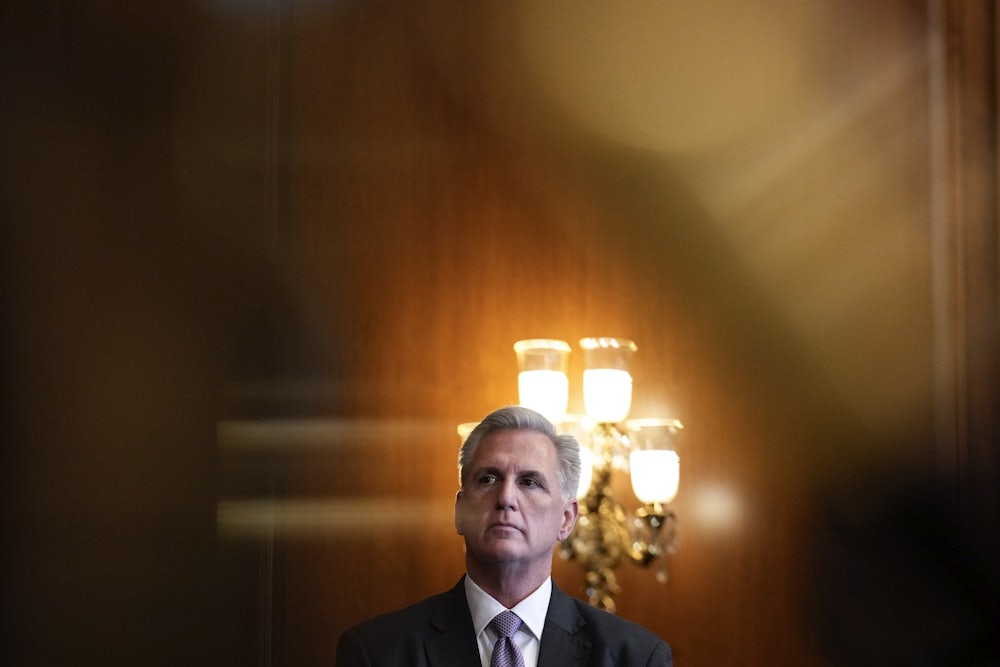

Congressional Republicans say they’re resisting an increase to the debt ceiling because government spending is out of control. “Before we borrow another dime,” House Speaker Kevin McCarthy said last month, “we owe it to our children to save money everywhere.” But McCarthy’s claim that all his party wants to do is bring down government spending isn’t entirely true.

Granted, it is true that the bill would, according to the Congressional Budget Office, or CBO, reduce projected deficits by $4.8 trillion over 10 years. Doing that would necessitate, next year, a 27 percent cut in discretionary spending, according to the Center on Budget and Policy Priorities. That’s assuming, as everyone does, that congressional Republicans will never apply these across-the-board spending cuts to the Pentagon. McCarthy blows a gasket every time President Joe Biden points out that his plan would require a severe reduction in veterans’ benefits. But as the Center on Budget and Policy Priorities pointed out, if McCarthy intends not to cut funding for the Veterans Administration, then discretionary spending on all other domestic programs next year will have to be cut not 27 percent but 33 percent.

It’s sheer fantasy to conceive that you can cut spending by anything close to this magnitude without doing severe damage to government functions and creating a public uproar. Even the tough-talking Freedom Caucus would never allow it to happen. McCarthy’s debt limit bill is a bluff that, as I’ve noted before, wouldn’t have won support from his own caucus without McCarthy’s assurance that the bill would never, ever become law.

But that isn’t what I invite you to think about today. Instead, let’s review how the GOP’s negotiating stance on the debt ceiling increases rather than decreases government spending.

Start with the debt limit bill itself. Democratic Senator Sheldon Whitehouse of Rhode Island tweeted last week that 275 of the 317 pages of McCarthy’s debt limit bill are “devoted to giveaways to the fossil fuel industry.” For example, the bill would reduce royalty rates for drilling on federal land. The combined cost of these giveaways, according to the CBO, is $430 million.

The debt limit bill would also claw back $71 billion of the $80 billion Congress included in last year’s climate bill to boost funding for the IRS. That sounds like a spending cut, but rescinding that increase would cost the federal government $186 billion in lost tax revenue over the next decade, according to CBO, netting out to a cost of $115 billion.

You may protest that the previous two calculations are speculation. If the debt ceiling bill’s pledge to cut discretionary spending next year by 27 or 33 percent is a bluff, isn’t that same bill’s pledge to bloat the deficit by $115.4 billion also a bluff? Sure, OK. But congressional Republicans say they’re fighting Biden on the debt ceiling (“We owe it to our children”) because they want to halt runaway spending. That renders glaringly hypocritical individual examples where they propose spending increases. We do not “owe it to our children” to charge oil companies less for leases on federal land or to enable tax cheating by the rich.

Even setting aside McCarthy’s debt ceiling bill, don’t kid yourself that Republican intransigence on the debt ceiling is cost-free. The statutory debt ceiling of $31.4 trillion was actually reached way back on January 19. The only reason the United States didn’t go into default then was that the Treasury used the same “extraordinary measures” (i.e., accounting gimmicks) that it deployed during similarly dangerous debt limit games of chicken that congressional Republicans chose to play in 2011 and 2013. Republicans like to point out that congressional Democrats have used the debt limit to extract concessions from Republican presidents. That’s true. But only Republicans resort to full-on extortion that puts the country at serious risk of default. In 2011, when the GOP played a similar game, it managed to lower Standard & Poor’s credit rating for U.S. Treasury bills.

You’ve probably got some experience taking extraordinary measures in your own financial life. You can’t afford to pay all your bills this month, so you look them over and decide which to defer. That incurs a small penalty you’ll have to pay on your next bill. Or you pay only the minimum on your credit card and leave the remainder for next month, or the month after that. That incurs a bigger penalty. To employ these tricks is economically unwise because you end up spending more money. But your cash flow leaves you no alternative.

The federal budget operates on the same principle. When money is suddenly tight, either because of a government shutdown or because of a debt limit standoff, Uncle Sam does what you do: He calculates which bills to pay now and which bills to pay later. Only instead of shorting the gas bill or the electric bill or the Visa bill, he skips contributions to retirement funds for civil servants and postal workers and he suspends the issuing of certain securities.

Some question has been raised about whether this is entirely legit. Last week I wrote about an ingenious lawsuit brought by the National Association of Government Employees, or NAGE, arguing that any planning the Treasury undertakes for a possible default violates the Constitution because only Congress has power of the purse. NAGE has standing to sue because its own members’ pensions are getting shorted during the current round of “extraordinary measures.”

The federal government’s extraordinary measures will soon be all used up, possibly as early as June 1. At that point, the cost of Republican intransigence will be an economic recession, and that’s if we’re lucky. A protracted default would, according to the White House, push unemployment near or beyond 10 percent in the next quarter and cause a drop in gross domestic product of more than 6 percent. Even a brief default could lower the yield on Treasury bills by $750 billion over the next decade, according to economists Wendy Edelberg and Louise Sheiner, writing for the Brookings Institution. That’s all speculation, because the United States has never experienced an across-the-board economic default before. The real cost is, “You don’t want to find out.”

None of this can be news to anybody besides that notorious deadbeat Donald Trump, who said of a possible default last week in his CNN town hall, “Maybe it’s—you have a bad week or a bad day.” Almost nobody of either major political party would agree with that trivializing statement.

But let’s get back to the cost not of outright default but of those “extraordinary measures” that an intransigent GOP has, since January, forced on the Biden administration. According to the White House, yields on Treasury bills have already been pushed up, increasing the cost of government borrowing, and credit default swap spreads (i.e., insurance premiums on U.S. debt) have nearly doubled over the past month.

It will be awhile before we have official numbers on what the extraordinary measures are costing the federal government. But a 2017 paper by four economists at the Federal Reserve concluded that these same accounting tricks cost the federal government $260 million in 2011 and $230 million in 2013 due to rising yields on Treasury bills. Let’s split the difference and set the price of extraordinary measures, conservatively, at $245 million in 2012. Eleven subsequent years of inflation increase that cost to $328 million.

GOP giveaways in the debt limit bill total $115.4 billion. Add in the $328 million we’re spending on extraordinary measures, and congressional Republicans’ holy war on government spending increases the federal deficit by nearly $116 billion. That means McCarthy will have to commit Biden to about $116 billion in budget cuts just to break even on what his bill proposes to spend plus what his theatrics have already cost the U.S. taxpayer.

If you prefer to calculate, more conservatively, based on the tab McCarthy has run up already, then that tab is $328 million. That may not sound like much in a federal budget that exceeds $6 trillion. But it ain’t nothing. It’s nearly four times what Biden proposes to spend next year to support state and local fair housing enforcement organizations.

It’s only slightly less than what Biden proposes to invest in the industry-led Registered Apprenticeship program. It’s about twice what Biden proposes next year in grants from the National Endowment of the Arts, and indeed one-third larger than NEA’s entire proposed budget for next year. It represents most of the $495 million Biden requested for the Peace Corps. It’s nearly four times the $87 million that the federal government will send this year to Mississippi, the poorest state in the union, for Temporary Assistance for Needy Families, the federal government’s cash-welfare program (and it’s anybody’s guess how much of that will get to benefit recipients, given recent pretty outrageous scandals surrounding Mississippi’s allocation of those funds).

If a Republican member of Congress figured out how to cut $328 million from the federal budget, he’d send out a press release, right? But no Republican is going to send out a press release saying we could have saved $328 million had McCarthy not pissed it away refusing to let Congress pay its bills.