A basic rule of Donald Trump is that he often accuses his foes of what he does himself. He described his first impeachment as a “coup attempt” just over a year before he incited a mob to attack Congress and the vice president. He accused President Joe Biden and his son Hunter of enriching themselves through foreign policy while his own son-in-law started a hedge fund with Saudi investors after supervising Middle East diplomacy. And he routinely described opponents as crooked and corrupt when he presided over the most self-serving presidency in American history.

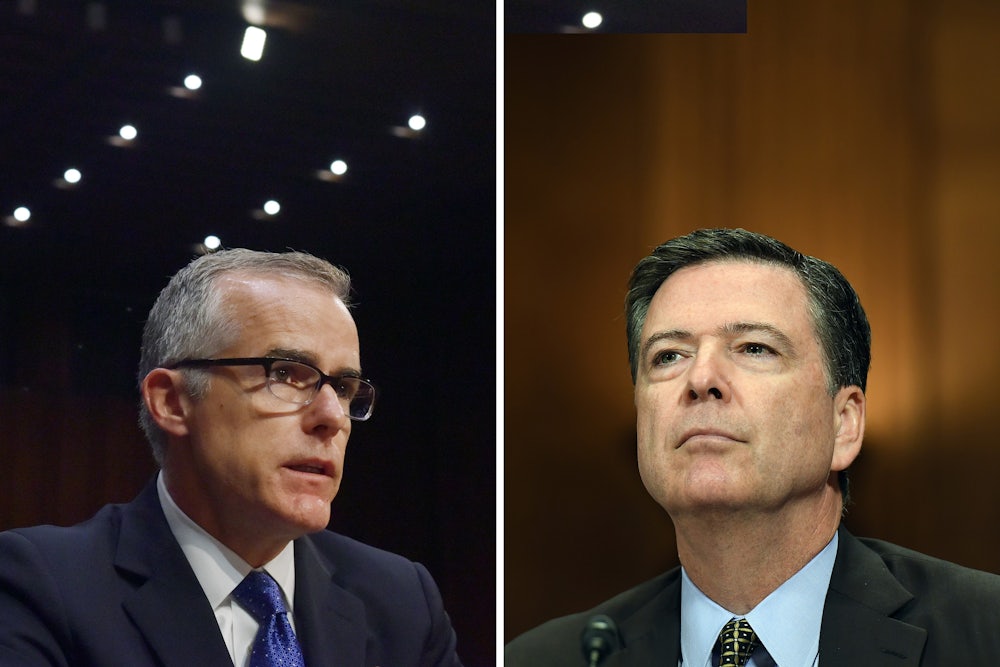

So it would be only a little surprising if Trump, who has been dogged by questions about his taxes for years, had turned the IRS against his own political opponents. On Wednesday, The New York Times reported that two of the former president’s targets of criticism—James Comey, the former director of the FBI, and Andrew McCabe, who served as his deputy—recently found themselves under the harsh gaze of the IRS. Trump ousted both men from their jobs in his early presidency after they failed to demonstrate sufficient personal loyalty to him.

According to documents that the two men shared with the Times, Comey’s 2017 tax returns came under special scrutiny in one of the IRS’s most stringent audit processes. He did not learn about the audit until 2019. McCabe’s 2019 tax returns fell under the same audit process, which began in late 2021 after Trump had already left office. In theory, the IRS chooses the tax returns selected for this type of audit at random from more than 150 million individual returns. The Times reported that about one in 30,600 returns were selected in 2019 and one in 19,250 returns were chosen in 2021.

My first thought after reading about the Comey and McCabe audits was that it could be yet another instance of partisan politics infecting the ordinary machinery of American governance in the Trump years. At second glance, however, it was also an opportunity. Previous scandals have hindered the agency’s ability to properly carry out its mandate. With the current commissioner set to leave in November, now is the perfect time for the Biden administration to strengthen the IRS after years of congressional and presidential neglect.

The selections of Comey and McCabe for a harsh tax audit could be a coincidence, albeit a statistically unlikely one. IRS Commissioner Charles Rettig, a Trump appointee, told the Times through an agency spokesperson that audits are determined at random by career civil servants. He told the newspaper that he hadn’t been involved in any individual audits and that he had never spoken with the White House about tax enforcement or any individual cases. Trump also told the Times that he “had no knowledge of this.” Still, it was enough to prompt the Treasury’s inspector general to open an investigation on Thursday, and for good reason.

I said earlier that it would be “a little surprising” if Trump and his allies were behind this—not because I have any real confidence in Trumpworld’s ethics or morals but because the IRS is supposed to have safeguards built in to prevent these sorts of abuses. It was Richard Nixon who pioneered the use of the federal tax agency to harass and punish his enemies through the ominously bland Special Services Staff. In the articles of impeachment drawn up as the Watergate crisis reached its conclusion in 1974, the House of Representatives was set to accuse Nixon of abusing his office by conducting tax audits “in a discriminatory manner.”

More recently, the Obama administration was accused of targeting conservative groups in the early 2010s by scrutinizing their nonprofit status more closely than usual. The allegations became a staple of conservative attacks on the administration during Obama’s second term; forced the resignation of the acting IRS commissioner at the time; and damaged the agency’s ability to get proper funding from Congress, especially after Republicans had recaptured both chambers. In 2017, four years after the scandal had erupted, the Treasury Department’s inspector general released a report that found liberal and nonpartisan groups had also been caught up in the tax-exempt crackdown that led to the scandal, undercutting claims of partisan warfare.

If anything, there is abundant evidence that the IRS isn’t actually doing enough to enforce the nation’s tax laws. In an investigation last year as part of its long-running scrutiny of the IRS and American taxation, ProPublica found that some of the country’s wealthiest citizens—Elon Musk, Warren Buffett, Bill Gates, and the like—pay little to no income tax even as their fortunes grow by millions or even billions of dollars each year. A recent investigation by the Times found that the IRS’s fast-tracking of charity applications led it to approve dozens of scams for nonprofit status, including 76 that shared the same postal address in New York.

That fast-track process, the Times noted, is the product of efforts to circumvent budgetary constraints after years of underfunding by Congress. (The IRS under-audits wealthy Americans for similar reasons.) I’ve written before on how the IRS needs a major infusion of funding and staff to make up for lost ground when it comes to tax enforcement. By some estimates, closer scrutiny of the wealthiest taxpayers could yield billions of dollars in federal funds. It would also help enforce a basic principle of taxation: that everyone pays their fair share.

The Comey and McCabe saga, even if it turns out to be harmless, is a good reminder that presidents should stay as far away as possible from individual IRS cases and specific enforcement matters. But it also shouldn’t be a deterrent for the administration when it comes to bolstering the agency’s functions to ensure it can fulfill its congressional mandate. The IRS will never be a popular part of the federal government. The Biden administration can at least ensure it is an effective one.