Donald Trump first achieved national fame in 1987 with a bestselling book titled The Art of the Deal, which created an enduring false impression that Trump was good at making deals. In fact, the secret to Trump’s initial financial success—and also to his many subsequent financial failures—is Trump’s propensity not to make deals, but to break them. A better title would have been The Art of the Stiff.

On Sunday, Trump hinted that the United States might renege on some of the $36.22 trillion that it owes on the national debt. Speaking to reporters Sunday on Air Force One about Elon Musk’s review of government spending, Trump said:

We’re even looking at Treasury. There could be a problem—you’ve been reading about that, with Treasuries, and that could be an interesting problem because it could be that a lot of those things don’t count. In other words, that some of that stuff that we’re finding is very fraudulent, therefore maybe we have less debt than we thought of. Think of that!

“For those not familiar with how financial markets work,” Paul Krugman later explained on BlueSky, “U.S. Treasuries are the ultimate safe asset, used as collateral for everything. Even a hint that some Treasuries might not be honored could bring everything to a screeching halt.”

The bond market did not come to a screeching halt. We didn’t even see an uptick in interest rates (which is how the bond market expresses distress). Trump’s veiled threat not to honor U.S. debt obligations got amazingly little coverage, probably because nobody thought to ask a follow-up question. I’d guess there weren’t any financial reporters present.

Another mitigating circumstance was the Crazy Old Bastard factor. Trump made his unsupported allegation of bond fraud after signing, in front of the cameras, a proclamation declaring February 9 “Gulf of America Day” and telling reporters, “I’m committed to buying and owning Gaza.” It can’t be repeated too often that Trump has been declared by 200 mental health professionals to suffer from a “severe, untreatable personality disorder—malignant narcissism” and also to suffer from cognitive decline. If the markets (or the press) reacted to every crazy thing Trump said they couldn’t function.

On the other hand, Trump is president of the United States, enabling him to follow through on his more unhinged statements, and reneging is a lifelong habit. That’s how he got rich! I don’t mean to minimize the hundreds of millions that Trump received from his father over the years. (At age 3, Trump’s weekly allowance was the equivalent in 2025 dollars of $5,605.) But we’ve seen silver-spooned “bootstrappers” before. What distinguished Trump’s financial success was his well-documented enthusiasm for declining to honor agreements. That also distinguished Trump’s financial failure. Eventually Trump’s reputation caught up with him and most banks refused to do business with the Trump Organization (a prejudice Trump has lately misconstrued as a refusal to do business with conservatives). As I’ve written previously, Trump’s personal finances are in a dangerously precarious state, rendering him highly susceptible to bribery.

As president, Trump judges himself free to ignore any and all preexisting arrangements, from the Constitution to statutes to judicial rulings. Even when Trump himself signs an international treaty like the 2020 United States-Mexico-Canada Agreement, or USMCA, it’s a coin flip whether he’ll honor it. What’s kept financial markets from tanking since January 20 is their conviction, however misplaced, that Trump won’t deliver on his intermittent threats to wreck the economy—that he will renege on reneging. That’s what happened last week when a stock market tumble spooked Trump into withdrawing for 30 days his threatened 25 percent tariffs on Canada and Mexico (which, had he carried them out, would have violated USMCA).

The bond market’s initial reaction to Trump’s comments was to shrug them off. “Trump’s veiled threat is so insane that it won’t happen,” Harvard economist Jason Furman assured me. Politico’s Victoria Guida quoted an administration official saying that Trump was talking about unspecified Treasury payments, not Treasuries, prompting some of the business press (for instance, Bloomberg) to report that Trump’s meaning was unclear. Trump’s meaning was not unclear, and that administration official was lying when he or she said Trump was talking about unspecified Treasury payments. Go back and look at what Trump said. It’s on video, for Christ’s sake. (Fast forward to 21:15.) He said, “Treasuries.” You aren’t imagining things. Your president is not a well man.

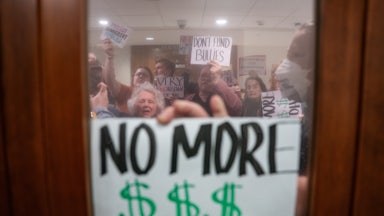

The bond market’s calm won’t last if Trump repeats his threat once or twice more, as he tends to do until he gets a reaction. Or it may react with even greater alarm than expected when Trump and congressional Republicans reveal their deficit-busting tax plan. (The bond market has for some time been freaking out about the budget deficit.) “The political world needs to appreciate the fact that he’s playing with fire that will burn everyone,” MSNBC’s Steve Benen observed Monday. I second that.