German scandals are not like other scandals. The bouquet of a classic German scandal contains unmistakable notes: a rabbit-hole impenetrability, the implication of an entire guilt-ridden society, and, most importantly, a sense that the controversy says something essential about Germany as a whole. German scandals are collectivized. They are about a belief in German difference, for good or ill.

The rise and fall of the financial services giant Wirecard is such a scandal. Wirecard, whose products facilitated e-commerce payment transactions, was the rare German startup that seemed primed to become a “global player”—a phrase with special resonance in a country that, despite all evidence to the contrary, still perceives itself as being small-time. The company was founded in 1999, survived the dot-com bubble, began a massive expansion into Asia in the middle of the financial crisis, and, later, began another expansion into the Middle East. Its story was regarded as something of a German miracle, right down to the fact that the sources of its success seemed somewhat mysterious. During an appearance last January, then-CEO Markus Braun, clad in a black turtleneck like a real-life version of Dieter from “Sprockets,” claimed, “I like not to talk too much about technology acronyms,” before rattling off “RFID” and “NFC,” not to mention “artificial intelligence,” “fintech,” and “machine learning.” Wirecard checked every box on the buzzword bingo card.

Starting in the early 2010s, rumblings about fishy accounting practices at Wirecard started to build. Six years ago, the Financial Times reported that the company routinely inflated its assets and the number of transactions it actually handled. After breaking the story, the Financial Times rang the alarm bell again and again, dedicating as many as eight articles a year to new revelations. These articles often caused Wirecard’s stock price to nosedive. Before long, German regulators sprang into action—although not in the way one might have assumed.

BaFin, the Securities and Exchange Commission of Germany, began investigating claims that the revelations were part of a scheme by short sellers looking to manipulate Wirecard’s share price. In 2018, prosecutors in Munich sought an indictment against a financial research service that had reported problems with Wirecard’s accounting practices. In early 2019, prosecutors sought an indictment against Financial Times journalists for stock manipulation. That same February, BaFin banned short sales of Wirecard stock, an unprecedented step.

Meanwhile the evidence against Wirecard kept mounting. As the legal onslaught against the Financial Times ramped up, the paper in March 2019 gleefully published pictures of Wirecard’s “partners” in the Philippines—among them a small suburban home owned by a grandfather who had received precisely one letter from the company and seemed nonplussed by it. Chancellor Angela Merkel nevertheless lobbied for Wirecard’s acquisition of a Chinese rival during a state visit to Beijing in September 2019.

It took until the spring of 2020 for Wirecard to admit that indeed much of its income likely did not exist. Braun resigned and was arrested on charges of fraud and market manipulation. Chief Operating Officer Jan Marsalek was fired in June. He promptly disappeared, probably to Minsk, Belarus, before likely absconding to Russia.

Wirecard was immediately compared to erstwhile Silicon Valley darling Theranos: another Potemkin corporation for the New Gilded Age. But the differences between the two companies are significant. The truth that emerged during the company’s lightning collapse in 2020 was essentially what the Financial Times had laid out in 2015, 2016, 2018, and 2019. Unlike the shroud of secrecy that made Theranos’s deception hard to uncover, this was a scandal that had been hiding in plain sight. German politicians, regulators, and media had simply been unable to see it. As Jürgen Trittin, a former government minister and member of the Green Party, put it to me: “No one wanted to see the emperor was naked.”

After the spell was finally lifted, there was a need in the German media to make this scandal into a verdict about Germany. In an article in Der Spiegel, Stephan-Götz Richter connected the powers of delusion and denial that enabled Wirecard to “the anti-English spirit of late Wilhelminism,” and “a curious mixture of a belief in authority, ésprit de corps, compliance, and lapdog thinking.” Rather than being about the here and now, about individuals and their crimes, the failure of a company most Germans had never heard of was an indictment of all of German history. The collective self-flagellation was, in its own way, as remarkable as the earlier blindness, both of which tell a story about the enduring power of denial in Germany.

The Wirecard scandal is less about some charismatic confidence men and the system they bent to their advantage than about the system itself. (Indeed, the personal magnetism of Marsalek and Braun was so faint as to be nearly undetectable.) The German economic system tends to socialize scandals, partly because major companies are incorporated into a broader fabric. Before the 1990s, this system was known as “Deutschland AG,” as though the entire country were one big conglomerate.

Deutschland AG emerged from the supercharged growth of the immediate postwar era. Individuals sat on multiple boards, individual companies owned controlling stakes in one another, and bankers sat on the boards of companies they had invested in. In order to build broad political consensus, the government and unions had their seat at the table as well. Intended as a safeguard against the ravages of global competition, the system has frayed as globalization has grown more entrenched. But the basic idea—coopting all the stakeholders within a corporation’s governance structure—has remained.

One unintended consequence: Outside checks on these companies often come from outside Germany. The big scandals of recent years—which in addition to Wirecard included the Volkswagen emissions scandal and Deutsche Bank’s persistent involvement with Russian money laundering—were uncovered by the Financial Times, Californian regulators, and European Union watchdogs, respectively. They could, and often were, explained away as foreign interference and trade wars in disguise.

As Wirecard collapsed, new plotlines and villains emerged every day. The media narrative in Germany became murky. There was missing money in the Philippines and a shady businessman in Singapore. There was Marsalek’s flight, and his possible connection to the regime in Minsk and to the Russian Federal Security Service. There were the failures of Ernst & Young, the London-based accounting firm that had signed off on Wirecard’s fictions year after year. As the story broke, the suggestion seemed to be that Wirecard had been itself the victim of fraud.

It’s striking the way all these subplots led away from Germany. The idea of naïve home-grown companies being chewed up in the inclement waters of the global marketplace has an immediate and intuitive appeal in Germany, going back to the Second Empire of 1871 to 1918. Back then, German companies believed themselves to be venturing into an emerging world market created by the English and French and set up to favor their rivals in many ways. This fear helped push the Empire into its calamitous colonial ventures and obsessive fleet-building, and its loose-cannon leader, Kaiser Wilhelm II, into a never-ending string of international incidents.

When Deutsche Bank turned out to be up to its eyeballs in corruption and blood money—whether from various Putin cronies, the Trumps, or Jeffrey Epstein—this view still had a limited degree of plausibility. You could feasibly chalk up the bank’s missteps to an unfamiliarity with the global marketplace that the comparatively staid institution was desperate to join. But in the case of Wirecard it became clear that the global marketplace only ever existed virtually: Wirecard’s fraud had some victims in Abu Dhabi and Singapore, but mostly it seems to have used phony transactions in Abu Dhabi and Singapore to defraud a hometown audience.

If suspicion of a hostile outside world helped blind German authorities to the fraud at Wirecard, so did a desire to join that world. Global leadership has become an obsession in Germany, and this obsession has lent itself to a particular kind of low-grade scam: one that simulates worldly sophistication for a hometown crowd.

Der Spiegel journalist Claas Relotius published blockbuster reports about Trump’s America that were full of fabrications and screaming inaccuracies. German academics, politicians, and corporate leaders often claim to have “attended” famous global universities, when in fact they held little more than a library card there. Current European Commission President Ursula von der Leyen, for example, got in some hot water in 2015 for having claimed she studied at Stanford, when in fact she appears to have sat in on a few classes. Wirecard exploited this mix of interconnectedness and provincialism. It made its “profits” in this no-man’s-land of phony globalization, and the country’s press and regulators seemed unsuited to call the company out on it, because plenty of them make their home in that same zone.

No single figure embodies this peculiar tendency better than Karl-Theodor zu Guttenberg, who not only perfected the German con but also plays a prominent role in the Wirecard saga. A handsome man of aristocratic lineage, zu Guttenberg, at just 37 years old, became economy and technology minister in 2009, as a member of the Christian Socialist Union (the Bavarian sister party of Merkel’s ruling Christian Democratic Union). Zu Guttenberg became defense minister later that year. And then, after a year and a half on the job, he was pressured to resign.

Zu Guttenberg’s career mixed academic honors (he studied law, and attained a doctorate at the University of Bayreuth in 2007) and positions in various companies with a rapid rise through the ranks of the CSU. But there was something deeply threadbare about these accomplishments: Members of the various boards he sat on couldn’t remember him really having done anything on them, supposed jobs turned out to be brief internships, and the companies he claimed to have run were simply a family trust. Rhetorically, zu Guttenberg served up highly academic-sounding word-soufflés that collapsed under any amount of scrutiny. (He infamously called himself a “zoon politikon,” or political animal, a term reserved by Aristotle for ... every human being.)

It surely says something about this deeply German breed of confidence man that it was zu Guttenberg’s dissertation that eventually did him in. In February 2011, a law professor charged that it contained passages taken verbatim and without attribution from several newspaper articles and academic publications. Before long, a group of volunteer plagiarism detectives began combing through his work, and what they found was staggering. He had plagiarized from newspapers, standard academic works, and the Bundestag’s own research staff. “That became his downfall,” said Jürgen Trittin, who famously lambasted zu Guttenberg as a fraud on the floor of the Bundestag in 2011. The members of parliament, including those of zu Guttenberg’s party, “regarded those researchers as their brain trust in juridical questions, and very much worth protecting—and he had misused them.”

Zu Guttenberg’s denials sounded deeply convincing and emphatic, and every grotesque turn of the affair seemed to take him by complete surprise—almost as if someone else had written the dissertation for him.

In the absence of actual intellectual heft, what zu Guttenberg had down pat was a performance of worldliness for an audience willing to take him at face value. This probably explains why, after his career in politics ended, he moved to the United States, where he took on a sinecure literally called “Distinguished Statesman” at a think tank. He served as a consultant on internet strategy for the European Commission, founded an “investment and advisory” firm called Spitzberg Partners, consulted with Lufthansa on matters of “innovation.” Still, his new life in the McKinseysphere managed to implicate him in another scandal. Because among the client list of his firm was none other than Wirecard.

This may be the most bizarre aspect of the Wirecard scandal: the fact that, in the middle of a massive fraud investigation, someone talked Angela Merkel into shilling for the embattled company in Beijing. And that someone seems to have been zu Guttenberg. “Why would Merkel have believed zu Guttenberg, a proven liar?” the sociologist Oliver Nachtwey wondered. The answer appears to be that, just as Wirecard simulated a global presence to bilk German investors, zu Guttenberg simulated worldliness to pull the wool over the eyes of German politicians, voters, and journalists. No wonder the two found each other.

One factor that does not bind the remnants of Deutschland AG together is a revolving door between government and politics. Zu Guttenberg’s rocky post-politics transition is symptomatic of a system in which politicians cannot count on a plum gig in the companies they once regulated. This is of course a good thing, but it does have unintended consequences. German politicians rise slowly and tortuously through the ranks of their respective party machines. If they leave the political arena (which, given that German parties are absolute snake pits, they frequently do), they have a hard time landing another job. Only very rarely do they go to work for corporations.

“The spheres are actually surprisingly separate,” says Nachtwey, “which results in the fact that both sides have inferiority complexes vis-à-vis the other.” There is an almost desperate readiness to be taken in by a flashy performance from the other side.

In recent years, these two groups have chosen to converge on the cult of the “global player,” an English phrase that has become something of a mantra in German. That’s because it gets at a central paradox of German economics in the age of globalization. “Germany is the world champion in exporting,” Nachtwey says. “But it is painfully conscious of how small it is.” German companies are acutely aware of the big world beyond its borders, and are susceptible to a sense that whatever lurks out there isn’t altogether friendly.

Regulators thus often function more as cheerleaders for the companies they regulate. Politicians are intimately involved with the industries they are charged with overseeing. And even though Germany’s political parties have very different outlooks on governance and the economy, different regimes have done little to change these practices. “German business elites think of themselves as ordoliberal,” Nachtwey says, that is to say they acknowledge the need for state intervention in keeping the market fair and free. “But de facto they do not act ordoliberally.” There is an “omertà,” as he describes it, between politicians and managers, union bosses and financiers.

This arrangement disperses graft within the system, with no one having an interest in pointing out corruption until it has attained truly outlandish proportions. Straightforward political graft is usually exceedingly unambitious. As incensed as many were about zu Guttenberg, it’s remarkable that he ended up losing his job over citational practices. Other major scandals that toppled major politicians over the last 30 years include a free stay in a friend’s hotel for a night, a favorable loan, or shoddy accounting on the use of the ministerial car. The Trump Cabinet would have called that a Monday.

Germany’s truly major scandals benefit companies, not politicians. Take, for example, Germany’s recent attempt at introducing a toll system on the autobahn that only applied to non-Germans, which was predictably nixed by the EU courts. The minister who had spearheaded the project had signed deals with various contractors before knowing whether the toll system would ever happen, which—again, predictably—caused a massive hole in the government’s coffers and made some companies very rich. But it doesn’t seem like he personally profited, and he remains in office.

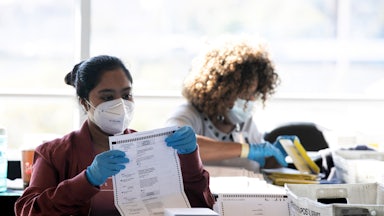

In early March, the CDU and CSU parties were asking members to resign who had participated in a bribery scheme involving shady mask deals during the early days of the Covid-19 pandemic. Deputy group leader Gitta Connemann insisted that the purge should exclude members of the party who “simply did their jobs and created connections, without enriching themselves.” Grifting for yourself is a mortal sin. Grifting for the Standort (German for a place to do business) is comparatively excusable.

That’s because the Standort has become a stand-in for a national pride that dare not speak its name. The phrase “made in Germany” was first established in 1887 in the United Kingdom to make visible shoddy German knock-offs of British wares. German manufacturers, like the British legislators, treated it as a mark of shame, with German companies placing the label in areas where it would be unlikely or impossible to spot. But even before the First World War, the stigma had become a badge of pride, and after the end of the Second World War, it became something even more important: the only possible vehicle for German power politics.

After the Second World War, German national pride was in tatters. It improved through the power of German industry and the mighty Deutschmark. The German economy became a seductive stand-in for explicit nationalism. Before long, Germans could show their face again as heralds of Bosch dishwashers and Volkswagen beetles, rather than spiked helmets and jackboots.

One result, the sociologist Oliver Decker has proposed, was a “secondary authoritarianism,” less focused on leaders or national greatness than on the economy and representative businesses. “This secondary authority,” Decker and his co-authors write, “can, like the primary kind, demand that the individual sacrifice their own wishes and life projects, and as compensation it offers the promise of a proximate participation in its power.” During the economic miracle of the postwar years, many Germans identified with “the economy” and its visible icons: its profitable corporations, its immense trade surpluses, its powerful currency.

During this transfer, German politics retained an old paranoid thinking about the economy. Just as German nationalism after World War I had its “stab in the back” myth to explain how the German army had lost the Great War, so postwar Germans tend to see secret plots to stymie their obviously superior economic power whenever their companies are found to have violated international norms. Nachtwey, who briefly worked with Volkswagen in the wake of the company’s notorious emissions scandals, says that even as managers were going to jail and the lawsuits piled up, higher-ups “talked privately about how all of this was just an element to weaken V.W. in the U.S., because we’re too strong.”

It is really quite striking: a

country that, for historical reasons, diligently declines to treat itself as a

victim in its political discourse always seems ready to do exactly that when it comes to the economy.

An over-identification with something so nebulous as “the economy” can easily become a trap. It sustains you in good times, but what happens when what you identify with is found to be a fraud? If the pride certain segments of Germany take in individual companies or sectors of the economy is maybe more extreme than it would be in other countries, the same is true for the feelings of shame and humiliation when companies fall behind their competition or, worst of all, go bust. This is already happening with Wirecard. As Götz Richter wrote in Der Spiegel, “We [Germans] have to be aware of the fact that this systemic failure puts us in the pillory as a nation—and rightfully so.” When scandal happens, the country seems less interested in figuring out who exactly did what than in letting the old reflexes of collective guilt kick in.

The “global player” is enticing for Germany because it is ultimately utopian. Germany would like to have its own Uber, its own Amazon, its own Google. Wirecard promised German media and politicians exactly that. But in order to have companies of this kind, it would have to dismantle the regulatory apparatus that German unions and politicians have fought to create over the course of more than a century. A scandal like Wirecard is powered by the dream that you could have an Uber without slashing workers’ protection—that one could hold on to what remains of the German social market economy while at the same time going all-in on laissez-faire capitalism.

Similarly, German politicians have long suggested that the country needs to have “elite” universities, which seems to mean its own Harvards and Stanfords. The shininess of the great American models is premised on absurd student debt, on universities turning themselves into some mix of tax shelter and investment bank, and on the education system essentially laundering donor money unleashed by regressive tax schemes. German politics harbors the fantasy of having Harvard without all of the ravages that make Harvard possible, because it suggests a version of globalization without any of the drawbacks.

The Wirecard scandal could be depicted as an example of global neoliberalism run amok. But it might actually be about a country that is less neoliberal than it would like to be—that has talked itself into believing that dismantling the regulatory state and the welfare state are a good idea but can’t get itself to actually do it. A country obsessed with being a global player, but ultimately far more comfortable in its provincialism than it cares to admit.