Second Pension Fund Dumps U.S. Treasury Holdings as Trump Spirals

Donald Trump’s unpredictability has sent at least two countries running.

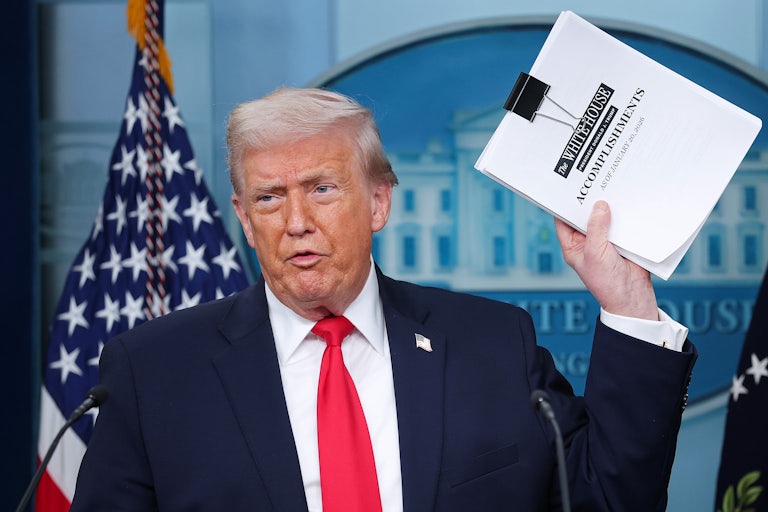

As Donald Trump delivered rambling remarks touting his new world order at the World Economic Forum in Davos, yet another European country announced that it had sold off billions of dollars of U.S. Treasuries.

Alecta, a Swedish pension fund, revealed to Reuters Wednesday that it had been slowly selling off its U.S Treasuries for about a year. “Since the beginning of 2025, we have reduced our holdings in U.S. government bonds in several rounds, and together the reductions account for the majority of our holdings,” said Alecta’s chief investment officer Pablo Bernengo.

Bernengo said that the decision to sell off American assets was “related to the reduced predictability of the policy pursued in combination with large budget deficits and growing government debt.”

Alecta reportedly sold between $7.7 billion and $8.8 billion worth of U.S. Treasury bonds over the course of last year, according to Dagens Industri, a Swedish business daily.

News of this major divestment comes just one day after AkademikerPension, a Danish pension fund, announced that it would sell $100 million in U.S. Treasuries because of “poor [U.S.] government finances.”

While Treasury Secretary Scott Bessent earlier Wednesday dismissed Denmark’s holding of U.S. bonds as “irrelevant,” Europe collectively holds roughly $8 trillion of U.S. bonds and equities, providing it with a potential lever to fight back against Trump’s unchecked threats and tariffs—should it choose to pull it.

Former U.S. allies in Europe have started to push back against Trump’s repeated and unwelcome efforts to acquire Greenland (sometimes Iceland) from Denmark. A key group of European Union members blocked a trade deal with the United States Wednesday, after Trump threatened to take over Greenland and levy a 35 percent tariff on any European country that did not support his imperialist ambitions.