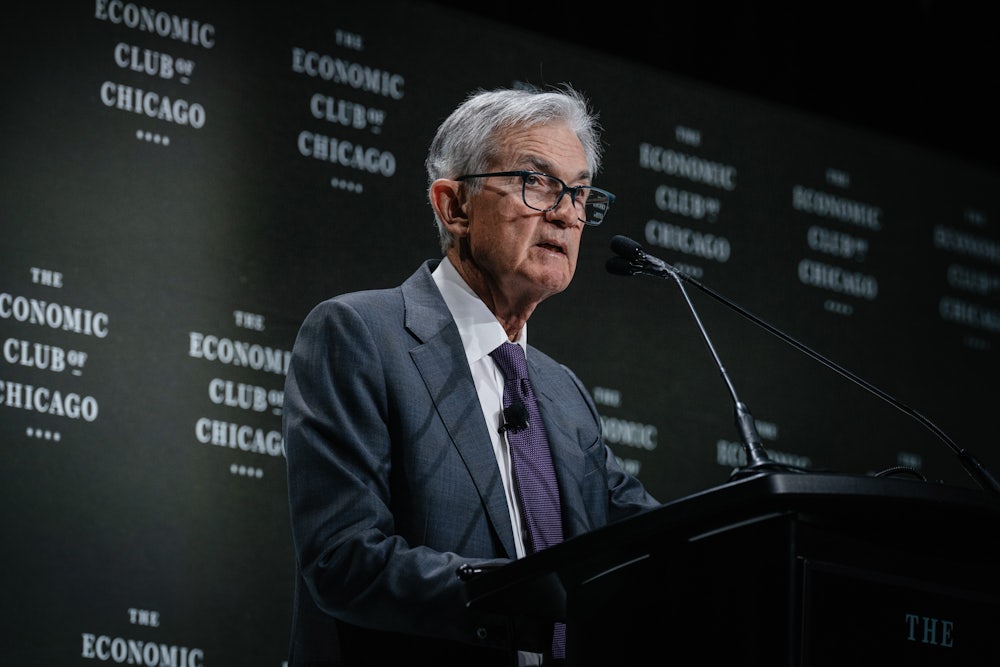

The chair of the Federal Reserve enjoys significant power. Powell is essentially the Fed’s mouthpiece, the primary conduit to both the executive and legislative branches of government and the interpreter of the board’s decisions to the public. His word can and does quite literally move markets. After being appointed by the president and confirmed by the Senate, a Fed chair is functionally independent and largely untethered to the political concerns of the White House and Congress. Powell also chairs the Federal Open Market Committee, which meets every six weeks to determine monetary policy.

Politically speaking—and for obvious reasons—lower interest rates are better than higher interest rates. “The president has an incentive to try to keep rates lower for longer to help juice up the economy, but ultimately it leads to higher inflation,” said Mark Zandi, the chief economist at Moody’s Analytics.

After lowering interest rates in December, the Fed has kept them steady in an effort to reach its annual target of 2 percent inflation. Trump thinks that Powell should be cutting interest rates, but the Fed has not done so—in fact, the board seems to be making decisions entirely independent of the president’s political wishes. Powell has pledged that the Fed “will only make our decisions based on our best thinking, based on our best analysis of the data and what is the way to achieve our dual-mandate goals as we can to best serve the American people.”

“We will do what we do strictly without consideration of political or any other extraneous factors,” Powell said earlier this month.

But there are several exigent circumstances. Trump’s tariffs have the potential to intensify inflation, but the risk of recession could lead to higher unemployment—meaning that both prongs of the Fed’s dual mandate are at risk. Moreover, there’s considerable uncertainty regarding trade policy, given that Trump’s announcements, implementation, and walking back of tariffs have been scattershot and inconsistent. As such, Powell and members of the Fed are in a holding pattern and keeping interest rates steady.

“If they’re worried about inflation, they would certainly not cut rates. They may even raise rates. If they’re more worried about growth, they would be cutting rates, or just certainly not raising them,” said Zandi. “The upshot of it is that it means they just sit on their hands. They’re not going to do anything until they get a better sense of what’s the predominant threat, the inflation or the weaker growth.”

This reality has been acknowledged by Powell himself. “We may find ourselves in the challenging scenario in which our dual-mandate goals are in tension,” he said earlier this month, in remarks that sent stocks tumbling downward.

Hence, Trump’s ire. It’s unclear whether the president actually could fire Powell. The Federal Reserve Act dictates that the members of the Fed can only be removed “for cause,” which does not include ideological differences with the president. The Supreme Court upheld this interpretation 90 years ago. However, since taking office in January, Trump has broken precedent and fired board members of independent agencies—actions that the current Supreme Court has thus far upheld. Even if Trump does not fire Powell, his term as chair will be up in 2026, and the president would be able to nominate his replacement.

So, what if you’re at a cocktail party and you need to explain why this matters? First of all, I don’t know what kind of cocktail party you’re attending, but it doesn’t sound very fun.

But you can tell your fellow partygoers that investors will freak out if they believe the independence of the Fed is under threat. Take it away, Wessel: “If the markets think the Fed is going to be controlled by the politicians, interest rates will be higher, because markets will think there’s a risk that we’ll get more inflation,” he said. This, in turn, would lead to higher interest rates for personal loans and lines of credit.

On a global scale, the American dollar’s supremacy is at risk. The value of the dollar has fallen in recent weeks amid the turmoil surrounding tariff implementation and Trump’s attacks on Powell. “In times of crises … when investors are nervous and scared about what’s going on, and they are, they flock to the safety of the U.S. Treasury bond market,” said Zandi. Capital flows into the American economy, and the value of the dollar appreciates.

Not this time. Instead, investors have pulled back, and the dollar fell to its lowest level since 2022. The “safe haven” assets of American Treasury securities may no longer be looking so safe, a trend that would continue if investors believe decisions by the Fed are politically motivated.

“It’s really quite calamitous. It would be not only inflation for us here, but we would just lose our status in the international financial markets,” said Meade. “We’ve never lived through anything like that.”

OK, so the dollar is weaker. What does that mean for the average American? You guessed it: that old chestnut, higher interest rates. Zandi noted that the current mortgage rate has been holding steady at around 7 percent. If capital were flowing into the country, that rate would be lower, as would rates for auto loans and business loans.

“We’re already feeling the ill effects of this. It’s a great advantage to have the safe haven status because when times are tough, it allows for lower rates and it makes it easier to navigate through,” said Zandi. “If you lose that status, you lose that benefit, and it feels like we’re losing that benefit.”