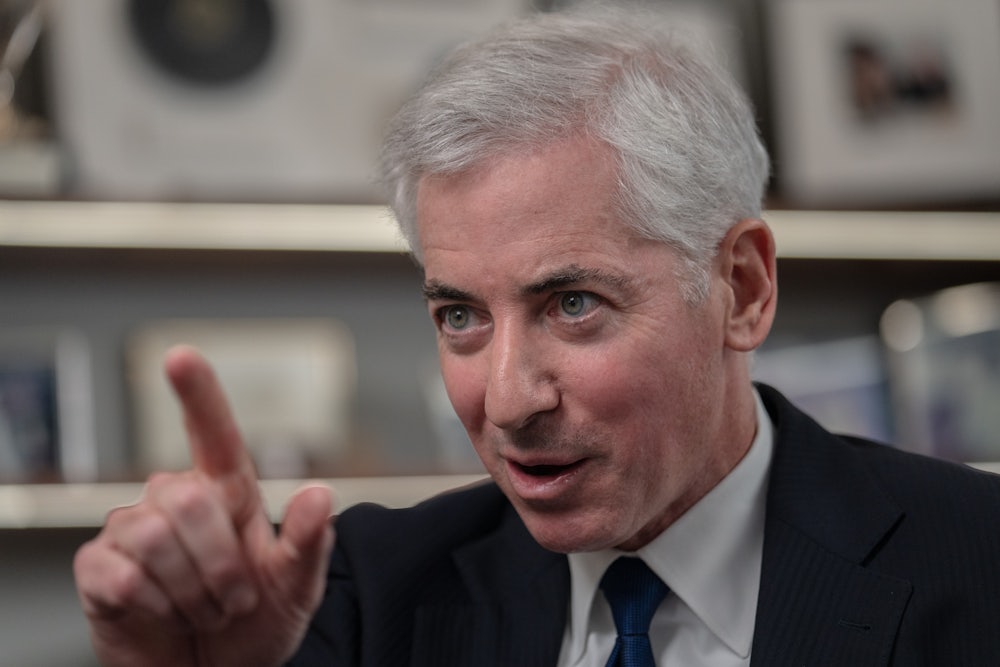

Bill Ackman, chief executive of the giant hedge fund Pershing Square Capital Management, is getting a lot of bad press right now for his vicious campaign against Harvard president Claudine Gay, and deservedly so. He’s just about the perfect example of a particular social type: the plutocrat who thinks that being very rich entitles him to run more or less everything.

The United States is populated with many more such preening oligarchs than it was 30 or 40 years ago, because income and wealth are now much more concentrated at the very top. The most stupendously arrogant of them tend to emanate from tech (see Musk, Elon). The Princeton historian David Bell, in a thought-provoking recent essay in Liberties on “The Triumph of Anti-Politics,” judged the Silicon Valley technocrats even more dangerous to democracy than Trumpian MAGA-heads. But Ackman shows that Wall Street financiers are no slouches at this oligarchy game. His particular megalomania arises, I believe, from an unwholesome influence over the bond market, as demonstrated by its weird zigzag behavior over the past four months.

Our story begins with the Hamas massacre of unarmed Israeli civilians on October 7. Some Harvard undergraduates immediately fired off a foolish and offensive letter that held Israel “entirely responsible for all unfolding violence.” Ackman, a Harvard alumnus who is Jewish and married to the prominent Israeli architect Neri Oxman, initiated a nasty campaign to blackball all members of the student groups that signed the letter. In a post on X, Ackman demanded that their names be released publicly “so as to insure that none of us inadvertently hire any of their members.”

The expression “pick on somebody your own size” has never been more salient. Ackman, age 57, is worth a reported $3.9 billion, and he’s given Harvard tens of millions over the years, including $25 million in 2014. He has nearly one million followers on X. Many of the kids Ackman was trying to ostracize were teenagers. They have a right to express their opinions. After Ackman’s tweet, the right-wing nonprofit Accuracy in Media hired a “doxxing truck” to cruise through Harvard Square billboarding the names of these students. This is harassment, pure and simple.

Next, Ackman set about trying to get Gay fired, suggesting in one notably ugly X post that she got the nod because she was Black (“it is … not good for those awarded the office of president who find themselves in a role that they would likely not have obtained were it not for a fat finger on the scale”). Granted, Gay didn’t cover herself in glory last week at a hearing of the House Education and Labor Committee, where she and the presidents of MIT and the University of Pennsylvania were grilled by Representative Elise Stefanik, Republican of New York, about their universities’ policies concerning antisemitism. All three presidents got tangled up in legalities about their respective speech codes, which obviously need rethinking.

But Ackman’s December 10 letter to Harvard’s governing boards of directors accusing Gray of doing “more damage to the reputation of Harvard University than any individual in our nearly 500-year history” was unhinged. For the record, the worst Harvard president in history was A. Lawrence Lowell (1909–1933), who evicted Black students from Harvard dorms, imposed a quota on Jewish students, convened a “secret court” that ejected eight students for homosexuality, and then, for good measure, chaired a three-person Massachusetts state committee that passed up an opportunity to recommend clemency in the murder convictions of Nicola Sacco and Bartolomeo Vanzetti (despite evidence of outrageous judicial infractions by Judge Webster Thayer and the two anarchists’ near-certain innocence), sending Sacco and Vanzetti to the electric chair.

But I digress.

Gay is still new at her job—she was appointed just five months ago—and the prospect that the country’s oldest university might fire its president to pacify Ackman and a few other rich donors (as the University of Pennsylvania, sadly, did last week under parallel circumstances, prompting Ackman to tweet, “One down”) was repugnant. Happily, Gay dodged a bullet. Harvard’s governing body announced Monday that she would remain at her job.

Ackman’s temper tantrums have not gone unnoticed. I wrote about his blackballing tweet in October. This week, a Wall Street Journal headline flagged “Bill Ackman’s Ruthless Quest to Oust College Presidents.” “Bill Ackman’s Campaign Against Harvard Follows Years of Resentment,” reported a New York Times headline. “Bill Ackman Says Harvard Squandered His Donation, but Denies Resentment,” clarified Bloomberg, tongue firmly in cheek. According to the Times story, Ackman is “privately steamed” that Harvard “brushed off his suggestions for how to set up a testing lab to get students and staff back to campus during the pandemic.” He also reportedly threatened two years ago to quit donating because the university wouldn’t heed his investment advice, sending off “a series of fiery letters to Harvard administrators questioning their financial acumen.” (“Fiery” is newspaper code for “completely nuts.”)

“I have held no resentment toward Harvard ever,” Ackman replied Tuesday on X. “And I have none now.” Ackman then related in mind-numbing (but not resentful!) detail the story of the investment dustup.

You might ask: Why would a valiant warrior against antisemitism maintain an account on X? I quit the place back in April because I couldn’t stomach Musk’s rantings. Many of these rants were so antisemitic that advertisers eventually started departing in droves. Disney, Lionsgate, Paramount Global (which owns CBS), Apple, Walmart, IBM—they all said goodbye. Not Ackman. Musk’s first response to the advertiser exodus was to apologize; his second was to tell those who took offense to “Go fuck yourself,” prompting a bizarre defense from Ackman. “Musk is a free speech absolutist,” Ackman wrote, “which I respect. I think that he is entirely correct that he and @X are treated unfairly by advertisers.” Ackman then ventured a tortured defense of one of Musks’s antisemitic tweets, ignoring various others.

Why would Ackman do this? One interlocutor on X pointed out that Pershing Square invested $10 million in X back when it was Twitter, but that’s pocket change to Ackman, and anyway, that money is long gone. I think Ackman defends Musk and stays on X because the site has been Ackman’s tool lately for controlling the bond market. The totality of Ackman’s control in that realm—The Washington Post has called him the “big, bad alpha wolf” of hedge funds—explains why Ackman thinks he ought to run Harvard and pretty much the whole world.

Let’s talk about the bond market. As recently as October it was in terrible shape. Bond traders were dumping so many Treasuries that 10-year bond yields rose to 16-year highs. The prevailing view was that it had something to do with the budget deficit. But two months later, Hanukkah candles are burning, Eartha Kitt is singing “Santa Baby” on the radio—and the bond market has recovered. On Wednesday, 10-year Treasury bond yields dropped 11 basis points down to 4.098 percent, their lowest level since September, on news of a reduced 2.4 percent inflation forecast for 2024 from the Fed, down from the previous 2.6 percent.

Just to be clear, a drop in Treasury bond yields, at least in this context, is good news rather than bad. When nobody wants to buy government bonds, the Treasury Department has to jack up yields, which makes the bonds more appealing to buyers but effectively lowers the price and puts Uncle Sam deeper in hock. Once bond purchasing rebounds, the Treasury can lower those yields, thereby raising the bonds’ price and easing Uncle Sam’s indebtedness.

What happened between October and mid-December to make the bond crisis go away? The deficit isn’t any lower; indeed, in November it jumped 26 percent over the previous year thanks largely to rising interest costs. The consensus explanation for the bonds’ recovery is that the Fed is expected to lower interest rates in 2024, and this week it more or less said to expect three rate cuts next year. But in October the market was already anticipating interest rates would come down next year. What changed?

Ed Yardeni, founder of Yardeni Research Inc., credits Treasury Secretary Janet Yellen. Yellen oversees Treasury bond auctions, and in November the Treasury twiddled a bit with their pace, increasing the number of bond sales through January while shifting the balance from long-term bonds to short-term bonds. In essence, Yellen addressed the surplus of long-term Treasuries by reducing their supply and shifting a little more debt to shorter-term Treasuries. “The Treasury can fine tune,” Yardeni explained in an interview with Bloomberg, “it can manipulate the bond market by simply reducing the supply of long bonds for a while.”

Yellen’s twiddling probably helped. But I think the real reason the investor stampede away from Treasury bonds ended was because Ackman called it off.

Last August, Ackman announced to his million followers on X that he was feeling kinda done with Treasuries. “I have been surprised,” Ackman tweeted,

how low US long-term rates have remained in light of structural changes that are likely to lead to higher levels of long-term inflation including de-globalization, higher defense costs, the energy transition, growing entitlements, and the greater bargaining power of workers. As a result, I would be very surprised if we don’t find ourselves in a world with persistent ~3 percent inflation.

As a consequence, Ackman announced, Pershing Square was shorting long-term Treasuries.

Around the same time, I was arguing in this space that 3 percent inflation is perfectly acceptable; even Larry Summers has suggested that he can live with a 3 percent inflation target instead of the current 2 percent target (which was the arbitrary result of something New Zealand’s finance minister blurted out on television back in 1988). But I’m just a hack magazine writer, and I certainly don’t have a million followers on social media. The market heeded Ackman, and ran away from Treasuries. By the end of October, Ackman’s bet against Treasury bonds had earned him a reported $200 million.

Then Ackman changed his mind.

On October 23, Ackman announced on X that he was done shorting Treasuries because “there is too much risk in the world to remain short bonds at current long-term rates.” Why the change? Were there market signals? None that I can find; on October 23, Treasury rates were still sky-high. And Ackman couldn’t have been responding to Yellen’s auction strategy because she didn’t announce that until November 1. What turned Ackman from bond bear to bond bull?

The gruesome events of October 7.

Ackman’s X posts turned immediately to Hamas’s massacre. That was the “risk in the world” that Ackman alluded to when he told his X following to resume buying Treasuries. And almost immediately—even before Yellen’s November 1 announcement—the bond market began to rally.

Now just a minute, you might argue. In times of global crisis investors tend to put their money in Treasuries because they’re safe, and nobody needs Bill Ackman to tell them that. Sure, fine. But this particular global crisis was already more than two weeks old when bond yields started to fall. That tells me the real reason the bond rally began was that Ackman no longer felt he could spare the time to play bond vigilante. As October drew to a close he basically said as much on X, and the bond market dutifully rallied.

In sum: Ackman thinks he can make the Red Sea part because he maintains godlike control over the bond market, to his considerable personal profit. Ackman says don’t buy Treasuries, and investors run away as fast as they can. He says buy Treasuries, and investors run toward them just as fast. Ackman wields more power in the financial markets than any human should.

Ackman is a textbook example of how absolute power within one realm invites those who enjoy it to wield absolute power elsewhere. It turns them not just into bullies but into bullies who can reasonably expect they’ll get what they want. I don’t believe Ackman is done trying to fire Gay, and I don’t feel confident that Harvard has the fortitude to keep resisting him if he persists. I hope I’m wrong about that. But if Ackman can’t get his way here, he’ll just find another playpen from which to throw his toys. It’s the way of the oligarch.