On October 23, I predicted that a stock market crash was imminent, but we didn’t even get a bear market. The S&P 500 has risen 3.4 percent since I published that story, and it closed out 2025 up 16 percent for the year. For the record, I still believe a severe correction is likelier than not, but it’s clear that I underestimated the stock market’s capacity for denial.

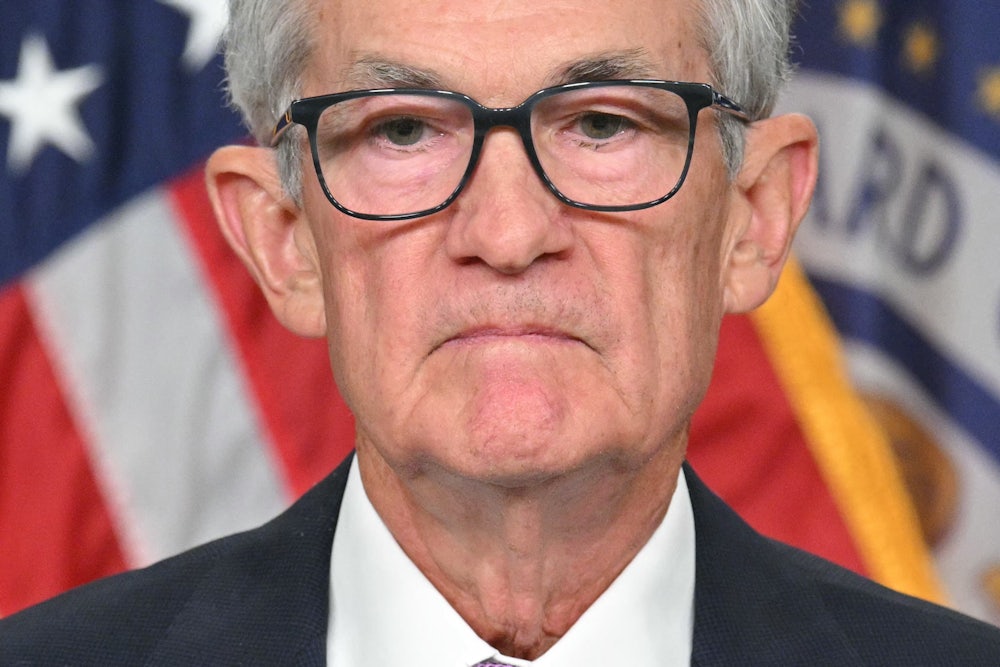

The latest example is the S&P 500’s amazingly mild reaction to an SOS that Federal Reserve Chair Jerome Powell sent out Sunday night. Powell’s distress signal took the form of a written statement and video emailed to reporters and posted on the Fed’s website, in which Powell said that the Justice Department was threatening to indict him over some testimony he gave before the Senate Banking Committee last June about the cost of renovating the Fed’s headquarters. This, Powell explained, was “not about my testimony,” nor “about the renovation of the Federal Reserve buildings,” nor “about Congress’s oversight role”:

Those are pretexts.… This is about whether the Fed will be able to continue to set interest rates based on evidence and economic conditions—or whether instead monetary policy will be directed by political pressure or intimidation.

Translation: Hey markets, if you’ve contemplated freaking out about President Donald Trump’s sustained assault on Fed independence, this would be a good moment to do so.

But the stock market didn’t freak out. The S&P 500 dipped a little Monday and then quickly recovered. “The impact of Chairman Powell being under investigation is likely a long-term impact,” Jim Lebenthal, chief markets strategist at Cerity Partners, told CNBC, “meaning it’s not going to change interest rates in the near term; it’s not going to change inflation in the near term.” Lebenthal didn’t exactly dispute that a mentally unbalanced president was seizing unprecedented control of the federal agency that sets interest rates and that the likely result would be higher inflation. But the January 13 inflation report, Lebenthal said, will likely show inflation “well below 3 percent,” and that’s all the stock market cares about. Don’t bore it about the collapse of rule of law.

The good news, I suppose, is that the stock market doesn’t appear to believe there’s any legitimacy to the Justice Department’s investigation of Powell. If it did, it would be worrying that the Fed is controlled by a crook. An understanding that the Justice Department is weaponized to punish Trump’s enemies appears to be baked into its calculus. The Justice Department hardly keeps that a secret; it created an office with the bracingly un-euphemistic name Weaponization Working Group, headed by the MAGA hack Ed Martin. Still, that DOJ is persecuting the federal government’s most consequential financial regulator ought to give stock market investors pause. It doesn’t.

Maybe it helps that many Republicans openly acknowledge the investigation’s illegitimacy. Trump’s Treasury Secretary Scott Bessent told the president that the Powell investigation “made a mess” for financial markets and dashed any hopes that Powell would step down in advance of his term ending in May, according to Axios’s Marc Caputo. Similarly, House Financial Services Committee Chair French Hill, a Republican, said he believes Powell to be “a man of integrity” and that the investigation “creates an unnecessary distraction,” which is a polite way to say it has no basis in reality. So did Senator Kevin Cramer, a Banking Committee Republican who frequently criticizes Powell. “Jerome Powell is a bad Fed Chair who has been elusive with Congress, especially regarding the overruns of the elaborate renovations of the building,” Cramer said. “I do not believe, however, he is a criminal. I hope this criminal investigation can be put to rest quickly.”

The Powell investigation was reportedly urged on by Bill Pulte, the Madame Defarge–like director of the Federal Housing Finance Agency, to whom Bessent famously once said, “Fuck you! I’m gonna punch you in your fucking face!” Pulte stated publicly on July 2 that he believed Powell’s testimony about the Fed renovations was sufficiently deceptive to justify a “for cause” removal, the only removal Trump can legally effect against a Fed chair.

Pulte cited as his source Senator Cynthia Lummis, a Republican on the Banking Committee, who made the criminal referral to DOJ. But even Lummis said primly on Monday that she felt unsure “whether Chairman Powell was unprepared for his testimony or intentionally misled Congress about the Fed’s extravagant spending.” Her bad-faith allegation that Powell may have perjured himself, which Russell Vought, the White House budget director, has repeated, is too stupid to delve into in any detail; suffice it to say that it’s based on supposed discrepancies between what Powell said in June and some Fed documents about the project that were four years out of date at the time of the hearing. (More on all that here.)

Not all the markets were impervious to Powell’s harassment by DOJ goons. The dollar, which is down 8.3 percent over the past year—that is, more or less since Trump took office—dropped steeply Monday morning before rising a bit in the afternoon. The yield on 30-year Treasury bonds, which has been rising since October, spiked Monday morning. That’s a sign that fewer people wish to buy them. Why purchase dollars or Treasury bonds when the president is so determined to lower their value that he’s willing to throw the Fed chair, who’s been lowering interest rates lately but not fast enough to suit Trump, in jail? Over the course of the afternoon, however, bond yields fell, leaving them about where they closed Friday.

Gold, meanwhile, jumped nearly 3 percent. As I’ve explained previously, the rising price of gold is the surest sign that the U.S. economy is headed in a terrible direction. It’s a vote of no confidence in the dollar. As I explained in October, investors call rising gold prices “debasement trade,” which means money is fleeing from assets in which the market is losing faith—in this case, the dollar and Treasury bonds. The higher the price of gold rises, the more debased our currency and our nation’s debt become.

Gold futures contracts now stand at a record high. We really have entered a Gilded Age, figuratively, in the dominance of billionaires in our politics; literally, in the price of gold; and symbolically, in Trump’s conversion of the Oval Office into an ersatz pharaoh’s tomb. It can’t last, and it won’t, but I’ve given up predicting when it all goes bust.