September 2022 will mark two decades since Ashley Pizzuti took out the loans she says have “imprisoned” her and her husband. The couple met at the now-shuttered Brooks Institute, an arts college in Southern California, and graduated with a combined half-million dollars in debt around 2006. Defaulting would mean ruining their parents’ credit, since they had co-signed the loans. Pizzuti says that now, in middle age, when the couple applies for a mortgage, they’re “laughed out of the office.” Despite having built a successful business on paper, their debt-to-income ratio overshadows everything else they’ve done in the last 15 years. A borrower’s defense claim Pizzuti filed seven years ago has yet to find a conclusion. A class action lawsuit filed against the Department of Education under former Education Secretary Betsy DeVos, after rejecting 94 percent of these claims, hasn’t been settled yet. Pizzuti doesn’t have much patience for the idea that she simply shouldn’t have signed her name on the offer back when she was starting college. “We’re talking about 2002,” she said. “I still had dial-up and an AOL account.”

Since 2015, Pizzuti and her organizing partner Theresa Sweet have been advocating for the forgiveness of their loans and the loans of others who attended the school. Career Education Corporation, the notorious for-profit education group that operated Brooks, was recently investigated by 48 attorneys general for “unfair and deceptive practices”; shortly after the school closed, Pizzuti began collecting data from former students and found just under 500 respondents to her survey were over $70 million in debt. This past October, Sweet and Pizzuti were nominated to serve on the Department of Education’s negotiated rulemaking committee to discuss school affordability and loans. Known colloquially as “neg reg” committees, the meetings represent a somewhat wonky process through which people affected by changes to federal programs are invited to negotiate with the department.* Neither of the women were ultimately allowed to participate; Sweet’s named participation in the class action lawsuit was considered a “conflict of interest,” according to Pizzuti.

Not that it would have ultimately mattered—the committees are run on a consensus model, and in the negotiations this past fall the president of a for-profit college single-handedly blocked a group of proposals that would protect debtors, citing “reputational harm to institutions” if the department forgave loans in bulk. “It was a slap in the face to see that they’re still choosing for-profit schools over people that have actually really been harmed,” Pizzuti said. How could it be that school administrators involved in the committees didn’t have a conflict of interest, too?

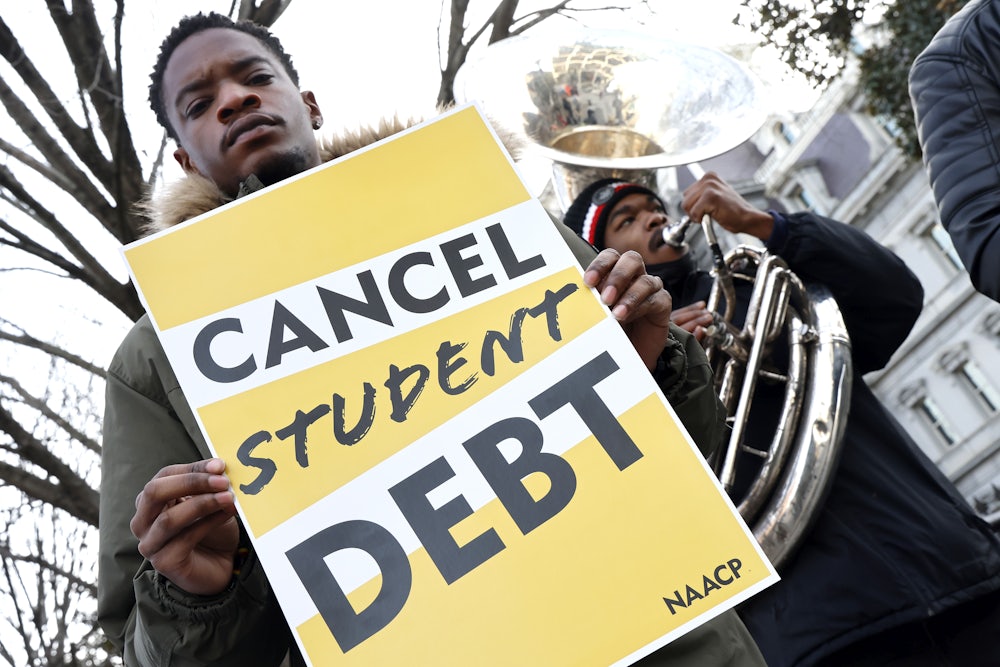

It’s been 94 weeks since President Joe Biden promised to wipe out significant student debt, and in the absence of broad executive reform, small-scale negotiations like these roll on, vexing the advocates who feel sidelined after having fought to make such a promise politically viable at all. The 2021 campaign staple—favored by a majority of Americans and a growing number of politicians—appears to make the president so uncomfortable that he recently ignored a question about it entirely. The administration has been “reviewing” a memo outlining its authority to cancel federal debt since last April. The movement to cancel the $1.6 trillion owed by 43 million borrowers, once considered implausible, has gained enough traction to find allies in the administration. But committees like the one Pizzuti was barred from are like a microcosm of the broader landscape in which organized debtors are considered activists, and well-compensated experts are somehow neutral parties. Even in this small example, it’s telling whose opinions are considered “informed.”

Another committee session began this month with a new group of negotiators. During the first days of the meeting a representative who ran a for-profit school was again at odds with the rest of the group during a discussion on how to prevent schools from misrepresenting the value of a degree or market too aggressively. The committee, which included veterans groups and consumer advocacy organizations, was being advised by a “labor economist” who has been one of the most prominent voices to argue against broad student loan forgiveness over the last few years.

If a person spends any time at all reading about debt cancellation in the mainstream press, they’ll encounter Adam Looney. A former member of the U.S. Treasury Department under the Obama administration, he is often called upon to counter moral and political arguments that favor wiping out significant federal debt. Recently, he’s been quoted as saying there is little legal basis for federal cancellation and that loan payments will become easier when they resume after their pandemic-era pause, given that people have accumulated savings. Most recently, however, he has focused on a fairly extreme extension of the conservative argument that broad loan forgiveness favors the wealthy: A recent paper Looney wrote for the Brookings Institution, a think tank, argued that proposals for broad cancellation were “regressive” and further entrenched racial divides. To make this argument, the economist argued the “increased earning power” of a degree was akin to a fixed asset, like a house. (Never mind that it’s impossible to sell a degree for actual money.) Therefore, cancelling the debt would increase racial and economic divides by granting the already well-off the equivalent of a free $1 million in earning power over the course of a lifetime while, given disparities in pay between white people and people of color, the latter group would benefit less. The paper was, naturally, picked up by right-leaning outlets even as it was described as flawed by prominent student debt experts who took issue with the obvious false equivalence between a degree and a home.

Looney’s primary post is as Executive Director of the Marriner S. Eccles Institute for Economics and Quantitative Analysis, a division of the University of Utah that’s been partially funded since 2017 with annual grants from the Koch Foundation. The argument that canceling student debt would increase the wealth of the already comfortable at the expense of low-income families is popular with talking heads with ties to the political right. For example, Beth Akers, who has frequently made the argument that debt cancellation isn’t “progressive,” is associated with the American Enterprise Institute, a right-wing think tank; Sandy Baum, recently quoted in The Atlantic for arguing that debt forgiveness is a “gift” to “people who have a certain privilege” publishes with the Lumina Foundation, which itself has controversial ties to the lender Sallie Mae.

“It’s really distorting to the political conversation,” said Astra Taylor, co-founder of the Debt Collective, the country’s largest debtor’s union. “People hear these arguments and think these people must be liberal.” And where there’s an obvious incentive for loan companies and right-wing funders to discourage definitive action on student debt, there’s less money floating around to counter their preferences. Recently I spoke to a prominent debt expert who told me there are “important voices that can’t participate right now because of the influence of money in the space,” describing a “small group of funders” responsible for think tanks and institutes: “In moments when people come out in favor of debt cancellation, the hammer comes down.”

Absent the political will to sign an executive order, forces

like these will shape any student debt reform, even in relatively innocuous

venues. The committee sessions are just the beginning of a rulemaking process,

and as anyone who has ever made a decision via consensus can tell you, it

isn’t an exercise that facilitates bold action among disparate groups. But the

distinction between informed policymaking and lived experience feels

particularly blurry both here and at the national level. Who has more expertise on predatory lending than a person who has owed a half-million to a

defunct institution for 20 years? And who will represent their position if they

aren’t allowed to participate?

* This article originally misstated the colloquial name for negotiated rulemaking committees.