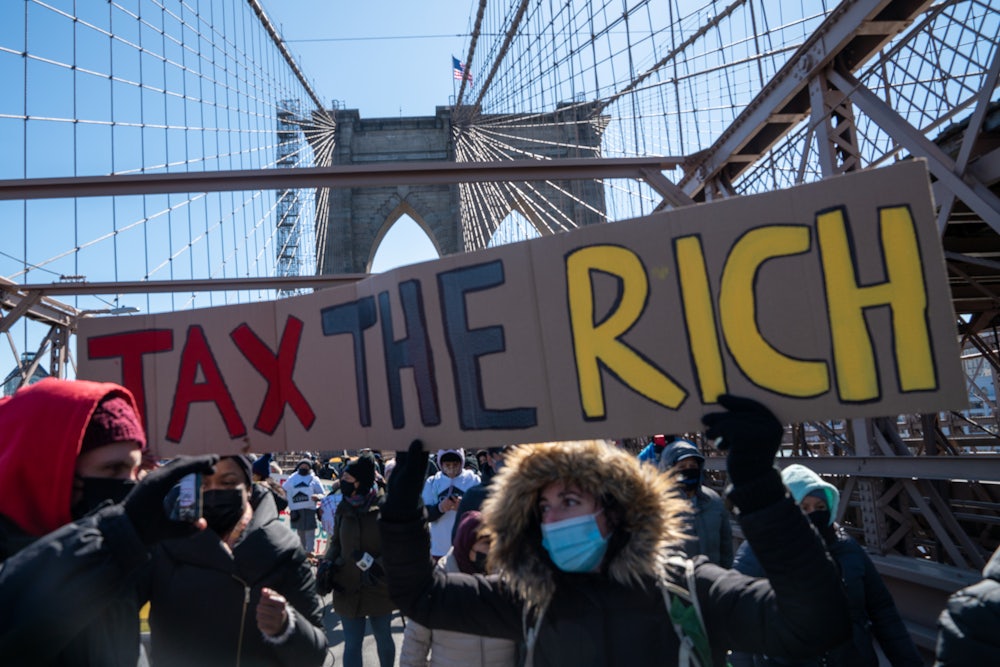

As one of those rich guys who will pay boatloads of higher taxes under President Biden’s plan, I have one thing to say to Congress: Do it! Passing this legislation is the most significant step you can take toward economic prosperity.

It drives me crazy when I hear Democrats say that “for the sake of the economy” we have to cut back on the $3.5 trillion spending in Biden’s Build Back Better legislation, or that we can’t possibly raise taxes on the wealthy and huge corporations as much as Biden proposed. Those folks have it totally backward. Taxing the rich is the only plan that would increase investment, boost productivity, grow the economy, and create more and better jobs.

As I’ve written before (and here and here too), “Raise taxes on the rich, and almost anything the federal government does with the revenue will pump more money through the economy than what the wealthy are doing with our hoarded cash today. Tax the rich to put money back in the hands of the American people through middle-class tax cuts, and corporations will expand production and payrolls to meet the resulting spike in consumer demand. Tax the rich to invest in roads, transit, bridges, health care, schools, and to transition to a green energy economy, and we will create millions of good-paying jobs while building the physical and human infrastructure on which our collective prosperity relies.”

But Biden’s Build Back Better plan is far from “almost anything.” It uses the money raised from a modest increase in taxes on big business and zillionaires like me to create the foundation for broad-based prosperity in the twenty-first century. First, it invests in the capacity of our people to realize their highest potential by making raising children more affordable and extending free public education from preschool through the first two years of college. Second, it meaningfully tackles climate change, the biggest long-term threat to our economy. And third, by lowering the cost of health care and providing paid family and medical leave, it puts more money in the pockets of working Americans to spend in their communities.

By now, this should be common sense, but unfortunately some Democrats in Congress—and every Republican—still cling to the failed trickle-down theory that giving money to the rich and big corporations translates into economic growth and prosperity. But the problem with today’s economy isn’t that rich people like me don’t have enough capital to invest; it’s that we’re not productively investing the glut of capital we already have. We’d have far higher levels of economic growth today if trickle-down policies hadn’t taken $42,000 a year in wages from the average American and given that money to the wealthiest 1 percent. When ordinary Americans get more money, they spend it in their local communities, thereby creating jobs through increased consumer demand. When rich people like me get that money instead, we hoard it.

And though we didn’t need another lesson about how giving corporations more tax breaks just makes CEOs and wealthy shareholders richer, we got it when the 2017 GOP tax cuts led to corporations spending $927 billion buying back their stocks. Put another way, when handed almost a trillion dollars in tax breaks, corporations chose to enrich their own executives and shareholders, rather than make new investments in products or higher wages for their employees. Corporate taxes are now at record lows as a share of federal revenues and of the economy.

Only inside the Beltway is this even a debate. By now the public, including Republicans, understand that raising taxes on the rich is good for the economy. There is strong bipartisan support not only for the spending provisions in the BBB but also for its tax hikes on the wealthy and corporations. But somehow—campaign cash maybe?—the faded allure of trickle-down economics still has a hold on some Democrats in Congress.

So, no: $3.5 trillion in tax hikes over the next decade for my fellow plutocrats and CEOs isn’t too much. If anything, it’s too little. Democrats who are pushing to lower that number or who are shying away from raising my taxes are sabotaging an economy that will deliver broad-based prosperity for years to come. They need to pass both the reconciliation and the infrastructure bills ASAP and stop this nonsense. And if they don’t, well, as I tweeted the other day, they’d better lose my phone number and stop calling for donations.