Trump Adviser Vows Government Will Take Over More Businesses Soon

Isn’t this called ... communism?

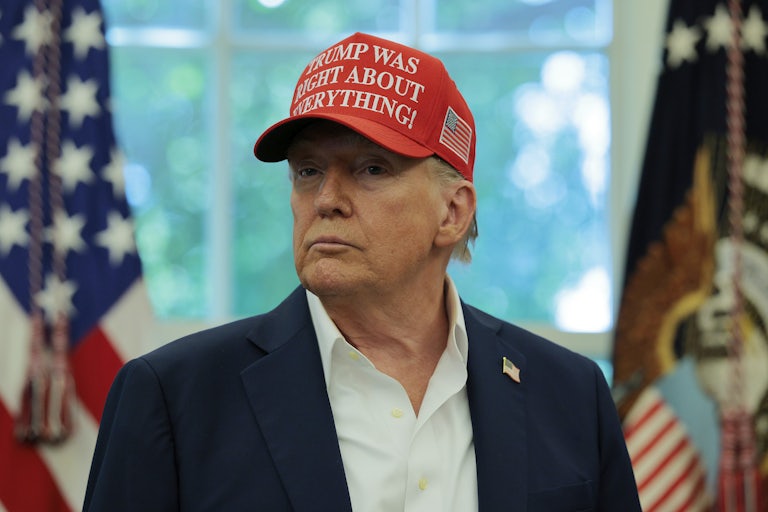

The Trump administration’s Intel deal represents only the first of more such interventions into the private sector, according to Kevin Hassett, the director of the White House National Economic Council.

Trump last week announced that the U.S. government will be taking a 10 percent passive ownership stake in the tech company Intel. The deal came just weeks after the president called for Intel CEO Lip-Bu Tan to resign after Senator Tom Cotton alleged the executive has problematic ties to China.

Trump made remarks Friday indicating that the move was something more of a shakedown than a deal, and that more such interventions may eventually be in the works. “[Tan] walked in wanting to keep his job, and he ended up giving us $10 billion for the United States,” the president told reporters. “So we picked up 10 billion. And we do a lot of deals like that. I’ll do more of them.”

On Monday, CNBC host Andrew Ross Sorkin asked Hassett about that prospect.

“So, we should expect the U.S. government to be taking more equity stakes in businesses around the country?” Sorkin asked. “That is something that if you’re a CEO, this morning, watching us, you should say, ‘OK, the sovereign wealth fund may be coming and trying to effectively buy in some kind of equity stake?’”

Hassett replied in the affirmative. “It’s possible, yeah,” he said. “That’s absolutely right.”

To allay fears of government meddling in business decisions, the adviser insisted that the government would only ever acquire non-voting stock.

But such assurances are likely to be met with skepticism, given that a major tenet of Trump’s agenda appears to be bending American businesses and institutions to his will. Take, for example, recent reports that the administration is keeping a scorecard of companies’ loyalty to the administration’s agenda.