Raise your hand if you expected President Joe Biden’s first veto would protect the financial sector from excessive meddling by Congress. I don’t mind admitting this one took me by surprise.

There are many areas where political meddling with the financial sector would be a very fine thing. Eliminating the carried interest loophole is way up there. But the private equity industry has stopped that with $600 million in political spending over the past decade. Another desirable type of meddling is President Joe Biden’s proposed quadrupling of the 1 percent tax on stock buybacks. But with Warren Buffet deploying his considerable prestige to defend stock buybacks, the likelihood of enactment is not good.

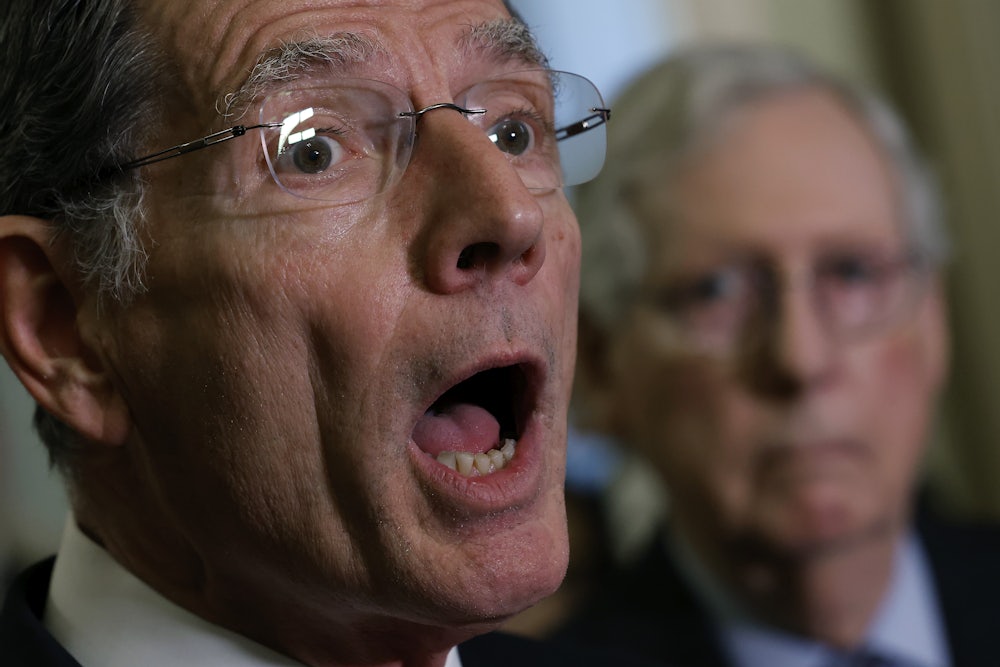

Congressional meddling in these examples would check bad behavior. That isn’t the sort of meddling the Senate voted for Wednesday, 50–46, with Democrats Joe Manchin of West Virginia and Jon Tester of Montana joining 48 Republicans, following House passage Tuesday, 216–204, with Democrat Jared Golden of Maine joining 215 Republicans. The target here wasn’t bad behavior but good behavior. To congressional Republicans and the three defecting Democrats, virtue corrupts the proper working of the market.

The bill Biden pledges to veto is a “resolution of disapproval” blocking implementation of a Labor Department rule so unremarkable that when it was finalized late last year it completely escaped my attention. The rule reversed an earlier rule, issued under President Donald Trump, that threw up legal roadblocks against brokers and other financial advisers recommending retirement investments that adhered to ESG principles.

ESG, which stands for environment, social, and governance, is a type of investing that favors nonextravagant executive pay, shareholder accountability, honest accounting, environmental sustainability, workplace safety, racial and gender diversity, and all the other practices one would think necessary or at least useful to a well-run corporation. The Trump rule presumed these goody-goody considerations got in the way of profitability and that a retirement adviser who accommodated them couldn’t fulfill his professional responsibility to maximize his client’s return. Congress, in voting to kill the Biden rule, was endorsing this view. In Manchin’s case, political contributions from the oil and gas industries, whose stocks are often shunned by ESG investors, likely tipped the scales. In the 2022 congressional cycle, Manchin received more from these industries ($763,559) than any other senator.

Biden didn’t reverse the Trump rule and rehabilitate ESG investing because Greta Thunberg asked him to. He did it because Wall Street banks asked him to. They asked because ESG is well established at this point and the financial sector can’t afford to avoid it. And while it is I suppose conceivable that the financial community has gotten so “woke” that it no longer cares about money, that strikes me as pretty unlikely.

Can ESG save the world? Probably not. As TNR’s Kate Aronoff has observed, there is no universally accepted definition for ESG, and the corporate and banking worlds engage in a lot of insincere posturing to persuade younger investors (ESG-heads tend to be young) that they’re doing good while doing well. Relying on corporate virtue to end climate change and racism and inequality is more than a little naïve, and I don’t recommend it.

Does ESG generate strong financial returns? There’s a lot of debate about that, not least because practically everybody wants to call themselves ESG these days, and figuring out which companies really are isn’t easily done. But as Aronoff has reported, the jury’s in on conservative state governments banning ESG investment. It reduces return and shrinks pensions. The Biden veto and the regulation it protects don’t require that retirement funds go into ESG; they merely allow them to without the bureaucratic impediments imposed under Trump. A retirement investment adviser must take into account many factors in determining which investments are best. The Biden rule just says he can take into account planet-saving too.

A great irony is that before the ESG issue came along, Republicans were working overtime to relieve retirement advisers of legal obligations, not impose new ones. Specifically, they opposed a rule issued by the Obama Labor Department that imposed a fiduciary duty on financial professionals who advise clients on their retirement investments. Fiduciary duty is a very specific legal status that requires the highest level of responsibility to serve the needs of a client. The Obama administration wanted to make retirement advisers fiduciaries. Republicans (and also, regrettably, some Democrats) didn’t want that because the Wall Street lobby didn’t want it. The Wall Street lobby didn’t want it because it would get in the way of brokers pushing stock recommendations on which they’d receive a fee or commission. The whole matter became moot when Obama’s fiduciary rule got challenged in court and the Trump administration declined to defend it. In 2018 the conservative Fifth Circuit in New Orleans threw it out. The Biden Labor Department is now trying to cobble together a version of the fiduciary rule that the Fifth Circuit will accept.

Liberals and conservatives both, under different circumstances, want to meddle with the financial sector, and specifically with pension brokers. But the differences speak volumes. Liberals want to prevent these brokers from profiting at their clients’ expense. Conservatives are fine with that. But they don’t want brokers to recommend, at no profit to themselves, certain investments that might match the client’s desire to build a socially responsible portfolio.

I may not assign much faith in capitalism’s ability to save humankind, but I don’t see why corporate America shouldn’t be allowed to at least take a shot at it. Especially when that serves the desires of the consumer. The conservative approach to financial regulation treats consumers with contempt, dismissing their aspirations and thwarting their desires, ironically, in the name of freedom. Protecting consumers is secondary to protecting unethical conflicts of interest, defending the oil and gas industry, and owning the libs. This sort of thinking nicely illustrates the rot that sets in when a political party runs out of ideas.