The sellout of the Columbia Broadcasting System’s journalistic values to commercial interests was foreshadowed in 1976, in Sidney Lumet and Paddy Chayefsky’s dark comedy satire Network; in James Brooks’s 1987 romantic comedy Broadcast News; and in Michael Mann and Eric Roth’s 1999 drama The Insider, explicitly calling out the revered CBS. However, it was insider Shari Redstone who completed the dreaded desecration last week.

Surely the capitulation to President Trump by Redstone, controlling owner of Paramount-CBS, to secure Federal Communications Commission clearance to sell her dwindling media empire to David Ellison of Skydance and Redbird Capital was a moment of tragic irony. We had saluted the board battles of Redstone, the seemingly underrated, high-integrity daughter of owner Sumner Redstone, in her difficult governance battles with the CEOs of Viacom and CBS, expecting that she would return the media powerhouses to their strategic positioning as engines of innovation. Sadly, they only atrophied further, consumed by internal reshuffling and missed opportunities for timely investments in programming and technologies.

As prominent media commentators such as Oliver Darcy and Matt Belloni point out, the payment of $16 million to the Trump Presidential Library from CBS News’s 60 Minutes over the objections of its executive producer (who resigned in protest) resembled payment of an extortion-like penalty to the government for the standard editing of an interview with Kamala Harris last summer.

Of course, Trump’s claims of “damage” ring especially hollow given not only that the transcript showed nothing irregular about the edits but also, of course, the fact he won the election. This happened just weeks after the final performance of George Clooney’s Broadway blockbuster Good Night and Good Luck, a tribute to the bold, legendary head of CBS News, Edward R. Murrow, and his team of noble journalists. This was followed by the cancellation of “King of Comedy” Stephen Colbert’s revered late show, seemingly over its satirical criticism of the Trump administration. The explanation that the show was too expensive and lost money raised many eyebrows, particularly given the lack of attempts to trim the 200-person production staff to bring it in line before its abrupt cancellation on the eve of Trump’s FCC merger approval.

But Paramount’s woes extend much deeper than a few rough weeks. Sadly, this media enterprise had stopped innovating for decades, despite the fast-moving programming and technologies of the strategic context of news and entertainment, on top of its own legendary history of innovation.

The venerable media brands of CBS, Paramount, and Viacom shared a history as pioneering entrepreneurs that actually wandered into each other’s paths repeatedly. They also shared histories of early innovation followed by decades of palace intrigue, succession battles, organizational churning, and strategic atrophy.

CBS was founded in 1927 as a radio network by a talent agent, Arthur Judson. A year later, William Paley acquired 51 percent of the network, while Paramount Pictures bought 49 percent. In the Depression, Paramount was forced to sell its stake to emerge from bankruptcy. Under Paley, CBS became known as “the Tiffany network,” given its high-quality programming, expanding into television in the 1940s; its news division, under Edward R. Murrow, became the gold standard of broadcast journalism. It spun out its syndication business, known as Viacom, in 1971. Paley had undermined a series of four highly regarded successors with sequential palace coups over 60 years, until the board finally removed him and sold the business to the Tisch family’s Loews firm, which later sold it to Westinghouse, which in turn sold it to Sumner Redstone.

Paramount was founded in 1912 by Hungarian immigrant Adolph Zukor, an investor in the older media sector of the nickelodeon, the first form of indoor exhibition space dedicated to showing projected motion pictures through individual machines. As large-screen technology developed, Zukor launched a chain of palatial theaters to distribute the films his studio produced. He also created the star system, which featured performers such as Mary Pickford, Douglas Fairbanks, Gloria Swanson, Rudolph Valentino, W.C. Fields, Cary Grant, and the Marx Brothers. Paramount produced many great classic films, such as the Godfather movies, Psycho, Chinatown, and The Ten Commandments. Zukor pioneered many of the first animated cartoons, sound films (“talkies”), and musical films, and was an early investor in Bill Paley’s CBS broadcasting network; however, he surrendered that stake as part of Paramount’s bankruptcy reorganization during the Depression.

Meanwhile, NBC was created by David Sarnoff, a Russian immigrant and brilliant innovator, as a division of the Radio Corporation of America, or RCA, which he created in partnership with General Electric and Westinghouse in 1921. GE and Westinghouse were forced to divest their stakes due to antitrust concerns in 1932. At the 1939 New York World’s Fair, Sarnoff unveiled the first electronic black and white television and, later, in 1954, the first color television.

In 1948, the Supreme Court forced the divestiture of Paramount Studios from Paramount Theaters, separating production from exhibition. Leonard Goldenson, an antitrust attorney, bought the theater chain and merged it with ABC, which had been created in the court-ordered divestiture of one of NBC’s two networks. Paramount Studios became a major source of ABC TV shows. Paramount also opened a chain of amusement parks around the nation.

Gulf & Western, a large industrial conglomerate that manufactured automotive parts and purchased Paramount, was then led by Barry Diller and Michael Eisner, who produced many of the definitive box office hits of the late 1970 and 1980s, such as Airplane!, Ordinary People, Terms of Endearment, and the Indiana Jones franchise. Diller left to create Fox Television, while Eisner left to save Disney.

In the 1990s, Sumner Redstone’s Viacom, which had been CBS television’s syndication business, took control of Paramount and then merged back with CBS in 2000 but later spun out CBS in 2005, only to push to reunite them a decade later. In May 2016, the fast-fading 93-year-old Sumner Redstone removed Viacom CEO Philippe Dauman and George Abrams, a longtime Viacom board member, as members of his trust, which controls Redstone’s ownership of National Amusements, which, in turn, controls 80 percent of Viacom and CBS.

Dauman and Abrams expressed shock and outrage at the decision, but many wondered what took so long, given Dauman’s faltering performance. At that time, Dauman was one of the highest-paid CEOs in the nation (earning $85 million a year between 2011 and 2015), but Viacom’s stock price was down by 50 percent over the year, with the once-mighty cable channels of MTV and VH1 having gone creatively stale and the legendary Paramount studios all but moribund as Redstone, like Paley, churned through four highly regarded expected successors, staying in power into his nineties.

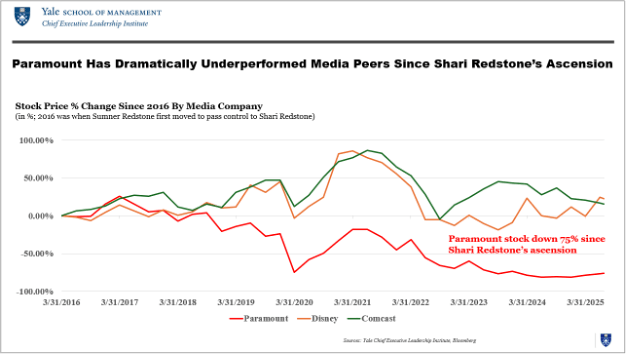

Since Sumner Redstone began the process of handing over control to Shari in 2016, Paramount stock has nosedived 75 percent, wiping out tens of billions of dollars in value and shrinking to a valuation of merely $8 billion, a fraction of the roughly $80 billion it was worth when Sumner was at his peak in 2001.

That value decline has been a long time coming, as media peers soared past the once-thriving Viacom and CBS empires, which had rotted from within, lethargic and seemingly watching as the world passed them by. Remarkably, in stark contrast to its peers, the company did not make a single major acquisition or enter a new business line over the last two decades.

Over the same period, Disney-ABC and Comcast-NBC brilliantly reinvented themselves with far better entertainment products, expanded highly profitable theme park investments with amusements showcasing films and TV shows, enhanced sports programming, and fortified respected news coverage. Disney, under its revered CEO Bob Iger, has undergone several transformations. Its film franchises (The Avengers, the Frozen movies, and Black Panther) consistently enjoyed widespread critical acclaim and set box office records. Wisely, Iger purchased Pixar for $7.4 billion, from which Disney has reaped over $40 billion. The subsequent $4 billion acquisition of Marvel has netted Disney $13 billion, followed by the $4 billion purchase of Lucasfilm, which has generated $12 billion.

Similarly, Comcast has captured a significant share of the media market following its complete acquisition of NBCUniversal for $39 billion in 2013, with continued innovation. Comcast-NBCUniversal has churned out hit after hit in its content—The Office, 30 Rock, the One Chicago and Law & Order franchises. Moreover, Universal Pictures, the studio unit, had huge blockbusters such as Oppenheimer and Wicked. Its Peacock streaming business has delivered $4.9 billion in revenue last year with 46 percent annual growth.

All Paramount seems to have accomplished in those years was the fruitless meiosis and mitosis of Viacom, CBS, and Paramount being constantly stapled together and torn apart, only to be pasted together again. Such waves of unification and dissolution were distractions from creative risk taking and business building, as they hindered the adoption of new technologies and the discovery of adjacent entertainment properties. The repeat business marriages and divorces mirrored the head-spinning matrimonial volatility of Elizabeth Taylor and Richard Burton.

The revival of NBC and ABC is proof that old brands can be either wasted or revitalized. Humorist Fred Allen, an old CBS radio star from back in the golden age, once complained that “imitation is the highest form … of television.” Had CBS only copied its peers, it would have been in far better shape.

In fairness, Skydance is buying not just venerable old brand names but undervalued current properties. Amazingly, CBS is hitting a record seventeenth consecutive season as the most watched network, with the top seven prime-time shows, not to mention streaming hits such as Paramount’s Yellowstone. Thus Skydance is getting a bargain that Redstone is handing off wrongly at distress prices.

With deal closure expected next week, the new Paramount-CBS will be 70 percent owned by Skydance Media and 30 percent by public owners. And what is Skydance? It was founded in 2006 by CEO David Ellison, a former actor, who is expected to become chairman-CEO of the new combined entity. He’s the son of Oracle founder Larry Ellison, a Trump supporter and the second-wealthiest person in the world with $280 billion.

David Ellison was backing Joe Biden—he gave Biden nearly a million dollars in April 2024 before Biden dropped out. Nonetheless, media experts were concerned by the exits of such respected leaders as CBS News chief Wendy McMahon and 60 Minutes executive producer Bill Owens, who resigned due to their opposition to the deal. The apparent courtship of the divisive journalist and Free Press founder Bari Weiss has also raised eyebrows about a prospective fusing of Free Press with CBS News. On the other hand, the new appointment of respected insider Tanya Simon to replace Owens at the helm of 60 Minutes was received as an encouraging move.

Yet still, key news leadership changes on top of the shameful shakedown of 60 Minutes and the politically driven cancellation of the hugely popular Colbert show, are beyond troubling. Ominously, according to reports, Paramount also surrendered to the hiring of an ombudsman at CBS News to be charged with investigating complaints of political bias, with the concession made in a letter to the FCC that “in all respects, Skydance will ensure that CBS’s reporting is fair, unbiased, and fact-based.”

Such tragic capitulation of First Amendment rights, accompanied by a demoralizing and brand-tarnishing political appeasement, followed decades of self-destructive value erosion. The turbulence of these last few weeks for Paramount seems a fitting capstone for Shari Redstone’s turbulent run at the helm of this storied but struggling company. Our private independent media enterprises are public treasures. They must not become state propaganda outlets. As CBS News titan Edward R. Murrow warned, 65 years ago: “To be persuasive, we must be believable. To be believable, we must be credible. To be credible, we must be truthful.… A nation of sheep will beget a government of wolves.”