Cindy Black of Lynnwood, Washington, has almost always done her own taxes. The 62-year-old nonprofit executive’s situation is straightforward: She only has one or two W2 forms for her employment, sometimes with a 1099 for some consulting work on the side, and her bank interest to report. She’s always figured that it wasn’t worth paying a company like TurboTax or H&R Block to do work she was capable of doing herself.

Naturally, that meant the onus was on her to print out paper forms and set aside hours to complete her taxes each year, following the instructions and hoping she got everything right. It was a process she consistently dreaded, so much so that she typically put it off until right before April 15. In more recent years she’s used the Internal Revenue Service’s free filing options, which offer people who earn under certain thresholds access to commercial tax prep software. These, she says, are “better than the paper ones but still time consuming.” Making her way through the numerous questions—and determining whether she qualified for various credits and deductions—took a lot of work. “It didn’t take a lot less time.” If she owed the government, it meant going through a separate process to either mail in a check or muddle through another online form.

But then she read about the IRS’s new Direct File pilot in a newspaper article, an option the IRS launched this year to let Americans file their taxes for free directly with the agency. And when she found out that her state is one of the ones where the pilot is operational this tax season, she was delighted. “I went, ‘Oh, that’s a great idea,’” she said.

Congressional Democrats passed the Inflation Reduction Act in 2022, which not only sent more funding to the IRS but required it to study direct filing. The IRS took that prompt and decided to build and roll out such an option this year. This season, Direct File is available in 12 states: Arizona, California, Florida, Massachusetts, Nevada, New Hampshire, New York, South Dakota, Tennessee, Texas, Washington, and Wyoming. It’s open to people with the simplest tax situations: those who take the standard deduction—which nearly 90 percent of Americans do—with W2 earnings from salaried employment, benefits from Social Security or unemployment insurance, and interest income of $1,500 or less. The IRS expects several hundred thousand people to use it this season; more than 50,000 people used it in the first two weeks.

Those lucky thousands who get to use Direct File this year will almost certainly save a whole lot of money and time. The IRS estimated that the average taxpayer spent $210 and 11 hours to file their taxes in 2019.

A few days after Black read about Direct File she decided to use it during an hour-long break in her work schedule, hoping that would be enough time to get her return done. She gathered the few documents she would need and logged in. “It was really user friendly compared to the other ones that I’ve used,” she said. “The questions were simple and very clear.” At the end she was told she owed $17 and was able to make the payment right then and there.

It took her between 15 and 20 minutes from start to finish, giving her back about 45 minutes to do other things. That kind of time “is really valuable,” she said. “That’s huge.” She also said it was far less stressful.

“It was the most convenient way I’ve ever filed my taxes,” she said. “I got to be honest, it surprised me how simple it was.”

Direct File is currently available in Spanish, and the goal is to expand it to other languages as well. It also offers a way to chat with an actual human IRS employee if someone has any problems or concerns, available Monday through Friday from 7 a.m. to 10 p.m. Eastern.

Some people who use it will have to file state taxes as well. Washington State has no income tax, nor do Florida, New Hampshire, Nevada, South Dakota, Tennessee, Texas, or Wyoming, so Black and her fellow Washingtonians don’t have to worry about state returns. In three other states—Arizona, Massachusetts, and New York—an integration tool copies a taxpayer’s data from the federal return over to the state one and then asks any remaining questions. California directs users to the state filing site but doesn’t prepopulate its fields with the information that users provide the feds.

Even so, Direct File was a revelation for Carlos Gomez. When the 28-year-old got his first W2 five years ago, he took it across the street from his apartment in Pomona, California, to a storefront tax preparation firm. His parents had instilled in him a fear of getting things wrong on his return, so he figured a service would ensure no mistakes were made, and he went back every tax season. But it cost him about $100 every year to file his taxes, not to mention finding the time to get away from work and spend an hour getting them done.

This year when he saw something about Direct File pop up in a friend’s Instagram story he figured he would try doing his taxes by himself for the first time. He “basically did my taxes on my lunch break,” he said. He had his W2 with him at work, so he was able to fill out all of his income information right then and there. The last piece was his signature from last year’s return, which he was able to complete after digging his return out of a box at home in a matter of seconds. Start to finish it took him about 20 minutes. “It was a walk in the park,” he said. Afterward the site directed him to where to file his state return digitally, which was “very similar,” he said.

Besides saving himself time, it meant he didn’t have to shell money out to a preparer. He got back about $400 total from his return this year—and would have lost a quarter of that had he stuck to his previous accountant. That money will “go in a piggy bank to save for a rainy day,” he said. “It makes a big difference.” He’s since tried to convince his family members and co-workers to use Direct File too.

This year’s Direct File pilot has been purposefully small and contained. Memories of the tortured debacle that was the Healthcare.gov rollout linger in Washington, so the IRS was smart to start small, the better to give itself the opportunity to fix bugs and learn lessons about the user experience, and then expand the program carefully. The pilot was strategically released during the quiet part of tax season in the hope that it would be ready for prime time when the last-minute crunch of Tax Day finally arrives.

Advocates now have their eyes set on not just making sure the pilot doesn’t disappear but expanding as far as possible. “Direct File ought to be expanded over a period of a couple years to most situations,” said Adam Ruben, vice president of campaigns and political strategy at the Economic Security Project.

One immediate goal for advocates is not just to expand the number of states where Direct File is available but also to incorporate the integration available in Arizona, Massachusetts, and New York to others so that state returns are prepopulated. Two different versions of that integration software were built for this season, which means state systems that operate differently will be able to choose the one that works best. For some states it “is not much more than flipping a switch,” Ruben said. For others, such as California, which has its own unique platform, it will take more work.

Next, Ruben wants to see Direct File expanded to include people with 1099 forms for gig work or side jobs. Eventually, he thinks it could cover the most common situations. TurboTax, after all, is able to tackle any tax situation with its online software.

Ultimately, the goal is not only a filing system that is simple and free, but one where the IRS does most of the work. Economists have found that even with just the information the agency already has on its own it could successfully fully prepopulate about half of all Americans’ returns, and for the rest of taxpayers, the majority would need to make just one change to finish their return. “It’s very clear the IRS could do most people’s taxes,” said Vanessa Williamson, a senior fellow at the Urban-Brookings Tax Policy Center. Treasury Secretary Janet Yellen has already said she hopes future versions of Direct File will include information from W2s.

“In the long run, we want to see all states, all common tax situations, and really robust prepopulation,” Ruben said. That would include filling forms out not just with information the IRS already has but with information from other government agencies as well, such as the Social Security Administration. As in many other countries, that would mean most American taxpayers could simply check to make sure their return looked correct and sign off on it; anyone who wanted to add more information for credits or deductions would be free to do so. “There’s really no reason why we should put taxpayers through this annual exercise of, ‘Better make sure you do this right because we’ll check your math on the back end,’” said Igor Volsky, campaign director of Better IRS.

The Economic Security Project has estimated that Direct File could cover most tax situations in all states, integrate with state filing, and offer “significant” prepopulation within five years. At that point, the organization projects that it would save Americans $8 billion a year in filing fees and $3 billion worth of time saved. It could deliver billions of unclaimed tax credits, such as the Earned Income Tax Credit and Child Tax Credit, to families that are currently eligible but don’t claim them.

The program would also save the government money. The IRS could save $300 million, the organization estimates, by reducing the time it takes to handle paper returns and resolve errors.

The problem with expanding Direct File “is not a technological problem or a logistical problem,” Williamson said. “The problem is a political problem.” Making the program permanent and allowing it to keep growing will require both reliable funding and letting the agency do its work without interference.

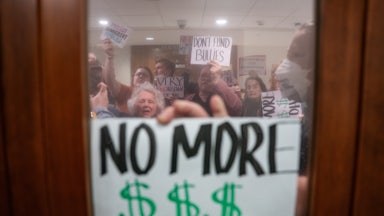

But there is already opposition coalescing against Direct File. Intuit, which owns TurboTax and has spent decades fighting free and easy tax filing, immediately and unsurprisingly opposed it. In February, 12 state attorneys general sent a letter to Yellen opposing Direct File and calling it “unconstitutional.” Republicans in Congress have been pushing hard to claw back IRS funding, some of which has made the pilot possible, and have even tried to explicitly block the agency from doing it.

Volsky still thinks that now that Direct File is out in the open, it will prove hard to get rid of. “There is a strong foundation both of public support and also a proof point about the success of the program,” he said. “The roots of Direct File are pretty damn strong.”

The goal, Ruben said, is not to eliminate the accountants and TurboTaxes of the world. If you like your tax preparer, you’ll be able to keep them. The idea is to compete with them by having the government offer something better. “This is a public option,” he noted. The very wealthy will probably need their accountants for all of their offshore tax havens; some low-income people with very complicated returns and language barriers can make use of the Volunteer Income Tax Assistance program. But with a free and easy option on the market, other preparers may feel the pressure to make their products better and more affordable. “It’s fighting TurboTax’s effective monopoly on the market,” he said.

That alone carries huge significance. Paying taxes is “a civic function that should be handled by the government,” Williamson argued. The faster people can do their taxes, the faster they can get their refunds and get back to their lives.

Moreover, a program that dramatically reduces the time, expense, and anxiety about filing your annual return could change how Americans view paying taxes generally—and, possibly, make them less allergic to raising them. The United States is a low-tax country given our wealth. “Because the income tax is irritating for many Americans, it puts them in the mindset that they are in the same class as all the other taxpayers who are oppressed by the tax system,” Williamson said. In other words, because paying taxes is such a huge hassle, the 99 percent has come to believe that it pays taxes just like the 1 percent. This illusion can make us “more open to top-heavy tax cuts,” she says, because it distorts our sense of class—and therefore our sense of tax fairness.

Direct File even has the potential to change how Americans interact with and see their government. If scaled up completely, it could represent “government at its best,” Ruben said. “It’s taking something that’s a real pain point with being a taxpayer in this country and making it frictionless.”

That pays dividends for our democracy. An easy tax-paying process may not sound like something that could make or break our increasingly fragile political system, but it’s one of the regular times we all interact directly with our government. If the government can prove that it can make our lives easier, we might become more inclined to participate in it and work to improve it. “Creating a government that people have trust in is vitally important to the functioning of a democracy,” Williamson noted.

Cindy Black doesn’t just recommend that other people use Direct File. She’s hoping it sticks around for good. “I would totally do it again,” she said. She’d like to see it expanded so that it can be available to people with more complicated tax filing needs. The only change she would make would be prepopulating the form with information the IRS already has. “That would just take it to the next level,” she said.