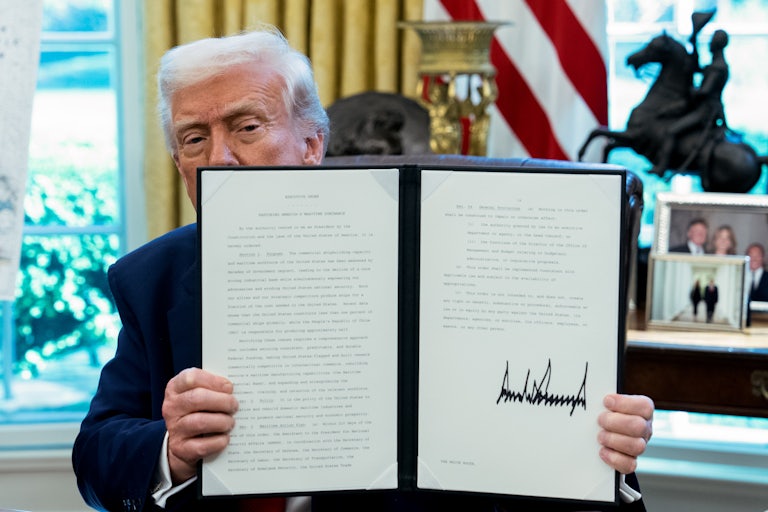

Trump Makes Startling Confession About Takeover of Panama Canal

Donald Trump and Defense Secretary Pete Hegseth are openly talking about U.S. troops in Panama.

At the White House Thursday, Secretary of State Pete Hegseth and Donald Trump admitted that U.S. troops have been deployed to the Panama Canal.

“We’re taking back the canal. China’s had too much influence, Obama and others let them creep in. We along with Panama are pushing them out, Sir,” Hegseth said to Trump at a Cabinet meeting held in front of the press, adding that after his trip to the country earlier this week, President José Raúl Mulino spoke positively of partnering with U.S. troops to get “the Communist Chinese out.”

“We’ve moved a lot of troops to Panama, and, uh, filled up some areas that we used to have, we didn’t have any longer, but we have them now, and I think it’s in very good control, right?” Trump said, turning to Hegseth, who replied, “Yes, Sir.”

HEGSETH: We're taking back the canal

— Aaron Rupar (@atrupar) April 10, 2025

TRUMP: We've moved a lot of troops to Panama pic.twitter.com/FJn00pca9P

The exchange seems to indicate that Trump has moved to control the canal and is working with Panama’s president, despite Trump previously antagonizing the country by expressing the desire to retake it. Hegseth’s visit to Panama earlier this week seemed to calm down tensions between the two countries, with Hegseth acknowledging Panama’s sovereignty over the canal.

But Trump asked the military last month to draw up plans for retaking the canal, meaning that he prefers to have that option on the table. Panama has taken steps to try to appease Trump, making a deal to reimburse U.S. ships for any transit fees for going through the canal, signing a security cooperation agreement, and agreeing to allow U.S. troops to resume jungle warfare training.

Panama has also agreed to end an infrastructure agreement with China and conduct a financial audit of Hong Kong–based CK Hutchison Holdings, which controls ports on the canal’s opposite sides. Whether all of this will be enough to keep Trump happy and allow Panama not to worry about a full U.S. military takeover of the canal remains to be seen.