On April 10, Chief Justice John Roberts placed a case on the Supreme Court’s docket that could potentially entrench far more devastating and irremediable damage to the global economy than Trump’s tariffs; eviscerate American democracy more than the president’s maneuvers to crush critics in academia, law, and business; and undermine rule-of-law governance more than the court’s widely covered April 7 procedural finesse of Trump officials’ defiance of district judges’ orders to halt unlawful deportations. The potential for catastrophe cannot be dismissed as hysterical fearmongering. It will indeed come to pass, if the court adheres to the letter of the so-called “unitary executive” theory long treasured by right-wing legal academics and pundits, repeated reflexively by hard-line conservative judges, and recently given nods of approval by various justices on the Supreme Court’s right—to justify the claim that the Constitution bars Congress from prescribing that presidents can remove heads of multimember agencies only “for cause.”

Dating back well over a century, courts have interpreted that bar to be so high that presidents refrain from even trying to terminate officeholders enjoying “for-cause” removal protection. Ideological legal conservatives have long condemned this brake on presidential power because, they insist, by “vesting” the “executive power” in “a president,” the Constitution gave the president “all of the executive power … not some of it,” in the words of their late icon, Justice Antonin Scalia.

Scalia’s reasoning and rhetoric have driven some of the Roberts court’s most significant decisions. However, despite this seemingly implacable momentum, reasons exist to expect that a majority of the court, including at least two of the six conservative justices, can be persuaded, however regretfully, to put ideology aside when they reach the merits of the case the chief justice just docketed.

The case in question consolidates two litigations challenging Trump’s firing of commissioners of, respectively, the National Labor Relations Board, or NLRB (Wilcox v. Trump), and the Merit Systems Protection Board, or MSPB (Harris v. [Treasury Secretary Scott] Bessent). Both of the terminated officials are covered by statutory for-cause-only removal safeguards. Trump and his legal minions acknowledge that there was no basis for removing either official in the requirements specified in the applicable statutes; both officials had exemplary performance records, which plainly failed to meet the identical criteria in both statutes that permit removal only for “inefficiency, neglect, or malfeasance.”

Nonetheless, Trump’s Justice Department lawyers maintain that he can ignore these strictures because the Constitution bars Congress from placing any limits on his ability to fire agency heads for any reason or no reason. “The President,” Solicitor General John Sauer told the justices in his brief, “should not be forced to delegate his executive power to agency heads who are demonstrably at odds with the Administration’s policy objectives for a single day.”

In 2020, when conservative justices comprised a five-justice majority, the court decided 5–4, in Seila Law v CFPB, that the Constitution mandated at-will status for single-headed executive agencies—namely, in that case, the Consumer Financial Protection Bureau. But the decision expressly declined to extend this mandate to multimember “independent” agencies, such as the NLRB and the MSPB. The justices can no longer dodge that fraught question.

On April 7, a 7–4 majority of the Court of Appeals for the District of Columbia Circuit rejected the Trump administration’s claim. The majority (consisting of all seven of the court’s judges appointed by Democratic presidents) ruled that a 1935 Supreme Court decision upholding for-cause removal protections for heads of multimember agencies remained binding precedent, never mind that it has fallen out of favor with their Republican-appointed colleagues and other legal luminaries on the right. The Court of Appeals majority ordered the reinstatement of both of the agency board members Trump had fired, pending the outcome of the litigation.

Two days later, Solicitor General Sauer filed an emergency petition in the Supreme Court seeking reversal of the reinstatement order. Chief Justice Roberts’s warp-speed grant of Sauer’s petition, three hours after it was filed, was interpreted as merely giving the justices time to mull the weighty issues at stake, not presaging the result after they complete that process. Sauer asked the court to hear and decide the case in the current term, which expires at the end of June.

Why might a critical mass of the Supreme Court’s conservative supermajority shrink from letting their ideology propel them to broaden untrammeled presidential firing authority to multiheaded agencies? Two potential reasons spring to mind: the real-world consequences of such an extension and the doctrinal and empirical holes in the undergirding unitary executive theory that scholars have exposed since Justice Antonin Scalia first expounded the current version of that concept in 1988.

Of the two, the calamitous-consequences barrier, while as yet only fleetingly acknowledged by the justices, is no doubt the most daunting. In particular, two words give that prospect intimidating force. Those words are the Fed. As legal scholar Stephen Vladeck recently wrote, “The not-very-well-kept secret is that the justices are (understandably) wary about handing down a ruling that would allow any President, and perhaps this one in particular, to exercise direct control over U.S. monetary policy by controlling who sits on the Federal Reserve Board.” Since the original Framers’ establishment of the first and, especially, the second Bank of the United States, a broad and bipartisan consensus has hardened, in the U.S. as well as every industrialized nation, that an independent central bank with far-reaching powers is essential to maintaining monetary stability and sustaining economic growth.

Conservative legal experts with financial regulatory expertise are well aware of the threat posed by subjecting the Fed to total presidential control. Peter Wallison of the American Enterprise Institute, otherwise a champion of judicially enforced controls on the “administrative state,” nevertheless wrote, on February 28 of this year, “Under no circumstances would it make sense as public policy for the president to have the power to control the Fed.” To date, no one has come up with a principled basis for distinguishing multimember agencies like the NLRB or the Federal Trade Commission, or FTC,—which conservatives would love to rein in—from the Fed, which they, along with the corporate sectors with which they are often allied, fervently believe requires independence. This poses a dilemma, since, as Wallison observed, “If the Court concludes that the president can control a multi-headed independent agency, there will be no Court-approved avenue that clearly makes the Fed immune from presidential control.”

Wallison’s acknowledgment of untoward real-world consequences is not the only weakness in conservatives’ support for unitary executive theory. In 2018, libertarian law professor Ilya Somin announced that “unitary executive theory is one of the few issues on which I have changed my mind during the Trump era,” a turnabout he confirmed in January of this year. Somin’s switch appeared on the widely read conservative-libertarian legal blog The Volokh Conspiracy, which has posted other broadsides against the theory.

Apart from the Fed, the Federal Communications Commission, or FCC, is another independent agency no one—right, left, or center—should want to be subject to unchecked presidential control. There would seem to be no need to elaborate the existential danger to democracy inherent in giving the White House, especially but by no means exclusively this White House, total control of the FCC’s authority to award or withdraw broadcast licenses from owners of, say, The Washington Post, The New York Times, or Rupert Murdoch’s media empire.

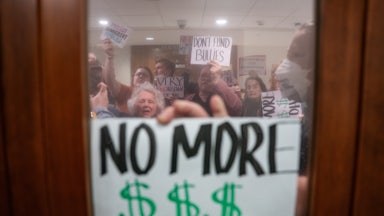

Perhaps less dramatic, but hardly unimportant, are the virtues of independence for other such agencies. For example, take the Federal Trade Commission. The FTC’s antitrust authority is often dismissed as duplicative of the Department of Justice’s Antitrust Division. But an unscrupulous president can readily use DOJ’s antitrust powers to bully corporations big and small into toeing his or her line—as indeed Trump was widely perceived to have done, or attempted, in his first term. Now, in his second term, the willingness to abuse power in this manner is something that Attorney General Pam Bondi has all but overtly proclaimed a linchpin for personnel evaluation.

There are unique reasons why the independence of the Merit Systems Protection Board, directly at stake in the pending Supreme Court case, is essential. Independence from White House control is central to the overriding objective of the 1883 Pendleton Act, as refined by the 1978 Civil Service Reform Act, to replace the corruption-saturated “spoils system” of the nineteenth century, which culminated in the assassination of President James Garfield by Charles Guiteau. Thereafter, the corrupt favor-trading regime was replaced by a merit-based professional civil service.

Since 1988, Justice Scalia and his disciples have consistently justified the unitary executive theory, as a matter of law, on originalist grounds—specifically, on the claim that the Framers so understood the Constitution, even though the Constitution’s text itself prescribes nothing whatsoever to limit Congress’s authority to regulate the mode of removing agency heads. Unitary executive proponents have rested their legal case on the contention that unfettered firing authority was implicit in Article 2’s “vesting” of federal “executive” power in the president.

Given the theory’s lack of actual textual basis, unitary executive proponents needed to show that their understanding was borne out by contemporaneous statements and practice. For a considerable time, this claim was widely accepted as true or at worst plausible. But as unitary executive theory took hold on the right, that narrative began to be challenged by (largely liberal) scholars. Over the years, more and more founding-era actions inconsistent with the theory came to light. Recently, research has irrefutably exposed the notion of a founding-era “consensus” around unitary executive theory as simply bad law-office history—despite its endorsement in opinions of the nation’s highest court.

To take one example, sufficiently persuasive on its own: the First and Second banks of the United States, vastly powerful instrumentalities resembling the twentieth-century Fed, especially the Second bank. As D.C. Circuit Judge Patricia Millett wrote on April 6, when the case was before her court, “As for the First and Second Banks of the United States, Congress provided the President no removal authority over members of the First Bank, and gave the President control over only five out of twenty-five members of the Second Bank.” Significantly, legislation creating the First Bank, enacted in 1791, was crafted by Treasury Secretary Alexander Hamilton—famously, among all the Founding Fathers, the most ardent champion of an “energetic” president. The Second Bank legislation was signed into law in 1816 by President James Madison. Recent scholarship has brought to light other founding-era legislation that extensively circumscribed presidential power to fire senior executive officers of federal instrumentalities, including officials equivalent to modern agency heads.

In short, we now know that contemporaneous practice demonstrated the opposite of unitary executive proponents’ claim that there was an original consensus understanding that Article 2 implicitly “vested” presidents with full authority over the entire executive branch, specifically over removal of all agency heads. With their contemporaneous-practice rationale in tatters, the legal case for extending unitary executive theory to junk over two centuries of federal institutional architecture simply falls apart.

Moreover, the constitutional text that does bear on the issue augurs emphatically in support of the flexibility Congresses and presidents from the founding era forward to the present have shown in crafting institutional arrangements like the central banks, the merit-based civil service system, and the National Labor Relations Act’s machinery for settling labor disputes through legal procedures rather than the industrial warfare rampant prior to passage of the 1936 National Labor Relations Act. That text is the “necessary and proper clause” of Article 1.

This clause confers on Congress the power “To make all Laws which shall be necessary and proper for carrying into Execution the foregoing [enumerated] Powers [specifically assigned to Congress], and all other Powers vested by this Constitution in the Government of the United States, or in any Department or Officer thereof.” (Emphasis mine.) Famously, that text was (contemporaneously) interpreted by Chief Justice John Marshall to empower future generations “to provide for exigencies which, if foreseen at all, must have been seen dimly, and which can be best provided for as they occur.” As one of today’s most widely respected center-right legal authorities, former Harvard Law dean and current University Provost John Manning, has explained, this clause precludes “establish[ing] a constitutional violation simply by showing that Congress has constrained” the way executive power “is implemented”; that is, per Manning, “exactly what the Clause gives Congress the power to do.”

In relevant opinions and oral arguments, the conservative justices have evinced that they feel tugged in opposite directions—on the one hand, by the long-held ideological staple that complete presidential control of the executive power is constitutionally compelled and, on the other, by their apparent recognition of the potentially catastrophic consequences of following that line to its logical end point.

In their 2020 decision nixing independence for the CFPB, Chief Justice Roberts repeated Scalia’s bromide that “the executive power—all of it—is vested in a President.” On the other hand, Roberts stressed that a 90-year-old precedent “held that expert agencies [were] led by a group of principal officers removable … only for good cause.” (Emphasis is in the original.) He also observed that the single-director arrangement enacted by Congress “differed from the proposals of [then] Professor [Elizabeth] Warren and the Obama administration,” for creating “a traditional independent agency headed by a multimember board or commission.”

For tea-leaf readers, of particular interest is potential swing justice Brett Kavanaugh’s lengthy dissenting opinion when he was on the Court of Appeals for the D.C. Circuit, regarding an identical 2018 challenge to the validity of the CFPB, just before his elevation to the Supreme Court. On that occasion, Kavanaugh did not merely argue that multimember independent agencies could be distinguished from their single-director cousins; he spelled out positive attributes of the former genre.

He stressed, “Because of their massive power and the absence of Presidential supervision and direction, [single-director] independent agencies pose a significant threat to [both] individual liberty and to the constitutional system of separation of powers and checks and balances [because of the director’s] authority to take action on one’s own, subject to no check—[unlike] any single commissioner or board member … or any other official in the U.S. government, other than the president.”

He also noted that not only “then-Professor and now-Senator Elizabeth Warren,” as well as President Obama’s administration, but Representative Barney Frank and Democratic leader Nancy Pelosi also backed a multimember format for the CFPB. He detailed how presidents retain considerable authority to shape the policy direction of multimember independent agencies because, typically, they can replace the agency chairperson and designate a replacement from among the members, with no requirement to show cause. On the other hand, Kavanaugh referenced another D.C. Circuit opinion of his noting “tension” between the Supreme Court’s 90-year-old precedent upholding independent multimember agencies and more recent decisions, especially the CFPB case, Seila Law v. CFPB.

What all this mandates for liberal advocates is that they must mobilize a robust and broad coalition that includes conservatives, economists, business and especially financial leaders, as well as liberal constituencies close to the NLRB and the MSPB, to hammer home to the justices that it is time to shelve an ideological credo unfaithful to the text of the Constitution or the design and actions of its Framers, out of sync with over two centuries of entrenched—and successful—tradition, and, most of all, a real threat to economic stability and growth and democratic governance.