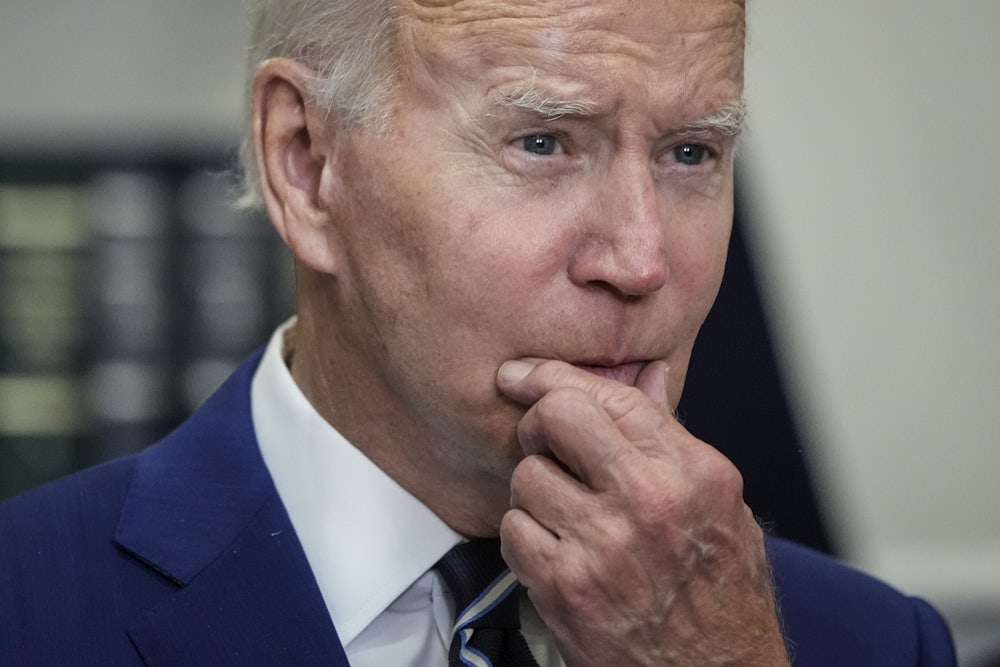

On Wednesday, Joe Biden called on Congress to enact a three-month pause in the gas tax, a “holiday” that would result in an 18 cent savings on every gallon of gasoline. He called on states to waive their own gas taxes, as well, and for oil companies to refine more oil. “I promise you,” he said, “I’m doing everything possible to bring the price of energy down.”

Nobody seemed to like it. Not just Biden’s Republican opposition but also climate activists, centrist wonks, and even members of Biden’s own administration have pointed out issues with this plan. Nancy Pelosi hasn’t agreed to bring a measure to the vote in the House, and it’s unlikely to get the votes needed to pass in either chamber. So why did Biden announce this improbable plan to begin with?

For months now, the White House has groped around for a coherent message on gas prices and what to do about them. Members of the administration have alternately blamed “Putin’s price hike” and price gouging by U.S.-based fossil fuel corporations and oil refineries. They’ve maintained that it’s the Federal Reserve’s job to bring down inflation, yet even Fed Chair Jerome Powell has conceded that the Fed has little control over one of inflation’s key drivers—prices at the pump.

All this makes the administration’s probably impotent push for a gas tax holiday even more confusing: The current gas tax is levied on refiners, who can choose to pass it on to consumers in whatever amount they choose. With hard limits on how much oil can be produced and refined in the short run, a gas tax holiday may well increase fuel demand and put more pressure on already stretched supplies of refined fuels. Given that Biden just last week called high oil company profits in wartime “unacceptable,” it’s weird that he’s now pushing a policy likely to drive those profits even higher.

It’s hard to know exactly what’s driving Biden’s decisions these days, and tempting to place all the blame on a bad comms strategy. But the problems probably run deeper.

The White House’s definition of “everything possible to bring the price of energy down” is strangely limited. As I wrote last week, Biden’s half-hearted denunciation of oil industry profits hasn’t been accompanied by any threats of actual action, like state intervention in refinery operations or even support for a windfall tax on profits. And the White House has been noticeably reticent so far to discuss some of the easiest and most direct policies for helping ease consumers’ pain: reducing demand for oil by expanding noncar transit use and other policies that could reduce gallons burned and time behind the wheel. These and more sweeping changes could improve quality of life for millions. One key constituency’s opposed, though: oil companies themselves, whose main worry about high gas prices is that they’ll start to cut into gas demand. In response to Biden’s letter to refiners last week, Chevron CEO Mike Wirth chided the administration for its frankly minimal steps toward more constrained energy use in transportation. “We live in a world,” Wirth said, where “the stated policy of the U.S. government is to reduce demand for the products that refiners produce,” citing fuel efficiency standards. Like nearly all of his colleagues, Wirth also just wants Biden to say nicer things about the industry.

So far the biggest defender of the gas tax holiday—who’s also downplaying demand reduction—has been State Department energy adviser Amos Hochstein, the former fossil fuel executive and longtime Biden confidant on all things oil and gas. Speaking with Bloomberg Thursday, Hochstein said the administration was doing it all it could on that front through the bipartisan infrastructure law’s $210 billion in spending for mass transit. “We’d like to put the investments to work. That’s what President Biden has been offering all along,” he said. Notably, just 20 percent of the bipartisan infrastructure bill’s spending on transportation—the single biggest source of U.S. greenhouse gas emissions—is for mass transit. The rest is for highways, meaning the bill could actually raise emissions.

Hochstein isn’t wrong about mass transit being a great way to reduce oil demand, of course. But there’s also much lower hanging fruit that the White House has so far ignored. In a report for the Center for Public Enterprise, Paul E. Williams, Yakov Feygin, and Chirag Lala suggest much faster-acting ways to reduce oil dependence: a fare holiday for buses and trains; helping transit infrastructure get built faster; encouraging work from home and car pools; and a national speed limit.

It’s not just the former fossil fuel executives in the administration who are wary of policies reducing oil and gas use: Decades of folk wisdom in the Democratic party holds that any talk of reducing fuel use is political suicide—that Jimmy Carter’s greatest political gaffe was telling Americans to put on a sweater. In reality, it was the Nixon administration that passed the most sweeping demand-reduction policies. In 1973, Nixon called for “the full cooperation of all the American people in sacrificing a little so that no one must endure real hardship.” Carter’s speech was popular at the time, leading, as Rick Perlstein points out in Reaganland, to an 11 percent bump in approval ratings. But people weren’t wild about the person Carter nominated to lead the Fed intentionally triggering a recession in the lead-up to Election Day. Reagan campaigned explicitly against it, and won.

Biden risks learning the wrong lessons from that time. Nearly half a century later, any talk of reducing oil demand remains a third rail for Democrats fearful of looking like out-of-touch austerians. Ironically, raising interest rates that wind up throwing millions out of work—hoping they’ll buy less gas as a result—is firmly on the table, as the Fed’s recent actions have shown. If he wants to deal with either gas prices or greenhouse emissions, Biden will at some point have to do something fossil fuel executives do not like. The good news is they already hate him and there’s probably not much he can do about that. The dead-end gas tax holiday doesn’t change any of those fundamental truths.