President Donald Trump, who is an inflation dove, announced Friday morning that he will name Kevin Warsh—whose past record is that of an inflation hawk—to succeed Jerome Powell as chairman of the Federal Reserve. Trump has been so desperate to lower interest rates that last year he contemplated firing Powell, whose views on monetary policy are fairly mainstream. Now he’s nominating somebody who, unless he’s undergone a complete ideological transformation, will displease Trump even more.

In the past, Warsh has been such an inflation hawk that when he was a Federal Reserve governor in April 2009, he pronounced himself “more worried about upside risks to inflation than downside risks.” This was at a time when the consumer price index, or CPI, was negative 0.4 percent, unemployment was 8.9 percent, and the economy was in a recession that turned out to be the longest and deepest downturn since the Great Depression. During the decade that followed, inflation never rose above 3.2 percent, and mostly stayed below 2 percent.

Today, inflation is 2.7 percent, which doesn’t worry me particularly. But that’s 0.3 points higher than it stood in the last CPI report, released before Trump won the 2024 election by claiming inflation was “the worst we’ve ever had.” (Trump turned inflation hawk temporarily so he could bash President Joe Biden.) There’s every reason to believe that Trump’s tariffs (assuming the Supreme Court doesn’t strike them down) will push inflation higher. The Warsh of April 2009 would be apoplectic about that.

But the Warsh of January 2026 is unconcerned—or at least he’s been saying he’s unconcerned in order to secure the Fed nomination. In a November Wall Street Journal op-ed, Warsh suggested inflation wasn’t a worry right now because “AI will be a significant disinflationary force, increasing productivity and bolstering American competitiveness.” Whatever.

The Fed, Warsh wrote, “should abandon the dogma that inflation is caused when the economy grows too much and workers get paid too much.” If that made Warsh sound like a left-winger, he reaffirmed in his next sentence that he was not. “Inflation,” Warsh wrote, “is caused when government spends too much and prints too much.” That sounded like the old inflation-hawk Warsh, but he was careful not to blame Trump’s “big, beautiful” reconciliation bill, which will increase the budget deficit by $3.4 trillion over the next decade. Instead, Warsh blamed quantitative easing—i.e., the Fed’s purchase of government bonds and other financial instruments to stimulate the economy after the Great Recession—even though the Fed had been unloading those assets (“quantitative tightening”) for the previous three years. The Fed stopped in December, but that was after Warsh published his op-ed.

Warsh’s Journal piece also faulted the Fed for excessive bank regulation, which he said “systematically disadvantaged small and medium-size banks, which has slowed the flow of credit to the real economy.” Here’s a reality check: The string of bank failures in 2023 (Silicon Valley Bank, Signature Bank, First Republic Bank) was the result of under-regulation, not overregulation, including a partial rollback of the Dodd-Frank financial reform bill that occurred during Trump’s first term.

Warsh used to oppose “the rising tide of economic protectionism,” and, as recently as 2018, he told Politico that “I wouldn’t prioritize a [U.S.-China] trade deficit as the framework by which we should judge the importance and the difficulty of the most important great power relationship for the next 100 years.” That’s heresy in MAGA-world. But today, Warsh is not only OK with Trump’s tariffs, he faults the Fed for criticizing them because it’s an admission that “their credibility has been impaired.”

These more up-to-date diagnoses (along with his more explicit calls for lower interest rates and his preposterous claim that the reconciliation bill was “putting the fiscal house in order”) apparently appeased Trump sufficiently for him to choose Warsh, bypassing the other, more reliably sycophantic Kevin in Trump’s White House. But if Trump believes Warsh is going to lower interest rates faster than Powell, the markets do not; news that Warsh was Trump’s pick sent the dollar higher and gold lower. They can’t both be right.

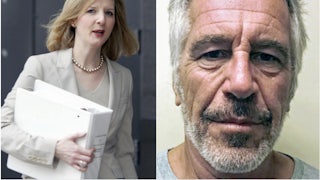

Don’t discount Warsh’s good looks. “On top of everything else, he is ‘central casting,’” Trump wrote on Truth Social. Trump’s post was otherwise a dull recital of Warsh’s résumé, suggesting that maybe there was no “everything else.” If there were, it might be that Trump enjoys forcing ambitious people to renounce their prior views. I’m convinced that he chose JD Vance (who has turned out to be a maladroit vice president) not in spite of Vance’s previously calling Trump “an idiot” and “America’s Hitler” but because of it; it demonstrated that he’d made Vance grovel.

An alternative explanation, though, is that Trump is doing this for the billionaires, who are displeased with his antics around the Fed. Billionaires don’t like inflation or regulation, and they trust only so far others who aren’t billionaires. Warsh would be the Fed’s first billionaire Fed chair. He has achieved that status not through his own efforts but through his wife, Jane Lauder, the daughter of Ronald and granddaughter of Estée. According to Forbes, she’s worth $2.7 billion, which means as long as they’re married Kevin is worth that much too. Jay Powell’s net worth is a not-inconsiderable $20 to $55 million, but Warsh would be easily the richest Fed chair in history. That he became so through a family connection conceivably increases Trump’s sympathy for him (since Trump did too).

If you’re inclined to believe, as I do, that billionaires’ opinions about how to manage the economy are (with rare exceptions) formulated by their money rather than their brains, then Wall Street is right about Warsh’s likely direction and Trump is wrong. It took Trump about a year to go from choosing Powell, in 2017, to turning against him. Lately he’s been trying to throw Powell in jail. I believe we’ll witness a similar trajectory with Warsh. Asked to choose between his president and his wealth, he’ll choose his wealth, because that’s what billionaires do. Score one for the American oligarchy.